Question: please do all 3 questions Requirements 1. Record the adjusting entry assuming that Lavish records the cash receipt of unearned revenue by initially crediting a

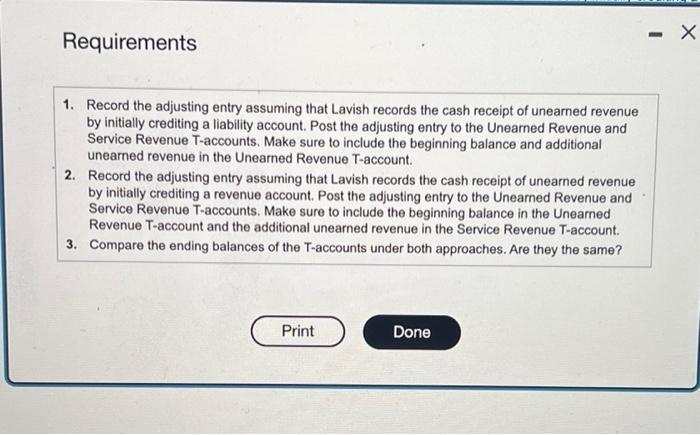

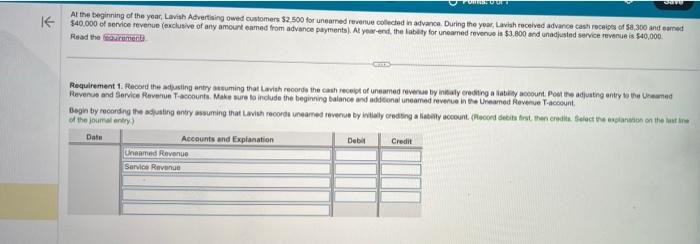

Requirements 1. Record the adjusting entry assuming that Lavish records the cash receipt of unearned revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unearned revenue in the Unearned Revenue T-account. 2. Record the adjusting entry assuming that Lavish records the cash receipt of unearned revenue by initially crediting a revenue account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance in the Unearned Revenue T-account and the additional unearned revenue in the Service Revenue T-account. 3. Compare the ending balances of the T-accounts under both approaches. Are they the same? At the beginning of the yoar, Laviah Advertising owed customers $2.500 for unearned revenue colected in advance. During the year, Laviah roceived advance cass roceiges of 5a,300 and earned $40.000 of service retyenue (euclusive of any amourt eamed from advance payments). Al year-end, the Labdity for unearned rovenue is $3.800 acd unadjasted service revenue is $40,000. Resad the Revenus and Service Reverse T.ascounts. Make sure to indude the beginning balance and addenenal unearned reverce in the Uneamed Revenue T.accecunt. Oegin by reconsing the adfuating entry assuming that Lavish records unearred reverue by ivilaly oreding a lakelly account. of the joumel entery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts