Question: Please do all 4 questions The current PCBA fails on average 0.4 times per year for each pump sold during the warranty period of two

Please do all 4 questions

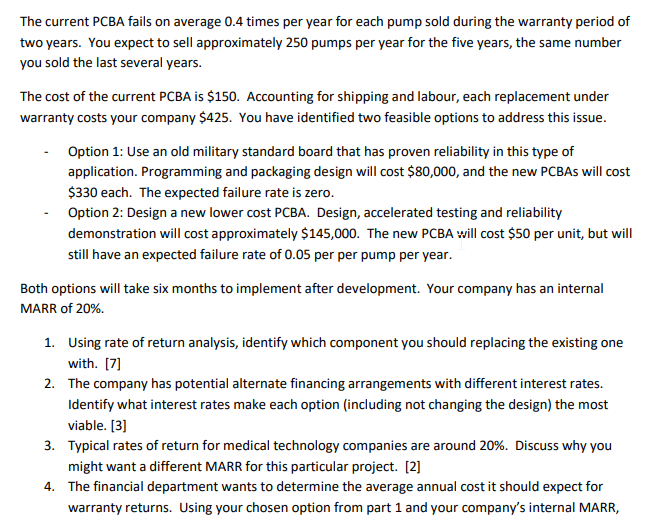

The current PCBA fails on average 0.4 times per year for each pump sold during the warranty period of two years. You expect to sell approximately 250 pumps per year for the five years, the same number you sold the last several years. The cost of the current PCBA is $150. Accounting for shipping and labour, each replacement under warranty costs your company $425. You have identified two feasible options to address this issue. Option 1: Use an old military standard board that has proven reliability in this type of application. Programming and packaging design will cost $80,000, and the new PCBAs will cost $330 each. The expected failure rate is zero. Option 2: Design a new lower cost PCBA. Design, accelerated testing and reliability demonstration will cost approximately $145,000. The new PCBA will cost $50 per unit, but will still have an expected failure rate of 0.05 per per pump per year. - Both options will take six months to implement after development. Your company has an internal MARR of 20%. 1. Using rate of return analysis, identify which component you should replacing the existing one with. [7] 2. The company has potential alternate financing arrangements with different interest rates. Identify what interest rates make each option (including not changing the design) the most viable. [3] 3. Typical rates of return for medical technology companies are around 20%. Discuss why you might want a different MARR for this particular project. [2] 4. The financial department wants to determine the average annual cost it should expect for warranty returns. Using your chosen option from part 1 and your company's internal MARR, estimate the annual warranty costs for the next 4 years, including any fixed and one-time costs associated with changing the design. Assume sales remain constant. [6] The current PCBA fails on average 0.4 times per year for each pump sold during the warranty period of two years. You expect to sell approximately 250 pumps per year for the five years, the same number you sold the last several years. The cost of the current PCBA is $150. Accounting for shipping and labour, each replacement under warranty costs your company $425. You have identified two feasible options to address this issue. Option 1: Use an old military standard board that has proven reliability in this type of application. Programming and packaging design will cost $80,000, and the new PCBAs will cost $330 each. The expected failure rate is zero. Option 2: Design a new lower cost PCBA. Design, accelerated testing and reliability demonstration will cost approximately $145,000. The new PCBA will cost $50 per unit, but will still have an expected failure rate of 0.05 per per pump per year. - Both options will take six months to implement after development. Your company has an internal MARR of 20%. 1. Using rate of return analysis, identify which component you should replacing the existing one with. [7] 2. The company has potential alternate financing arrangements with different interest rates. Identify what interest rates make each option (including not changing the design) the most viable. [3] 3. Typical rates of return for medical technology companies are around 20%. Discuss why you might want a different MARR for this particular project. [2] 4. The financial department wants to determine the average annual cost it should expect for warranty returns. Using your chosen option from part 1 and your company's internal MARR, estimate the annual warranty costs for the next 4 years, including any fixed and one-time costs associated with changing the design. Assume sales remain constant. [6]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts