Question: Please demonstrate how it is calculated instead of just providing the answer. Thank You. Jenkins Company uses a job order cost system with overhead applied

Please demonstrate how it is calculated instead of just providing the answer. Thank You.

Please demonstrate how it is calculated instead of just providing the answer. Thank You.

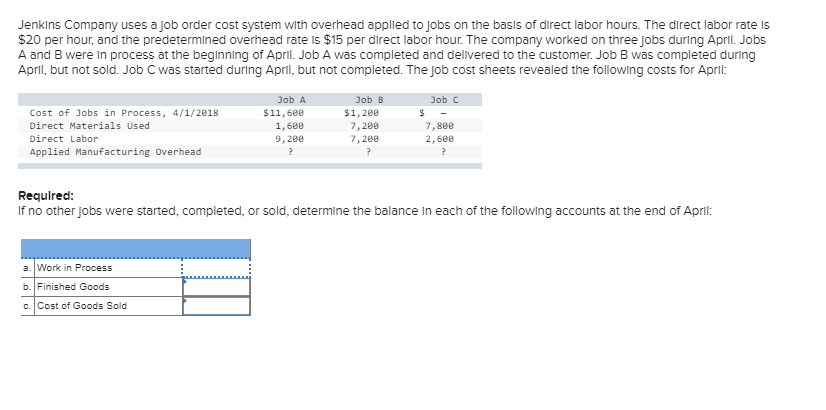

Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: $ Cost of Jobs in Process, 4/1/2018 Direct Materials Used Direct Labor Applied Manufacturing Overhead Job A $11,600 1,6ee 9,209 Job B $1,200 7,200 7, 2ee Job C - 7, 8ee 2,600 Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April: a. Work in Process b. Finished Goods c. Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts