Question: please do a and b Janice Wilcox is a wealthy investor who's looking for a tax shelter, Janice is in the maximum (37%) federal tax

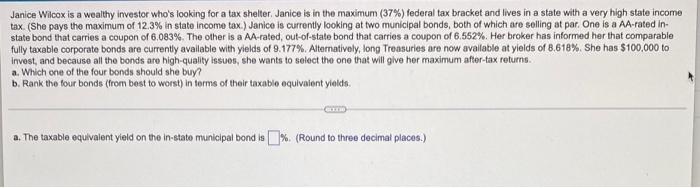

Janice Wilcox is a wealthy investor who's looking for a tax shelter, Janice is in the maximum (37%) federal tax bracket and lives in a state with a very high state income tax (She pays the maximum of 12.3% in state income tax.) Janice is currently looking at two municipal bonds, both of which are selling at par. One is a AA-rated in state bond that carries a coupon of 6.083%. The other is a AA-rated, out-of-state bond that carries a coupon of 6.552%. Her broker has informed her that comparable fully taxable corporate bonds are currently available with yields of 9.177%. Alternatively , long Treasures are now available at yields of 8.618% She has $100,000 to Invest, and because all the bonds are high-quality issues, she wants to select the one that will give her maximum after-tax returns. a. Which one of the four bonds should she buy? b. Rank the four bonds (from best to worst) in terms of their taxablo equivalent yields. a. The taxable equivalent yield on the In-stato municipal bond is % (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts