Question: Please do all Ambiguity aversion best explains which of the following asset market phenomena? Home bias O Local bias Momentum O Both A and B

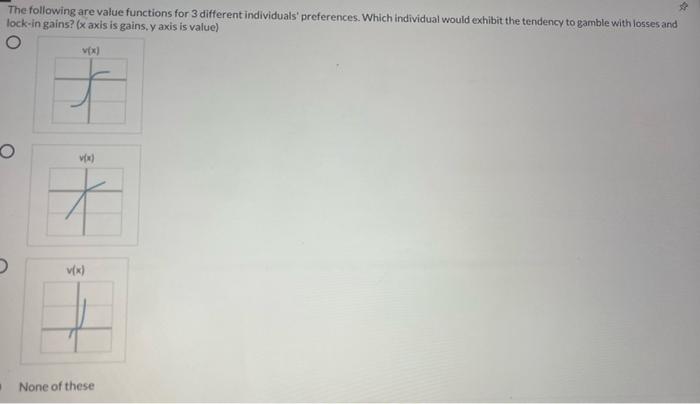

Ambiguity aversion best explains which of the following asset market phenomena? Home bias O Local bias Momentum O Both A and B Ambiguity aversion is the idea that Generally people prefer not to know the distribution of possible outcomes in an uncertain situation Generally people prefer to know the distribution of possible outcomes in an uncertain situation Generally people prefer a certain loss to a gamble where they lose on average the same amount Generally people prefer a certain gain to a gamble where they gain on average the same amount Assume you conducted a study that conclusively rejects Weak Form Market Efficiency. Which of the following must also be true? Semi-strong Form Market Efficiency is also rejected Strong Form Market Efficiency is also rejected Both a. and b. Neither a nor b. The following are value functions for 3 different individuals' preferences. Which individual would exhibit the tendency to gamble with losses and lock-in gains? (x axis is gains, y axis is value) O vix) + o Via) + vix None of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts