Question: please do a proper income statement for A as well as do B. please show working. 5. Betta, Gretta and Jetta operate a partnership business

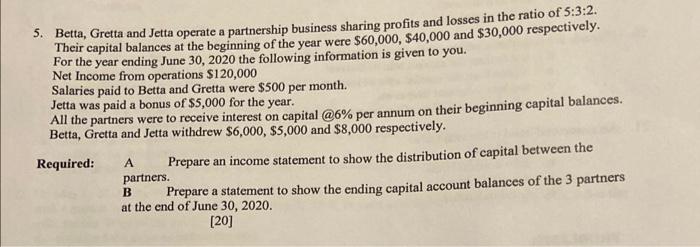

5. Betta, Gretta and Jetta operate a partnership business sharing profits and losses in the ratio of 5:3:2. Their capital balances at the beginning of the year were $60,000,$40,000 and $30,000 respectively. For the year ending June 30,2020 the following information is given to you. Net Income from operations $120,000 Salaries paid to Betta and Gretta were $500 per month. Jetta was paid a bonus of $5,000 for the year. All the partners were to receive interest on capital @6\% per annum on their beginning capital balances. Betta, Gretta and Jetta withdrew $6,000,$5,000 and $8,000 respectively. Required: A Prepare an income statement to show the distribution of capital between the partners. B Prepare a statement to show the ending capital account balances of the 3 partners at the end of June 30,2020. [20]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts