Question: please do a 10% increase in sales and make the necessary adjustments in the income statement to answer the questions below ASDF Corporate Income Statement

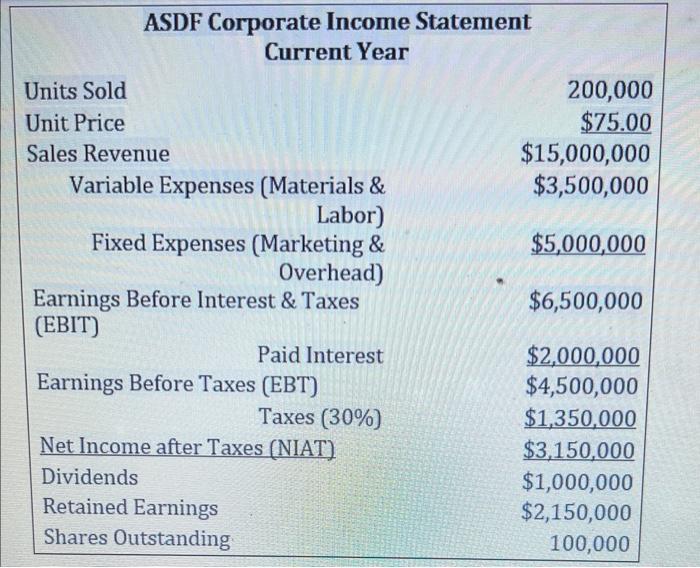

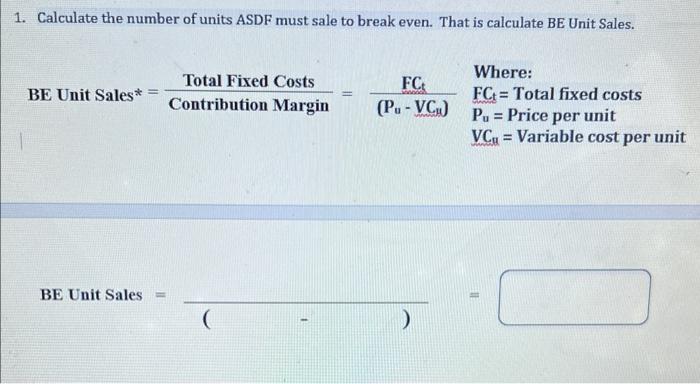

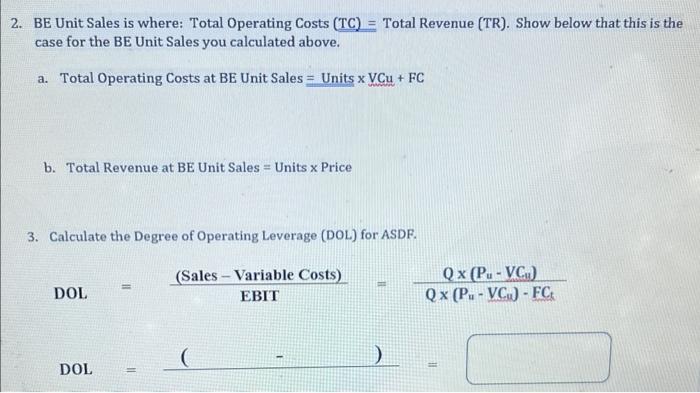

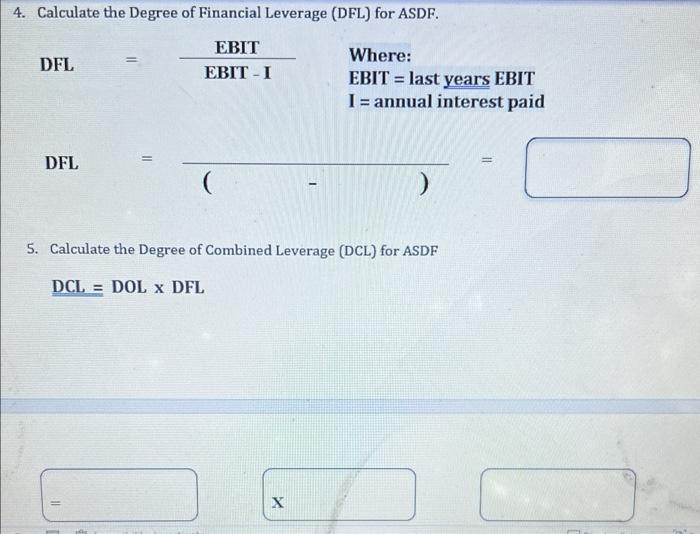

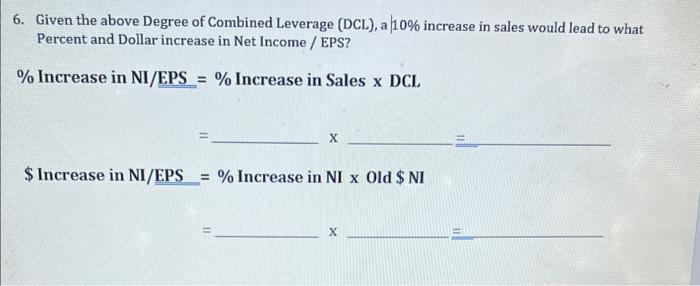

ASDF Corporate Income Statement Current Year Units Sold Unit Price Sales Revenue Variable Expenses (Materials \& Labor) Fixed Expenses (Marketing \& $5,000,000 Earnings Before Interest \& Taxes $6,500,000 (EBIT) Earnings Before Taxes (EBT) Taxes (30%) Net Income after Taxes (NIAT) Dividends Retained Earnings Shares Outstanding 1. Calculate the number of units ASDF must sale to break even. That is calculate BE Unit Sales. BEUnitSales=ContributionMarginTotalFixedCosts=(PuVCu)FCtWhere:Ft=TotalfixedcostsPu=PriceperunitVCa=Variablecostperunit BEUnitSales=()()= 2. BE Unit Sales is where: Total Operating Costs (TC)= Total Revenue (TR). Show below that this is the case for the BE Unit Sales you calculated above. a. Total Operating Costs at BE Unit Sales Units VCu + FC b. Total Revenue at BE Unit Sales = Units Price 3. Calculate the Degree of Operating Leverage (DOL) for ASDF. DOL=EBIT(SalesVariableCosts)=Q(PuVCu)FCtQ(PuVCu)DOL= Calculate the Degree of Financial Leverage (DFL) for ASDF. DFL =(1)= 5. Calculate the Degree of Combined Leverage (DCL) for ASDF DCL=DOLDFL 6. Given the above Degree of Combined Leverage (DCL), a 10% increase in sales would lead to what Percent and Dollar increase in Net Income / EPS? % Increase in NI/EPS =% Increase in Sales DCL = x \$Increase in NI/EPS =% Increase in NI x old $NI = x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts