Question: Please do 7A-4 and 7-57. Please do both questions and show all the formulas used. Thanks 7A-4 Given the following cash flow, determine the rate

Please do 7A-4 and 7-57. Please do both questions and show all the formulas used. Thanks

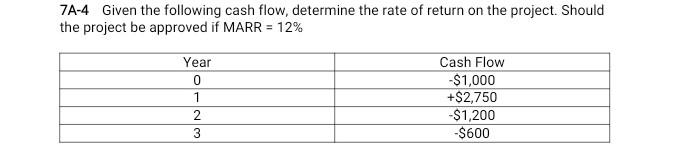

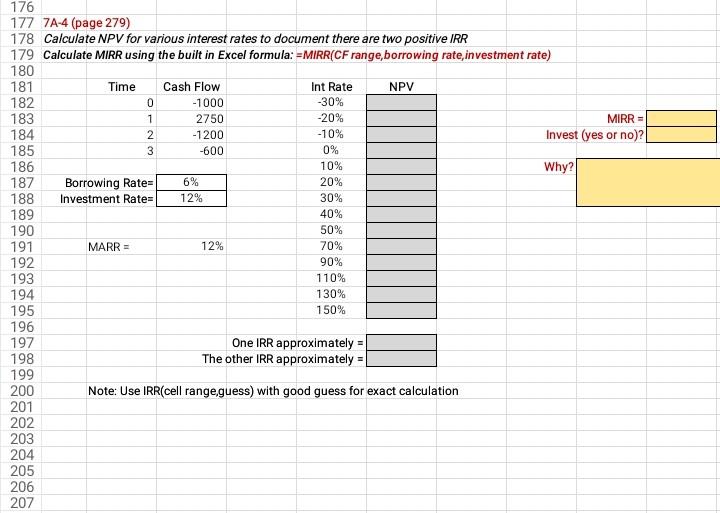

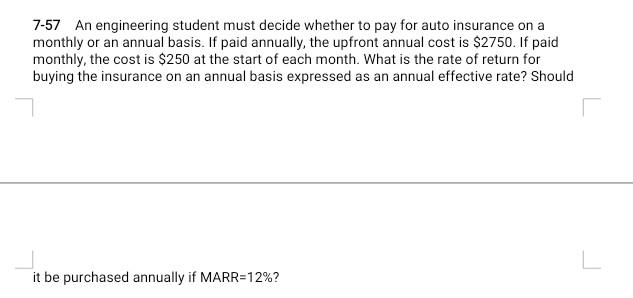

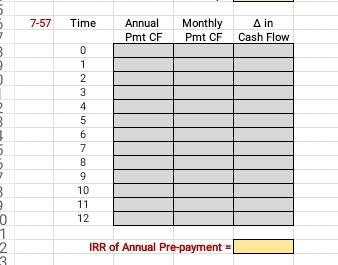

7A-4 Given the following cash flow, determine the rate of return on the project. Should the project be approved if MARR = 12% Year 0 1 2 3 Cash Flow $1,000 +$2,750 -$1,200 -$600 1 176 177 7A-4 (page 279) 178 Calculate NPV for various interest rates to document there are two positive IRR 179 Calculate MIRR using the built in Excel formula: -MIRR(CF range, borrowing rate, investment rate) 180 181 Time Cash Flow Int Rate NPV 182 0 -1000 -30% 183 2750 -20% MIRR = 184 2 -1200 -10% Invest (yes or no)? 185 3 -600 0% 186 10% Why? 187 Borrowing Rate 6% 20% 188 Investment Rate= 12% 30% 189 40% 190 50% 191 MARR = 12% 70% 192 90% 193 110% 194 130% 195 150% 196 197 One IRR approximately 198 The other IRR approximately = 199 200 Note: Use IRR(cell range,guess) with good guess for exact calculation 201 202 203 204 205 206 207 7-57 An engineering student must decide whether to pay for auto insurance on a monthly or an annual basis. If paid annually, the upfront annual cost is $2750. If paid monthly, the cost is $250 at the start of each month. What is the rate of return for buying the insurance on an annual basis expressed as an annual effective rate? Should L it be purchased annually if MARR=12%? 7-57 Time Annual Pmt CF Monthly Pmt CF A in Cash Flow 7 3 0 1 2 3 4 5 6 7 8 9 10 11 12 3 0 1 2 3 NI IRR of Annual Pre-payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts