Question: Please do 1 and 2 AS THEY CORRELATE TOGETHER PLEASE HELP ASAP The following questions are about estimating the value of CVS, the retail drug

Please do 1 and 2 AS THEY CORRELATE TOGETHER

PLEASE HELP ASAP

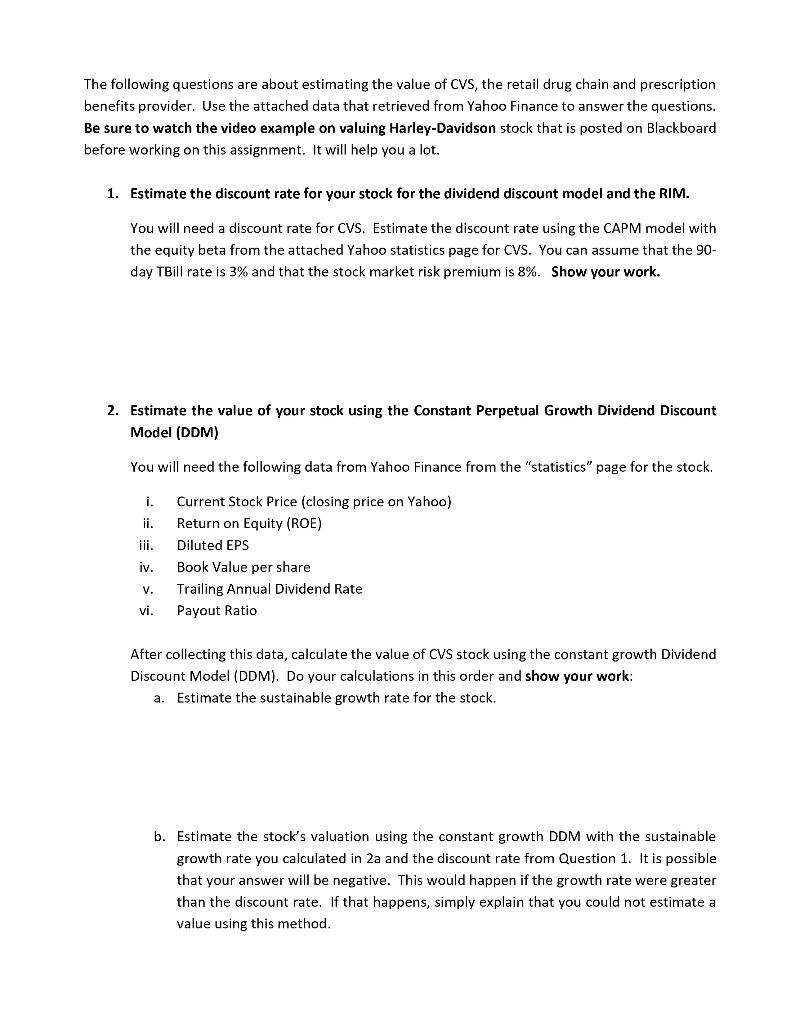

The following questions are about estimating the value of CVS, the retail drug chain and prescription benefits provider. Use the attached data that retrieved from Yahoo Finance to answer the questions. Be sure to watch the video example on valuing Harley-Davidson stock that is posted on Blackboard before working on this assignment. It will help you a lot. 1. Estimate the discount rate for your stock for the dividend discount model and the RIM. You will need a discount rate for CVS. Estimate the discount rate using the CAPM model with the equity beta from the attached Yahoo statistics page for CVS. You can assume that the 90- day TBill rate is 3% and that the stock market risk premium is 8%. Show your work. 2. Estimate the value of your stock using the Constant Perpetual Growth Dividend Discount Model (DDM) You will need the following data from Yahoo Finance from the "statistics" page for the stock. i. ii. iii. Current Stock Price (closing price on Yahoo) Return on Equity (ROE) Diluted EPS Book Value per share Trailing Annual Dividend Rate Payout Ratio iv. v. vi. After collecting this data, calculate the value of CVS stock using the constant growth Dividend Discount Model (DDM). Do your calculations in this order and show your work: a. Estimate the sustainable growth rate for the stock. b. Estimate the stock's valuation using the constant growth DDM with the sustainable growth rate you calculated in 2a and the discount rate from Question 1. It is possible that your answer will be negative. This would happen if the growth rate were greater than the discount rate. If that happens, simply explain that you could not estimate a value using this method. c. Using the constant growth DDM, solve backwards to get the growth rate by using the current stock price in Yahoo Finance (the close price in the Yahoo data). As a hint, using this method the growth rate will be less than the discount rate. The following questions are about estimating the value of CVS, the retail drug chain and prescription benefits provider. Use the attached data that retrieved from Yahoo Finance to answer the questions. Be sure to watch the video example on valuing Harley-Davidson stock that is posted on Blackboard before working on this assignment. It will help you a lot. 1. Estimate the discount rate for your stock for the dividend discount model and the RIM. You will need a discount rate for CVS. Estimate the discount rate using the CAPM model with the equity beta from the attached Yahoo statistics page for CVS. You can assume that the 90- day TBill rate is 3% and that the stock market risk premium is 8%. Show your work. 2. Estimate the value of your stock using the Constant Perpetual Growth Dividend Discount Model (DDM) You will need the following data from Yahoo Finance from the "statistics" page for the stock. i. ii. iii. Current Stock Price (closing price on Yahoo) Return on Equity (ROE) Diluted EPS Book Value per share Trailing Annual Dividend Rate Payout Ratio iv. v. vi. After collecting this data, calculate the value of CVS stock using the constant growth Dividend Discount Model (DDM). Do your calculations in this order and show your work: a. Estimate the sustainable growth rate for the stock. b. Estimate the stock's valuation using the constant growth DDM with the sustainable growth rate you calculated in 2a and the discount rate from Question 1. It is possible that your answer will be negative. This would happen if the growth rate were greater than the discount rate. If that happens, simply explain that you could not estimate a value using this method. c. Using the constant growth DDM, solve backwards to get the growth rate by using the current stock price in Yahoo Finance (the close price in the Yahoo data). As a hint, using this method the growth rate will be less than the discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts