Question: please disregard the above only answer these two only answer these two ^ Hammond Manufacturing inc. was legally incorporated on January 2, 2023. Its articles

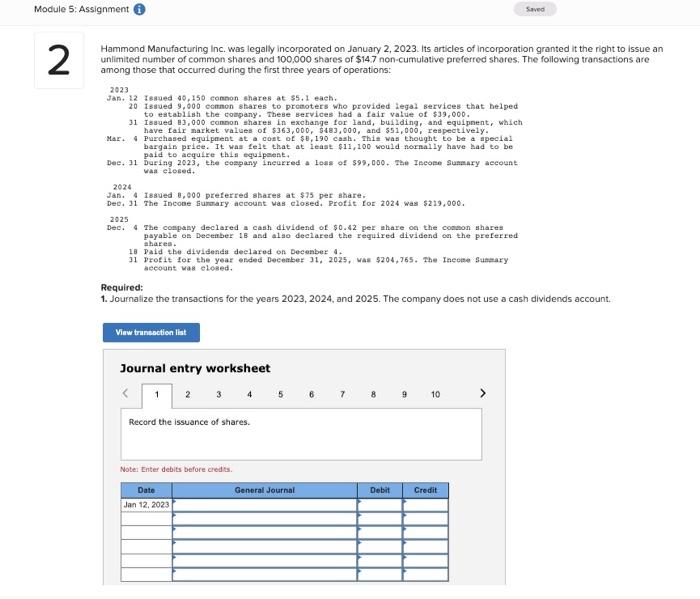

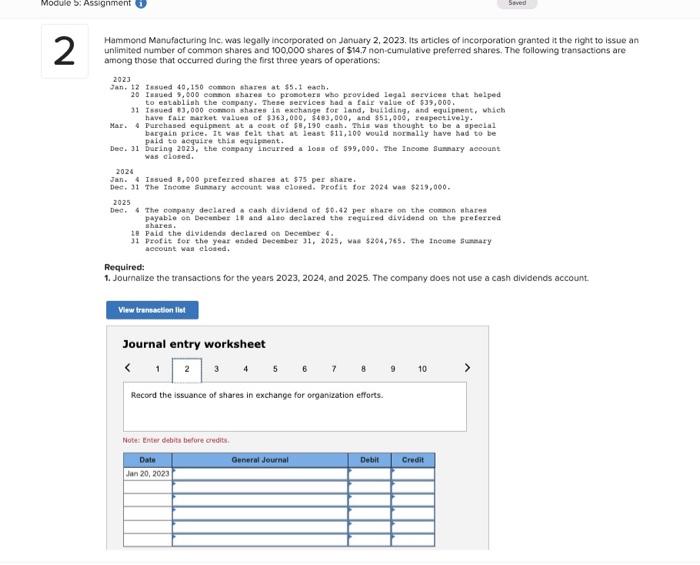

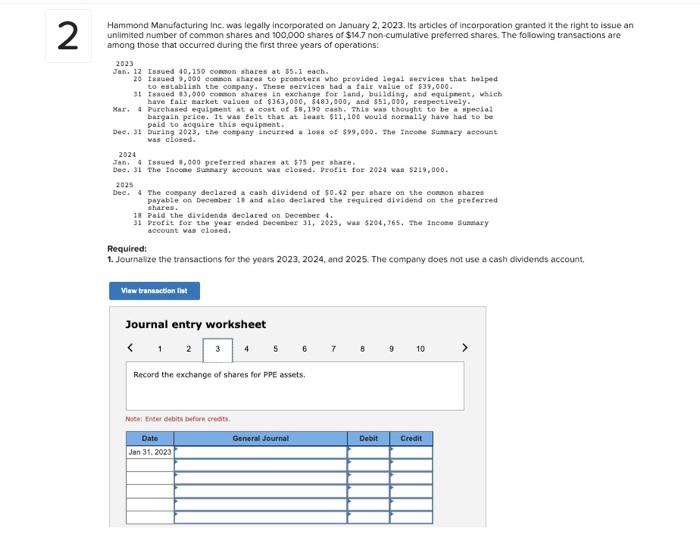

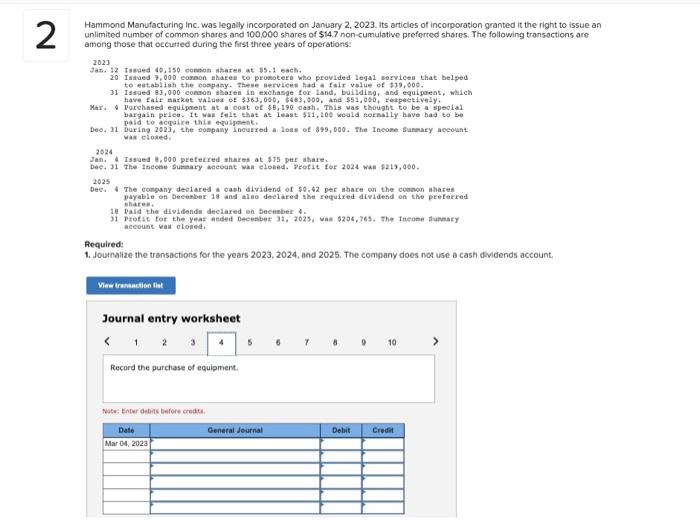

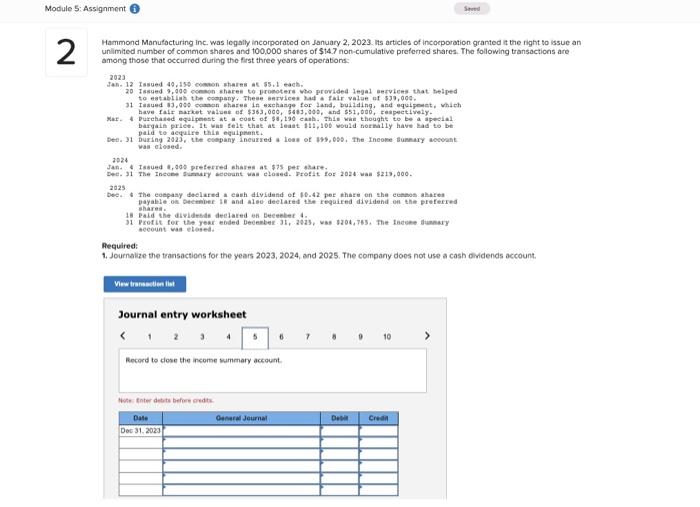

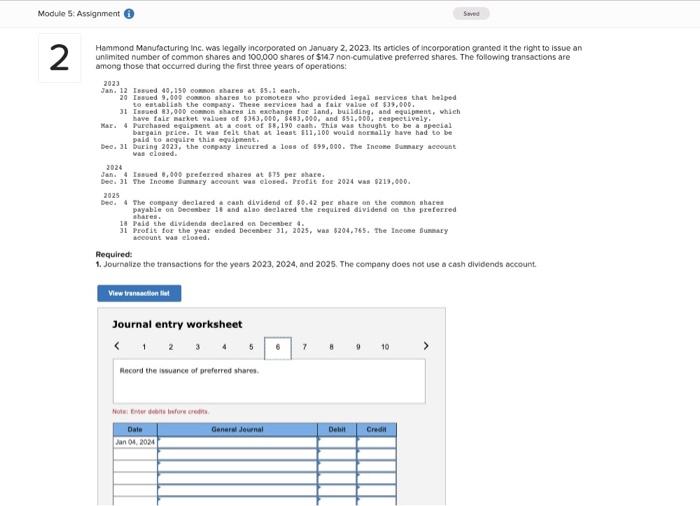

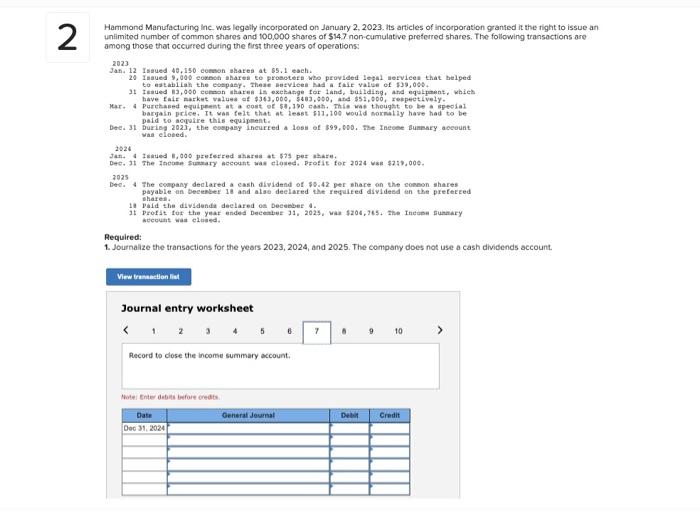

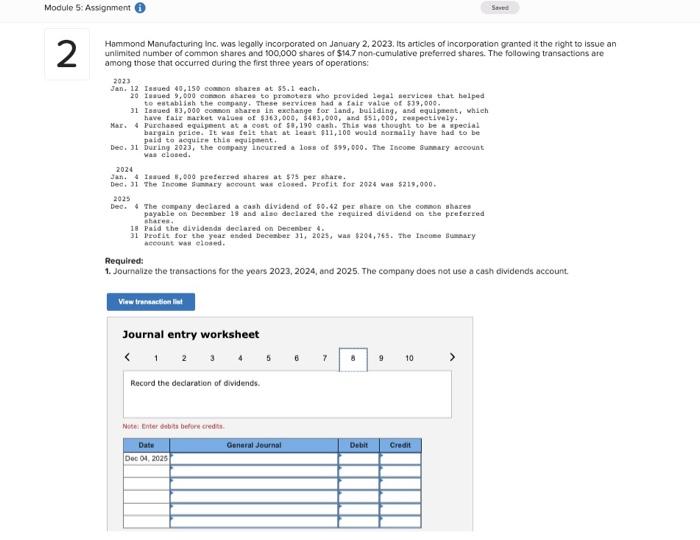

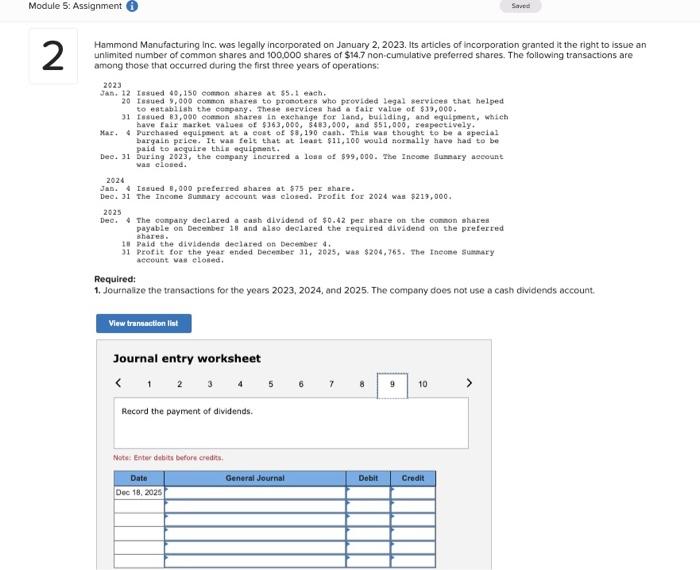

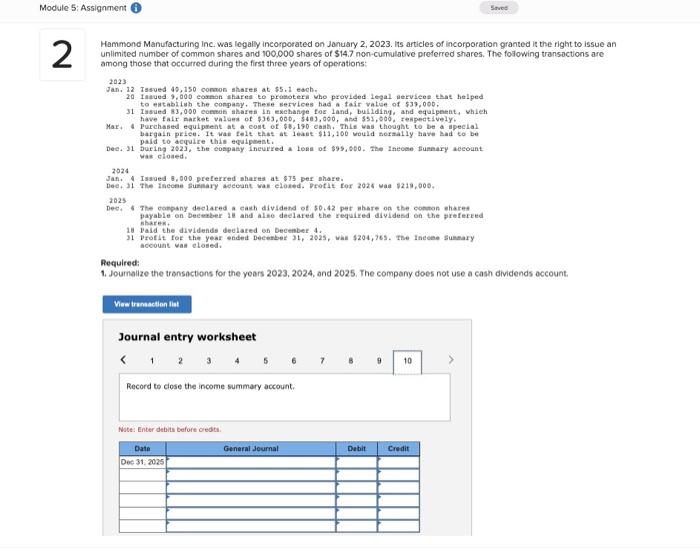

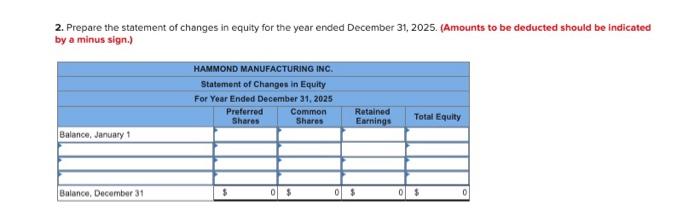

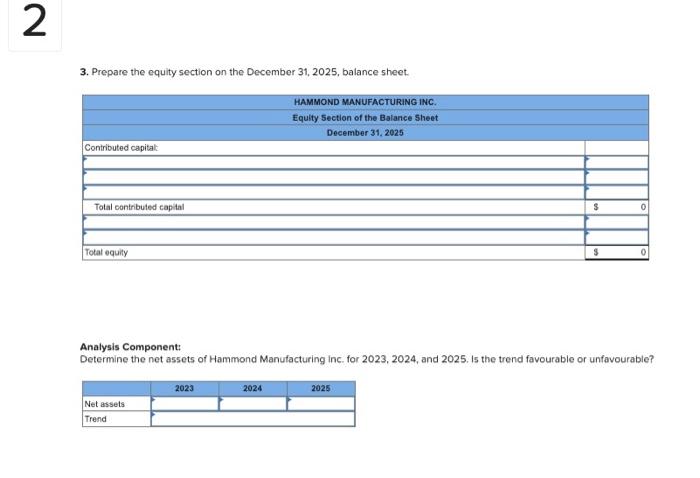

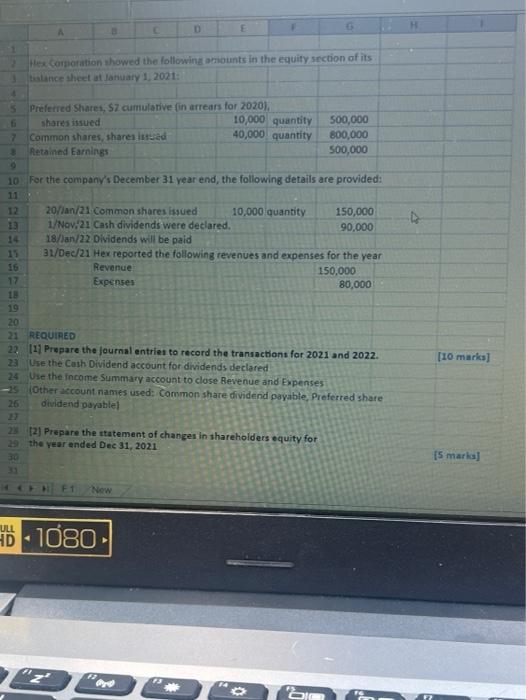

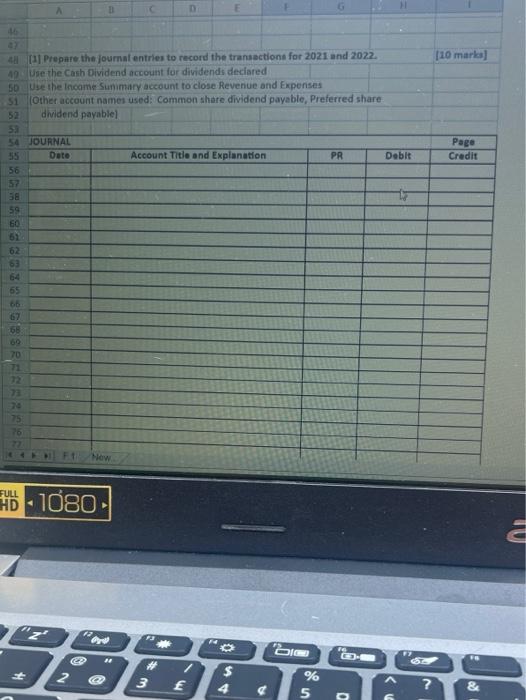

Hammond Manufacturing inc. was legally incorporated on January 2, 2023. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2023 Jaf, 12 Issued 40,150 connon shares at $5,1 eaeh. 20 issued 9,000 common stares to premoters who provided legal services that belped to estabilish the eospany. These services had a fair value of $39,000. 31 Isaued 13,000 connon shares in exchange for land, bullding, and equipnent, which have fair narket values of $363,000,$483,000, and $51,000, reapectively. Mar, \& Purchased equipaent at a cost of \$E, 190 cash. This was thought to be a apecial bargaln priee. It mas telt that at least $11,100 would normally have bad to be pald to acqulze this equipenest. Dee, 31 During 2023, the company incurred a loda of $99,000. The Incope guamary account Has chosed, 2024 Jan. 4 Issued b, 900 preferted sbares at $75 per share. Dect, 31 The Incone Gurtary account was closed. Profit for 2024 was 5219,000. 2025 Dec. \& The company declared a cash divldend of $0.42 per ahare on the conson aharea payable os Decenber 1B and alao declared the required dividend on the preferred ahazes. 18 Pald the dividenda declared on Decenber 4. aceognt was elesed. Required: 1. Journalize the transactions for the years 2023,2024 , and 2025 . The company does not use a cash dividends account. Hammond Manufacturing Inc- was legally incorporated on January 2,2023 , its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2023 Jan, 12 Issued 40,150 combe shares at 45.1 each, 20 Insued 3,600 conton sharea to promoterk who previded legal servicen that helped to ealablish the conpany. These services had a fair value of $39,000. 31 Issued 13,000 comen shares ia exchange for land, buliding, and equipoent, which have fair anket valuea of $363,060,$4b3,000, and $51,006, zeapectively. Mar. 4 Parchased equipnest at a eoat of $8,190 cash. This was thought to be a speclal bargain price. It was felt that at least 511,100 vould normaliy have bad to be pald to acquire enda equipestht. Ded. 31 During 2023 , the company Incurred a 100 of $99,000. The Income suahary aecount was elosed. 2024 Jan. 4 Issued 8,200 preferred shares at 575 per share. pect. 31 The Iacore Sunmary wecount was elosed. Profit for 2024 was 5219,000. 2025 Ded. 4 The conpany declared w eash dividend of 50,42 per nhare on the conchon, Bhares payable of Decanbet 18 and alo declared the rechifed dividend on the preterted ahares. 14 Paid the dividends declared on Decenber 4 . I1 profit for the year exded beceaber 31 , 2025 , wad 5204,765 , the ineome fommary accoust was cloded. Required: 1. Journailie the transactions for the years 2023, 2024, and 2025 . The company does not use a cash dividends account. Journal entry worksheet Note: Enter sebits before aredits. Hammond Manufacturing inc, was legally incorporated on January 2, 2023, its articies of incorporation granted it the right to issue an unimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2.23 Jan. 12 Issued 40,150 conwion shares at 55.1 each. te establimh the coapany, Whese bervices had a fale value of 839,000. have falt itazket values of $363,000,5483,000, and 551,000, zespectively. Mar, 4 Purchased equigment at a cost of 5 , 199 eash. Fhis was thought to bet a mpeckad birgaln pelee. It was felt taat at least \$1., dob would formaldy have had to be paid to acguire this equipatest. Has cLodeda 2024 Inin, a Isaged g, gog preferred shares at 575 per share, bee. 3 t The Ibecet Euphary weceutit wad elded. protit faz 2024 wad $219,000. 2825 bec, a The cobpany declafed a cash dividend of 50.42 per abare on the conion ahared payablet on pecenber 11 and also deekared khe requtred dividend on the preterted shares. 1 Pate the dividetids declared on Decenber 4. acecunt was elosed. Required: 1. Journalize the transactions for the years 2023, 2024, and 2025. The company does not use a cash dividends account, Hammond Manufacturing inc. was legally incorporated on January 2, 2023. its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $147 non-cumulative preferred shares. The following transoctions are among those that occurted during the first three years of operations: 2023 Jan. 12 Isaged 49,150 conmon shares at 55,1 each, 20 I saved 3,000 eomnon shared to proboterb who provided legal servicen that belped to establish the eonpasy. These Bervicen had idir value of $19,000, have falr market valuea of $363,060,5463,000, and $51,000, reapectively. Mar. A Purchased-equipsent at a cost of $8,190 eash. This vas thought to be a speoial bargain priee. It wat felt that at least $11,200 woald nornally hive had to be paid to acquire this equiponts. Dee. 31 During 252J, the eospany lneurred a lobs of $99,000. The Ineore suanary aecount vat elosed. 2024 Jah, Isaued 8,000 preferred whares at 775 per atare. bee, 31 The tacone Suraty wecount wan cloned. Fretit for 2024 wan 1213,060. 2025 Dees 4 The congany deolared a cash dividend of 50.42 per ahare on the cosaon ahares payable an becenter 18 and allo deelared sbe reuired dividehd on the preferred share is: 13 Paid the dividends declared on Decenber 4. 31 pretit for the year anded Decesber 31; 2025, wai 5206,765 . The Ineene flunhary aceount yas eloned, Aequired: 1. Journalize the transactions for the years 2023, 2024, and 2025. The company does not use a cash dividends account, Hammond Manufacturing inc. was icgally incorporated on January 2, 2023. its articles of incoeporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transoctions are among those that occurred during the first three years of operations: 2023 Jan, 12 Issued 49,35% coweon whares we 55,1 each. to establiab the cogpany. These onrvices lat a falr value af 530,009 . 31 fasued 13, 0se ceaban ihazes ia exchange for land, bullding, whd equipeet, whach have falr parket valuet of $363,000,5441,00.2, and 551,0 do, reaspectirely. Mar. 4 Purehaided equlpest at a cost of $8,130 cand. Thin what thought to be a apectal bargain priets it whe telt that at ieadi itt, 160 would horihally have Ead to bt pala te acquirt thin equipment. bet. 21 buring 2423, the cobpany ancuraed a leen of B75,65s, the Incoke tumpry acovaht vas elesed. 224 Jah, 4 Isaued 4,002 preterred sharen at 525 per start. Dee. 31 the Ineces fundiry teobunt wain elosed. Trotdt for 2024 was 5213, doo. 2025 bed. 4 the eobpasy declared a cash dividend of 10.42 per thaze on the cubbos aksitea payable on betemier 1 ind and albe declared lie reguired dividend en thin preferred shareil 18 Paid the dividrbde declared bi Eecester 4 , nceount was etosed. Required: 1. Journalie the transactions for the years 2023, 2024, and 2025. The company doos not use a cash oividends account. Hammond Manufacturing inc. was legally incorporated on January 2,2023 , its articles of incorporation qranted it the fight to issue an unlimited number of common shares and 100.000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that eccurred during the first three years of operations: 2023 Jah. 12 Issued 49,150 common nares at 75 a d eaeh. 20 Issued 9, 900 cowmon ahares to preeoteri who provided lejal services that belped to entablist the conpasy, Theie stervices bad a fair valwe of sjy, pob, 31 Issaed ga;000 conthob akares in exobange for dand, builidisg, and equiphent, which bave falr Barket yalues of $363,650,5483,405, and 551,500 , reajectively, Kar. 4 Rurchased equipaent at a coet of 18,190 eagh . This was thought te be a bgecial pald to acqulre ehie equiphent. bee. 31 buring 2023, the copsasy Ineutred a loss of 999,000 . The Ineoke surnary aceowe yas elomed. 2024 Jan. 4 lsased b, 905 preferred whares at 175 per ulare. 2025 beci 4 The cospany declared a cash dividend of 55.42 per share an the coemon bhaten paybble on becenber 14 and allo dedlared the Esquired dividend on the preferred phares. 19 Paid the dividends declared en Besesber 4. 31 Profit fer the year efded Decenber 31,2025 , was 8204,765 . The locuee bumary aceount mas eloned. Aequired: 1. Journalize the transactions for the years 2023,2024 , and 2025 . The conpany does not use a cash dividends accoumt. Hammond Manufacturing linc. was legally incorporated on January 2,2023, its articles of incorporation granted it the tight to issue an unimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transoctions are among those that occurred during the first three years of operations: 2023 Jan, 12 lsaued 40,150 eomon mhares at 55,1 each. 31 Ienued E3, 050 echeon whate is exetatge for lahd, butlding, and equlpant, whiet have fale narket waluea of $343,p0,54, 53,000 , afd $51,000, rekpectively. Mar, a parekabed equlpmest at a cost of s3, spo cash, Thia was thought to be a speolal bargain price. It wan felt that at iesst 511,100 would normatiy have had to be pald to scquire this equipment. bee. 31 buriby 2023, the cospasy incurred a losil of 599,600 . Fe Ineoee bummary aceount. was eloted. 2524 Jafi, 4 Ianied B, dop preferred ahkrea at 579 pez atare, 2025 Dec. 4 The company declared a cash dividend of \$5.42 per share on the cowmon shares payable an becenter 1 and alas declared the Iechited divldetd ton the prefterzed ihared 13) Paid the dividendt deelared os becenter 4 . It profit fut the year ended Deceaber 31,2625, wai $204,265, the Incupe funtary becoutht wat elesed. Aequired: 1. Journalie the transactions for the years 2023,2024 , and 2025 . The company does not use a cash dividends account. Hammond Manufocturing inc, was legoly incorporated on January 2, 2023. its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2923 Jan, 12 ladued 40,152 coomen abaref at 55,1 each. Mar. 4 Purchased equipnent at a cost of 58,190 dath. Thit was thodght to be a ipecial bargalin porited It whe felt that at dealt pli, 100 would bornaldy have had co be pais ta acdusten this ecyitpetant, Dec. 31 Duriny 2023 , the conpasy Incurred a loss of 399,000 . The Incove Gyhnary bocount walt elabed, 2024 Jafi A Iaaged b, 200 paetetred whazen at 575 per whare. 2025 payable ox Decenber 18 and alise declaxed the yequired disidend ea the preferted phaterat 1 Pafd the dividendm declartd on Decenber 4 : bechunt was elased Reguired: 1. Journalize the transactions for the years 2023,2024 , and 2025 . The company does not use a cash dividends account. Inirnal antru winrkehaet Hammond Manufacturing inc. was legally incorporated on January 2, 2023. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.7 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2623 Jan, 12 Issued 40,150 eomhon shares at $5,1 each. 20 Issued 9,000 coman shares to proeoters who provided legal services that helped to establish the cenpany, These servicen had a faif value of $30,000. 31 I ssued 83,000 eorsen shares in exelaage for land, buldding, and equipatest, which bave fair tarket valued of $363,000,$483,000, and $51,000, zeapectively+ Maf, 4 Purehased equipanest at a eost of 58,190 cash. This wain thought to be a apeciul bargaln priee. It wan felt that at least $11,100 would normally have has to be paid to acquire thin achiphest. Dee. 31 During 2023, the caspany lnaurked a loas of 599,000 . The Incose fuanary account val closed. 2024 Jab. 4 Istued B,000 preterred aharea at 575 per thare. Dec. 31 The Iacone Subarary account vas closed. Profit for 2024 was $219,000. 2525 Dec. 4 The conpany declared a cash dividend of $0.42 per share on the conmon whares payable on Decenber 18 and also declared the required dividend on the preferted shares. 1 il Pald the dividendg declared on Decenter 4 , 31 Proflt for the year ended Decenber 31,2025 , was $204,765. The frecese suanary acceunt was eloses, Required; 1. Journalize the transactions for the years 2023,2024 , and 2025 . The company does not use a cash dividends account. Hammond Manufacturing inc. was legally incorporated on Jonuary 2,2023. its articies of incorporation granted it the right to iss unlimited number of common shares and 100.000 shares of $14.7 non-cumulative preferred shares. The folowing transoctions a among those that occurred during the first three years of operations: 2023 jan, 12 Tssued 49,150 common shares at 55,1 each. padd to acquire thil equdpenent. wat eloued. 2524 Jan. A Issued a, 000 preterred whares at gJ5 per bhate w 2025 sharesin+ 10 Jadd the dividends deelared bh becetsber 4. aceount Man elosed. Required; 1. Joumalize the transactions for the years 2023,2024 , and 2025. The company does not use a cash dividends account. 2. Prepare the statement of changes in equity for the year ended December 31, 2025. (Amounts to be deducted should be indicated by a minus sign.) 3. Prepare the equity section on the December 31,2025 , balance sheet. Analysis Component: Determine the net assets of Hammond Manufacturing inc. for 2023, 2024, and 2025.15 the trend favourable or unfavourable? Hex comoration shawed the following amounts in the equity section of its tislance aheet at January 1, 2021: Preferred Sharei, $2 cumulsive-(in arrears for 2020), shares issued Common shares, shares isteded Retained Earnings For the company's December 31 year end, the following details are provided: 20/3an/21 common shares issued 1/ Nov, 21 Cash dividends were declared. 10,000 quantity 150,000 18/ Jan/22 Dividends will be paid 90,000 32/0ec/21 Hex reported the following revenues and expenses for the year Revenue: Expenses 150,000 80,000 REQUIRED 11) Prepare the journal entries to record the tramactions for 2021 and 2022. Use the Cash Oividend account for dividends declared [10 mark]] Use the income Summary account to close Bevenue and Expenses (0ther account names used: Common share dividend payable, Preferred share dividend poyablel 12) Prepare the itatement of changes in shareholders equity for the year ended Dec 31, 2021 [5 marki] [1] Prepare the journal entries to record the tranabetions for 2021 and 2022. [10 matra]] Use the Cash Dividend account for dividends deciared Whe the incame Sumimary account to close Revenue and Expenses [Other account names used; Common share dividend payable, Preferred share dividend payablel JOUNAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts