Question: please do 10 11 12 For Questions 7 through 12 (Rig HINT: Follow slides 21-25 in this week's lecture). Assume that you are using a

please do 10 11 12

please do 10 11 12

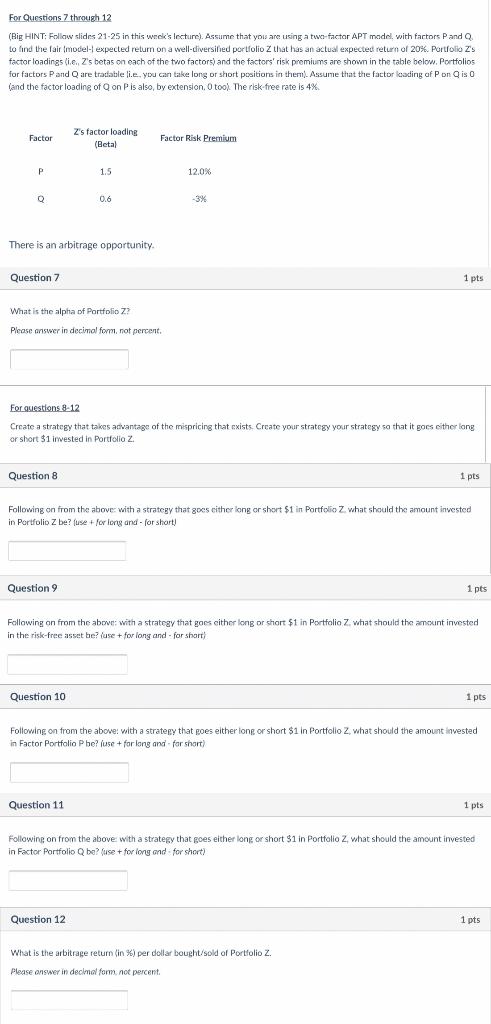

For Questions 7 through 12 (Rig HINT: Follow slides 21-25 in this week's lecture). Assume that you are using a two-factor APT model with factors Pand Q. to find the fair model- expected return on a well-diversified portfolio Z that has an actual expected return of 20%. Portfolio z's factor loadings (ie, Z's betas on each of the two factors) and the factors' risk premiums are shown in the table below. Portfolios for factors Pand Q are tradatle li.e. you can take long or short positions in the Assume that the factor loading of Pon Qiso and the factor loading of Q on Pis also, by extension, too. The risk-free rate is 4% Factor Z's factor loading (Betal Factor Risk Premium P 1.5 12.0% Q 0.6 -3% There is an arbitrage opportunity Question 7 1 pts What is the alpha of Portfolio Z? Please answer in decimal form. not percent. For questions 8-12 Create a strategy that takes advantage of the mispricing that exists. Create your strategy your strategy so that it goes either long . or short $1 invested in Portfolio Z. Question 8 1 pts Following on from the above with a strategy that goes cither long or short $1 in Portfolio Z what should the amount invested in Portfolio Z be? use for long and for short Question 9 1 pts Following on from the above with a strategy that goes cither long or short $1 in Portfolio Z. what should the amount invested in the risk-free asset be? luse + for long and for short Question 10 1 pts Following on from the above with a strategy that goes either long or short $1 in Portfolio 2 what should the amount invested 1 2 in Factor Portfolio Phe? luse + for long and for short) Question 11 1 pts Following on from the above with a strategy that goes either long or short $1 in Portfolio 2 what should the amount invested in Factor Portfolio Q be? use + for long and for short) Question 12 1 pts What is the arbitrage return (in %) per dollar bought/sold of Portfolio Z. Please answer in decimal form. not percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts