Question: please do a & b Exercise 9.13 (Algo) Units-of-Output Method (LO9-4) During the current year, Central Auto Rentals purchased 60 new automobiles at a cost

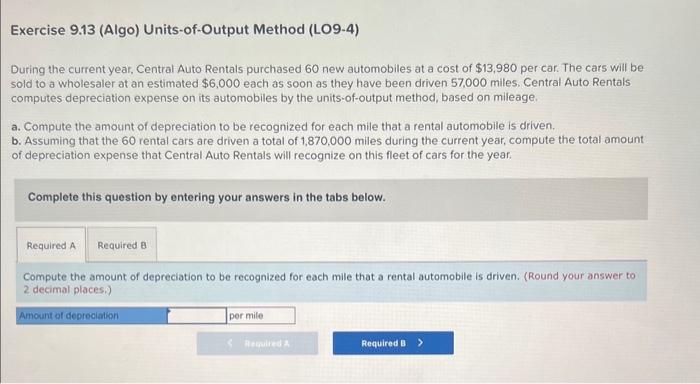

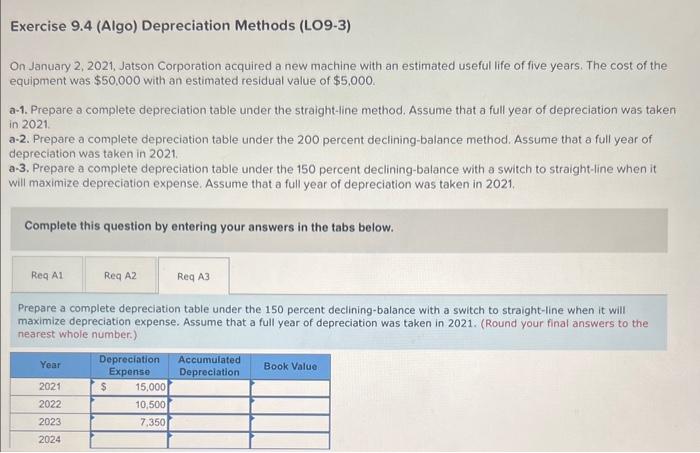

Exercise 9.13 (Algo) Units-of-Output Method (LO9-4) During the current year, Central Auto Rentals purchased 60 new automobiles at a cost of $13,980 per car. The cars will be sold to a wholesaler at an estimated $6,000 each as soon as they have been driven 57,000 miles. Central Auto Rentals computes depreciation expense on its automobiles by the units-of-output method, based on mileage. a. Compute the amount of depreciation to be recognized for each mile that a rental automobile is driven. b. Assuming that the 60 rental cars are driven a total of 1,870,000 miles during the current year, compute the total amount of depreciation expense that Central Auto Rentals will recognize on this fleet of cars for the year. Complete this question by entering your answers in the tabs below. Compute the amount of depreciation to be recognized for each mile that a rental automobile is driven. (Round your answer to 2 decimal places.) Exercise 9.4 (Algo) Depreciation Methods (LO9-3) On January 2, 2021, Jatson Corporation acquired a new machine with an estimated useful life of five years. The cost of the equipment was $50.000 with an estimated residual value of $5.000. a-1. Prepare a complete depreciation table under the straight-line method. Assume that a full year of depreciation was taken in 2021. a-2. Prepare a complete depreciation table under the 200 percent declining-balance method. Assume that a full year of depreciation was taken in 2021. a-3. Prepare a complete depreciation table under the 150 percent declining-balance with a switch to straight-line when it will maximize depreciation expense. Assume that a full year of depreciation was taken in 2021. Complete this question by entering your answers in the tabs below. Prepare a complete depreciation table under the 150 percent declining-balance with a switch to straight-line when it will maximize depreciation expense. Assume that a full year of depreciation was taken in 2021. (Round your final answers to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts