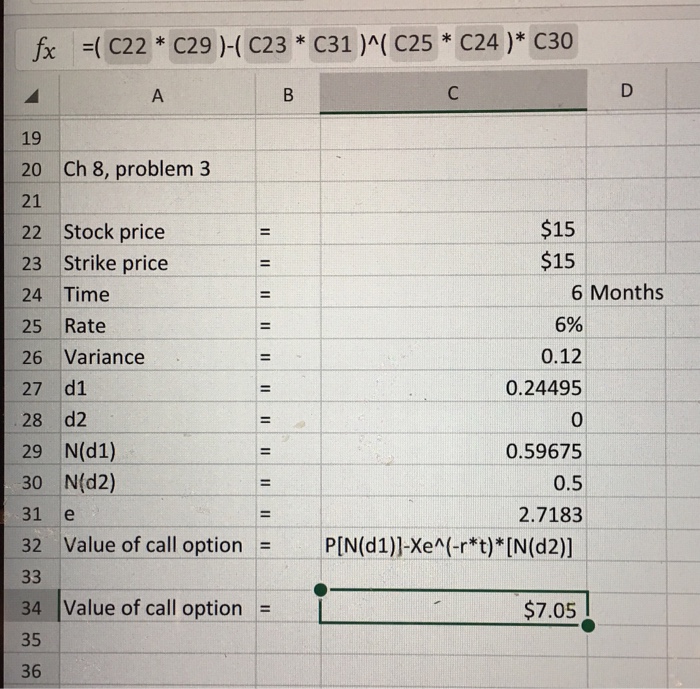

Question: Please demonstrate Black-Scholes Model and include excel formula This is what I currently have, but I know I am doing something incorrect because the Value

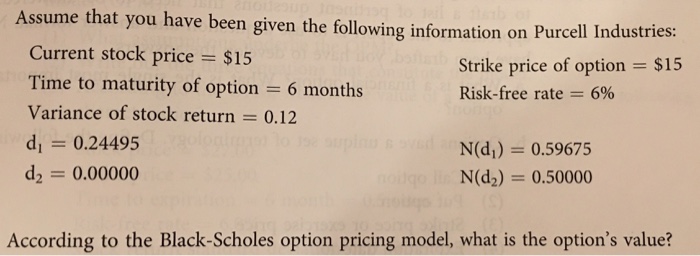

Assume that you have been given the following information on Purcell Industries. Current stock price $15 Time to maturity of option = 6 months Variance of stock return = 0.12 di = 0.24495 d2 0.00000 Strike price of option Risk-free rate = 6% $15 N(d) 0.59675 N(d2) = 0.50000 According to the Black-Scholes option pricing model, what is the option's value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts