Question: please describe and answer it correctly with relating it to the scenario 1) Describe the personal risk management process 2) List some unique characteristics of

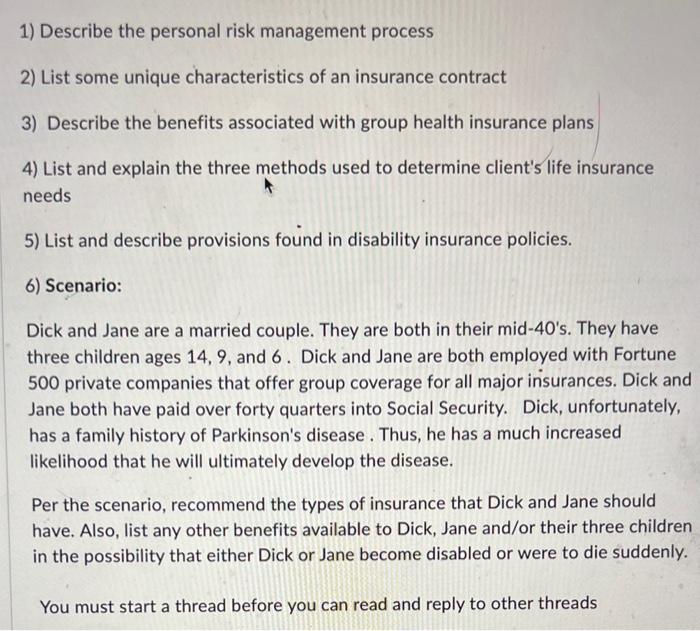

1) Describe the personal risk management process 2) List some unique characteristics of an insurance contract 3) Describe the benefits associated with group health insurance plans 4) List and explain the three methods used to determine client's life insurance needs 5) List and describe provisions found in disability insurance policies. 6) Scenario: Dick and Jane are a married couple. They are both in their mid-40's. They have three children ages 14,9 , and 6 . Dick and Jane are both employed with Fortune 500 private companies that offer group coverage for all major insurances. Dick and Jane both have paid over forty quarters into Social Security. Dick, unfortunately, has a family history of Parkinson's disease. Thus, he has a much increased likelihood that he will ultimately develop the disease. Per the scenario, recommend the types of insurance that Dick and Jane should have. Also, list any other benefits available to Dick, Jane and/or their three children in the possibility that either Dick or Jane become disabled or were to die suddenly. You must start a thread before you can read and reply to other threads

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts