Question: please do a detailed explanation and time diagram (a) Mr. Simpson buys a $1000 semi-annual coupon bond paying interest at 8.8%/year compounded semi-annually and redeemable

please do a detailed explanation and time diagram

please do a detailed explanation and time diagram

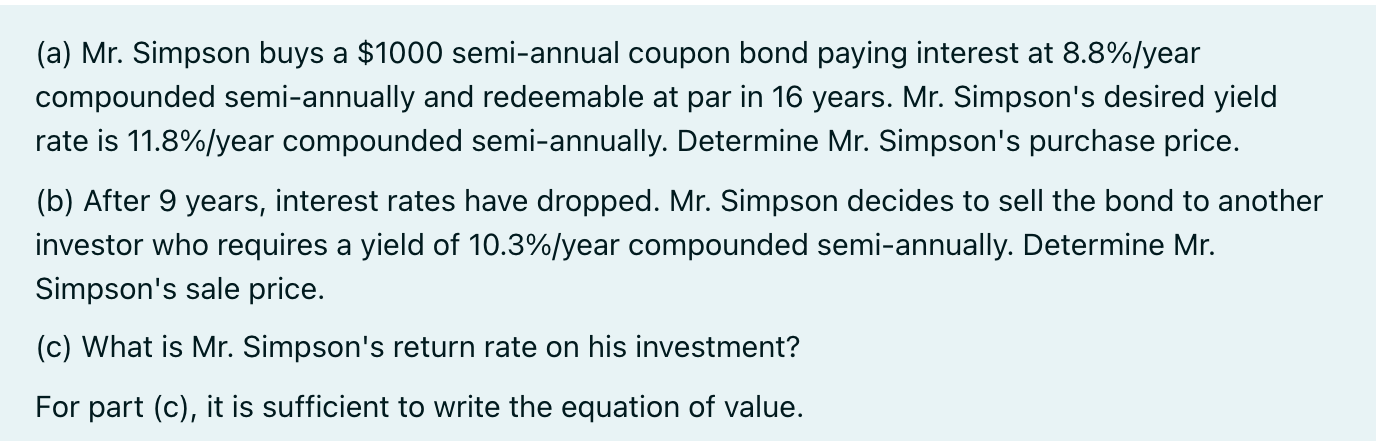

(a) Mr. Simpson buys a $1000 semi-annual coupon bond paying interest at 8.8%/year compounded semi-annually and redeemable at par in 16 years. Mr. Simpson's desired yield rate is 11.8%/year compounded semi-annually. Determine Mr. Simpson's purchase price. (b) After 9 years, interest rates have dropped. Mr. Simpson decides to sell the bond to another investor who requires a yield of 10.3%/year compounded semi-annually. Determine Mr. Simpson's sale price. (c) What is Mr. Simpson's return rate on his investment? For part (c), it is sufficient to write the equation of value. (a) Mr. Simpson buys a $1000 semi-annual coupon bond paying interest at 8.8%/year compounded semi-annually and redeemable at par in 16 years. Mr. Simpson's desired yield rate is 11.8%/year compounded semi-annually. Determine Mr. Simpson's purchase price. (b) After 9 years, interest rates have dropped. Mr. Simpson decides to sell the bond to another investor who requires a yield of 10.3%/year compounded semi-annually. Determine Mr. Simpson's sale price. (c) What is Mr. Simpson's return rate on his investment? For part (c), it is sufficient to write the equation of value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts