Question: please do all need help Question 19 3.34 pts Iden Inc. produced 50,000 units in year 1 and had operating cash flow of $600,000 and

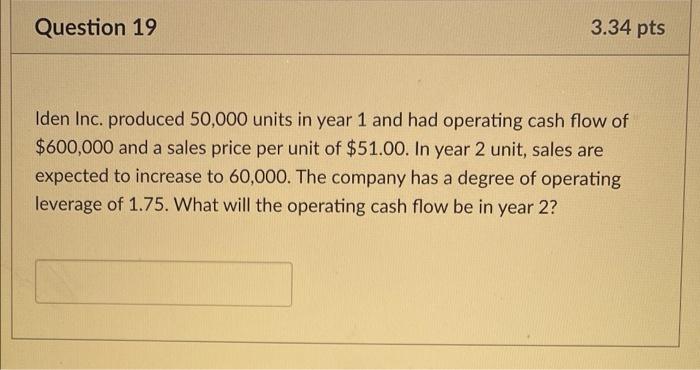

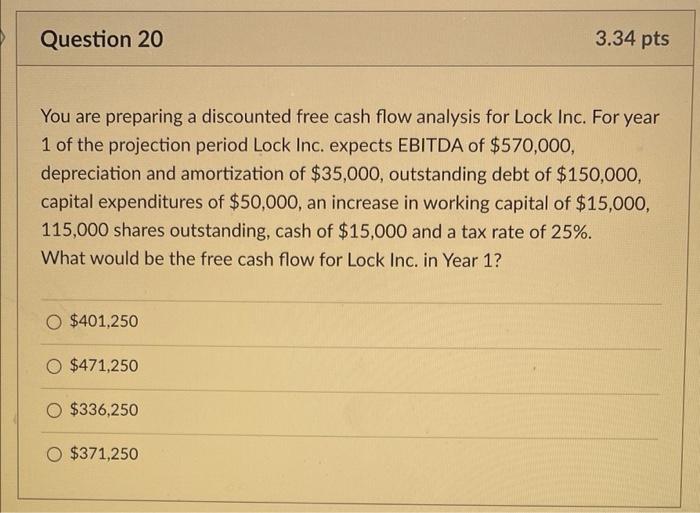

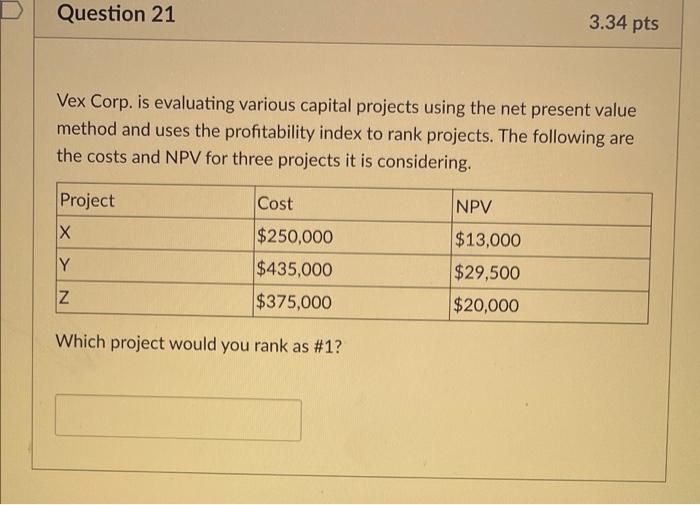

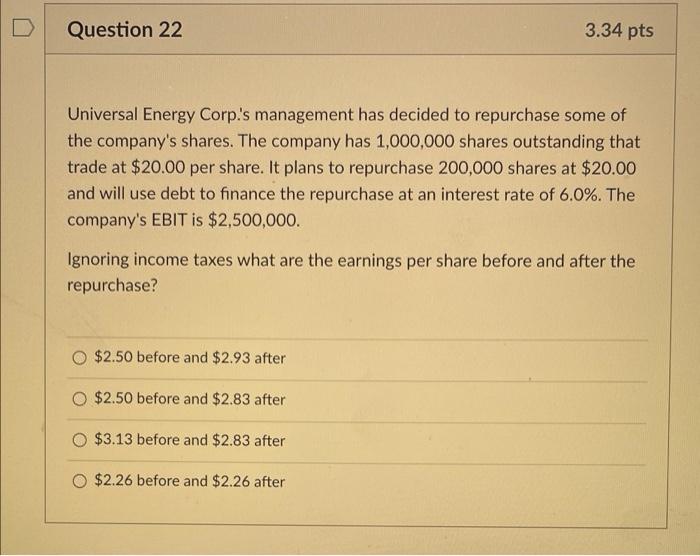

Question 19 3.34 pts Iden Inc. produced 50,000 units in year 1 and had operating cash flow of $600,000 and a sales price per unit of $51.00. In year 2 unit, sales are expected to increase to 60,000. The company has a degree of operating leverage of 1.75. What will the operating cash flow be in year 2? Question 20 3.34 pts You are preparing a discounted free cash flow analysis for Lock Inc. For year 1 of the projection period Lock Inc. expects EBITDA of $570,000, depreciation and amortization of $35,000, outstanding debt of $150,000, capital expenditures of $50,000, an increase in working capital of $15,000, 115,000 shares outstanding, cash of $15,000 and a tax rate of 25%. What would be the free cash flow for Lock Inc. in Year 1? O $401,250 $471,250 $336,250 O $371,250 Question 21 3.34 pts Vex Corp. is evaluating various capital projects using the net present value method and uses the profitability index to rank projects. The following are the costs and NPV for three projects it is considering. Project Cost NPV $250,000 Y $435,000 $375,000 $13,000 $29,500 $20,000 Z Which project would you rank as #1? Question 22 3.34 pts Universal Energy Corp.'s management has decided to repurchase some of the company's shares. The company has 1,000,000 shares outstanding that trade at $20.00 per share. It plans to repurchase 200,000 shares at $20.00 and will use debt to finance the repurchase at an interest rate of 6.0%. The company's EBIT is $2,500,000. Ignoring income taxes what are the earnings per share before and after the repurchase? $2.50 before and $2.93 after $2.50 before and $2.83 after $3.13 before and $2.83 after $2.26 before and $2.26 after

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts