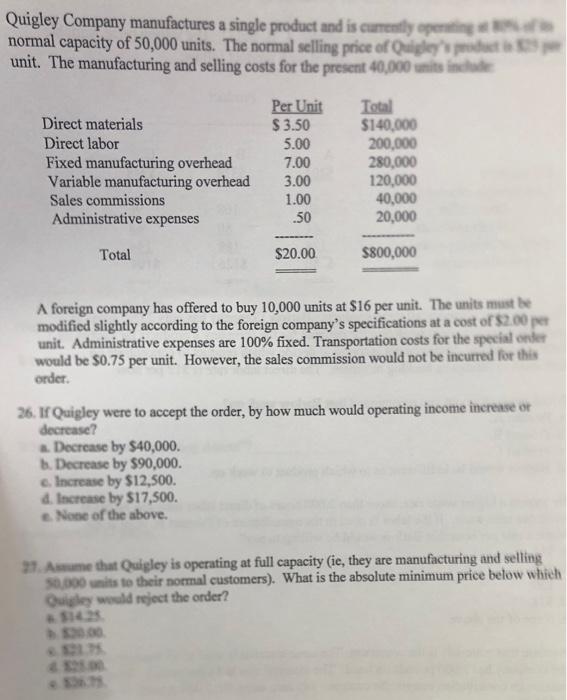

Question: please do 27 blurred numbers at top right are 80% f normal capacity and $25 per unit (if needed to answer) Quigley Company manufactures a

Quigley Company manufactures a single product and is currently normal capacity of 50,000 units. The normal selling price of Quigley unit. The manufacturing and selling costs for the present 40,000 units Direct materials Direct labor Fixed manufacturing overhead Variable manufacturing overhead Sales commissions Administrative expenses Per Unit $ 3.50 5.00 7.00 3.00 1.00 .50 Total $140,000 200,000 280,000 120,000 40,000 20,000 Total $20.00 $800,000 A foreign company has offered to buy 10,000 units at $16 per unit. The units must be modified slightly according to the foreign company's specifications at a cost of $2.00 unit. Administrative expenses are 100% fixed. Transportation costs for the special ondet would be $0.75 per unit. However, the sales commission would not be incurred for this order. 26. If Quigley were to accept the order, by how much would operating income increase or decrease? Decrease by $40,000. . Decrease by $90,000. Increase by $12,500. d. Increase by $17,500. None of the above. 21. Asume that Quigley is operating at full capacity (ie, they are manufacturing and selling 50.000 units to their normal customers). What is the absolute minimum price below which Quigley would reject the order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts