Question: Please demonstrate using excel with formulas. Companies often buy bonds to meet a future liability or cash outlay. Such an investment is called a dedicated

Please demonstrate using excel with formulas.

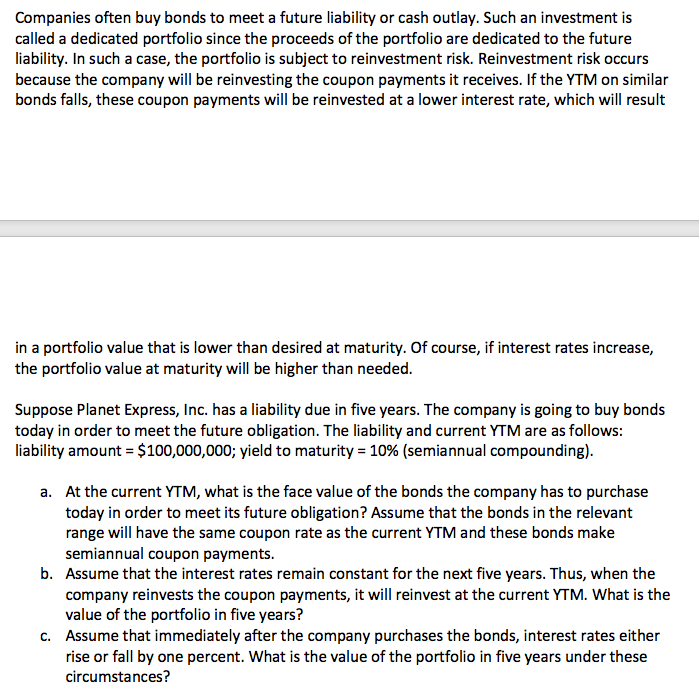

Companies often buy bonds to meet a future liability or cash outlay. Such an investment is called a dedicated portfolio since the proceeds of the portfolio are dedicated to the future liability. In such a case, the portfolio is subject to reinvestment risk. Reinvestment risk occurs because the company will be reinvesting the coupon payments it receives. If the YTM on similar bonds falls, these coupon payments will be reinvested at a lower interest rate, which will result in a portfolio value that is lower than desired at maturity. Of course, if interest rates increase, the portfolio value at maturity will be higher than needed. Suppose Planet Express, Inc. has a liability due in five years. The company is going to buy bonds today in order to meet the future obligation. The liability and current YTM are as follows: liability amount = $100,000,000; yield to maturity = 10% (semiannual compounding). a. At the current YTM, what is the face value of the bonds the company has to purchase today in order to meet its future obligation? Assume that the bonds in the relevant range will have the same coupon rate as the current YTM and these bonds make semiannual coupon payments. b. Assume that the interest rates remain constant for the next five years. Thus, when the company reinvests the coupon payments, it will reinvest at the current YTM. What is the value of the portfolio in five years? C. Assume that immediately after the company purchases the bonds, interest rates either rise or fall by one percent. What is the value of the portfolio in five years under these circumstances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts