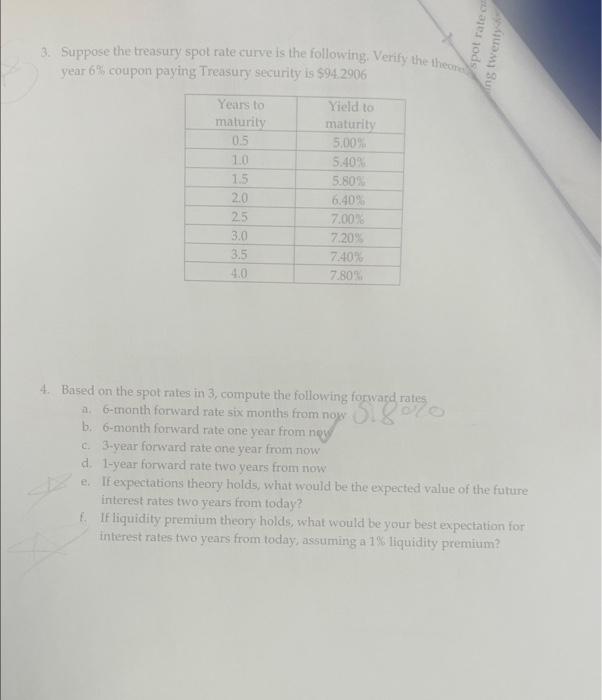

Question: please do 4 Spot ratech ng twent 0.5 3. Suppose the treasury spot rate curve is the following: Verify the theore year 6% coupon paying

Spot ratech ng twent 0.5 3. Suppose the treasury spot rate curve is the following: Verify the theore year 6% coupon paying Treasury security is $94.2906 Years to Yield to maturity maturity 5.00% 1.0 5.409 1.5 5.80 20 6.40% 25 7.00 3.0 7,209 3,5 7:40 40 7.80 4. Based on the spot rates in 3, compute the following forward rates n. 6-month forward rate six months from now b. 6-month forward rate one year from ney C3-year forward rate one year from now d. 1-year forward rate two years from now e. If expectations theory holds, what would be the expected value of the future interest rates two years from today? IF liquidity premium theory holds, what would be your best expectation for interest rates two years from today, assuming a 1% liquidity premium? Spot ratech ng twent 0.5 3. Suppose the treasury spot rate curve is the following: Verify the theore year 6% coupon paying Treasury security is $94.2906 Years to Yield to maturity maturity 5.00% 1.0 5.409 1.5 5.80 20 6.40% 25 7.00 3.0 7,209 3,5 7:40 40 7.80 4. Based on the spot rates in 3, compute the following forward rates n. 6-month forward rate six months from now b. 6-month forward rate one year from ney C3-year forward rate one year from now d. 1-year forward rate two years from now e. If expectations theory holds, what would be the expected value of the future interest rates two years from today? IF liquidity premium theory holds, what would be your best expectation for interest rates two years from today, assuming a 1% liquidity premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts