Question: Please disregard the instructions in the text and instead prepare a bank reconciliation using the format from exhibit 12 EX 8-16 Bank reconciliation OBJ.5 Identify

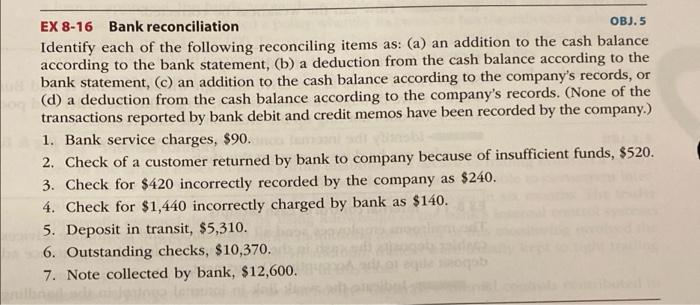

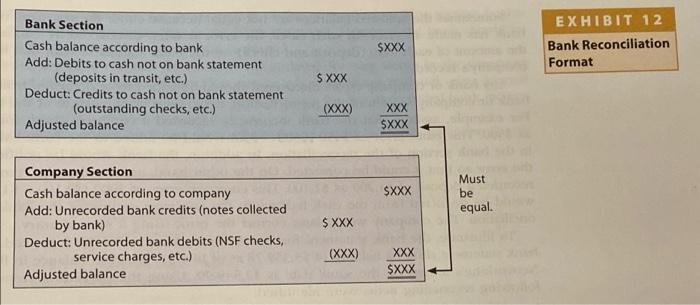

EX 8-16 Bank reconciliation OBJ.5 Identify each of the following reconciling items as: (a) an addition to the cash balance according to the bank statement, (b) a deduction from the cash balance according to the bank statement, (c) an addition to the cash balance according to the company's records, or (d) a deduction from the cash balance according to the company's records. (None of the transactions reported by bank debit and credit memos have been recorded by the company.) 1. Bank service charges, $90. 2. Check of a customer returned by bank to company because of insufficient funds, $520. 3. Check for $420 incorrectly recorded by the company as $240. 4. Check for $1,440 incorrectly charged by bank as $140. 5. Deposit in transit, $5,310. 6. Outstanding checks, $10,370. 7. Note collected by bank, $12,600. $XXX EXHIBIT 12 Bank Reconciliation Format Bank Section Cash balance according to bank Add: Debits to cash not on bank statement (deposits in transit, etc.) Deduct: Credits to cash not on bank statement (outstanding checks, etc.) Adjusted balance $ XXX (XXX) XXX $XXX $XXX Must be equal. Company Section Cash balance according to company Add: Unrecorded bank credits (notes collected by bank) Deduct: Unrecorded bank debits (NSF checks, service charges, etc.) Adjusted balance $ XXX (XXX) XXX $XXX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts