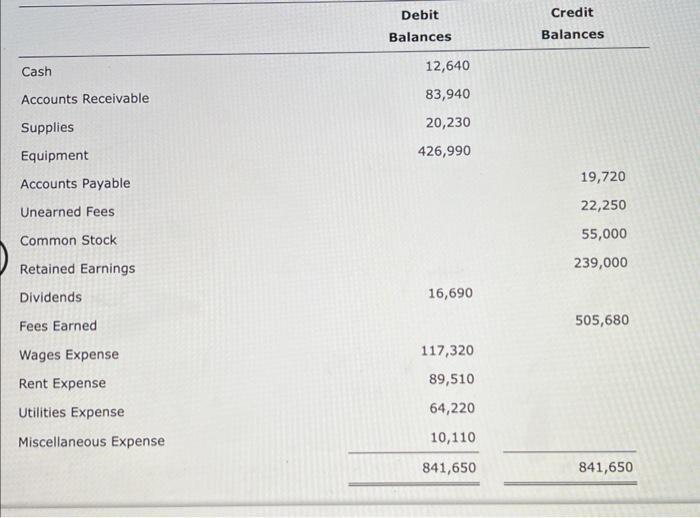

Question: Cash Accounts Receivable Supplies Equipment Accounts Payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Miscellaneous Expense

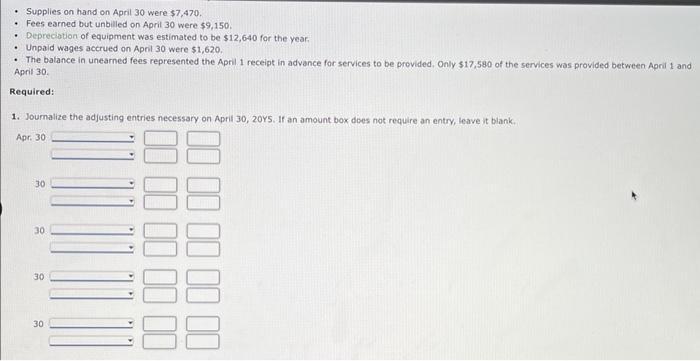

Cash Accounts Receivable Supplies Equipment Accounts Payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Miscellaneous Expense Debit Balances 12,640 83,940 20,230 426,990 16,690 117,320 89,510. 64,220 10,110 841,650 Credit Balances 19,720 22,250 55,000 239,000 505,680 841,650 Supplies on hand on April 30 were $7,470. Fees earned but unbilled on April 30 were $9,150. Depreciation of equipment was estimated to be $12,640 for the year. Unpaid wages accrued on April 30 were $1,620. The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $17,580 of the services was provided between April 1 and April 30. Required: 1. Journalize the adjusting entries necessary on April 30, 20YS. If an amount box does not require an entry, leave it blank. Apr. 30 30 30 30 30 00 00 00 2. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. before the adjusting entries. Revenues Expenses Net income 3. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. after the adjusting entries. Revenues Expenses Net income 4. Determine the effect of the adjusting entries on Retained Earnings. Retained Earnings by $

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Answer journal entries Date Account Debit Credit ... View full answer

Get step-by-step solutions from verified subject matter experts