Question: PLEASE DEMONSTRATE ON PAPER NOT USING EXCEL Question 4 An asset is currently priced at 95p, and its annual volatility is 25%. The continuous risk-free

PLEASE DEMONSTRATE ON PAPER NOT USING EXCEL

PLEASE DEMONSTRATE ON PAPER NOT USING EXCEL

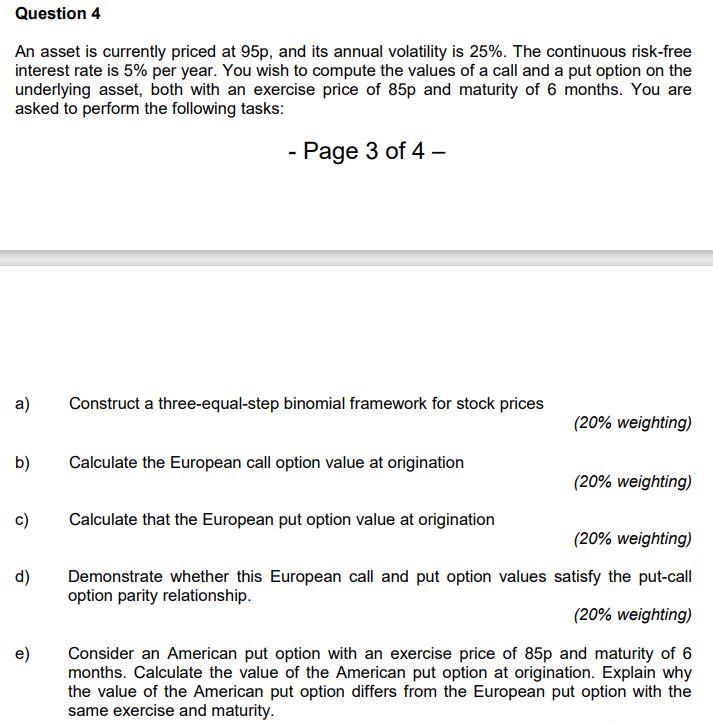

Question 4 An asset is currently priced at 95p, and its annual volatility is 25%. The continuous risk-free interest rate is 5% per year. You wish to compute the values of a call and a put option on the underlying asset, both with an exercise price of 85p and maturity of 6 months. You are asked to perform the following tasks: Page 3 of 4 - a) Construct a three-equal-step binomial framework for stock prices (20% weighting) b) Calculate the European call option value at origination (20% weighting) c) Calculate that the European put option value at origination (20% weighting) d) Demonstrate whether this European call and put option values satisfy the put-call option parity relationship. (20% weighting) e) Consider an American put option with an exercise price of 85p and maturity of 6 months. Calculate the value of the American put option at origination. Explain why the value of the American put option differs from the European put option with the same exercise and maturity. Question 4 An asset is currently priced at 95p, and its annual volatility is 25%. The continuous risk-free interest rate is 5% per year. You wish to compute the values of a call and a put option on the underlying asset, both with an exercise price of 85p and maturity of 6 months. You are asked to perform the following tasks: Page 3 of 4 - a) Construct a three-equal-step binomial framework for stock prices (20% weighting) b) Calculate the European call option value at origination (20% weighting) c) Calculate that the European put option value at origination (20% weighting) d) Demonstrate whether this European call and put option values satisfy the put-call option parity relationship. (20% weighting) e) Consider an American put option with an exercise price of 85p and maturity of 6 months. Calculate the value of the American put option at origination. Explain why the value of the American put option differs from the European put option with the same exercise and maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts