Question: Company XYZ in previous three years (2016,17,18) has lost $1,000,000 in each year. From 2019 and 2020 it is making $ 1,500,000 per year.

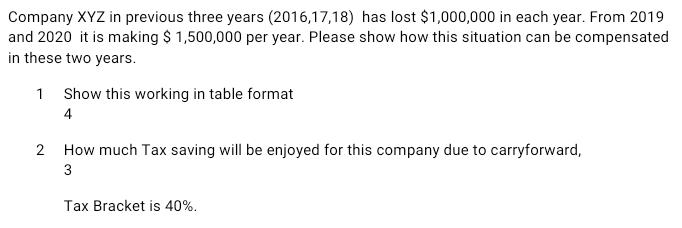

Company XYZ in previous three years (2016,17,18) has lost $1,000,000 in each year. From 2019 and 2020 it is making $ 1,500,000 per year. Please show how this situation can be compensated in these two years. 1 Show this working in table format 4 2 How much Tax saving will be enjoyed for this company due to carryforward, 3 Tax Bracket is 40%.

Step by Step Solution

3.26 Rating (158 Votes )

There are 3 Steps involved in it

Ans tax saving for 2019 6000000 and for 2020 520000... View full answer

Get step-by-step solutions from verified subject matter experts