Question: Please do all or as many as possible Insider Trading David Gain is the chief executive officer (CEO) of Forest Media Corp., which is interested

Please do all or as many as possible

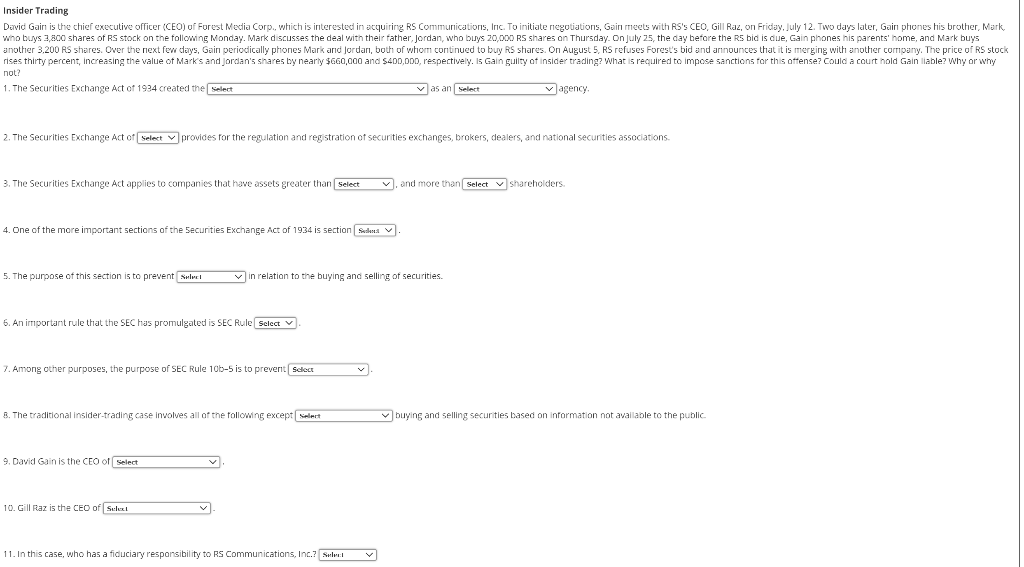

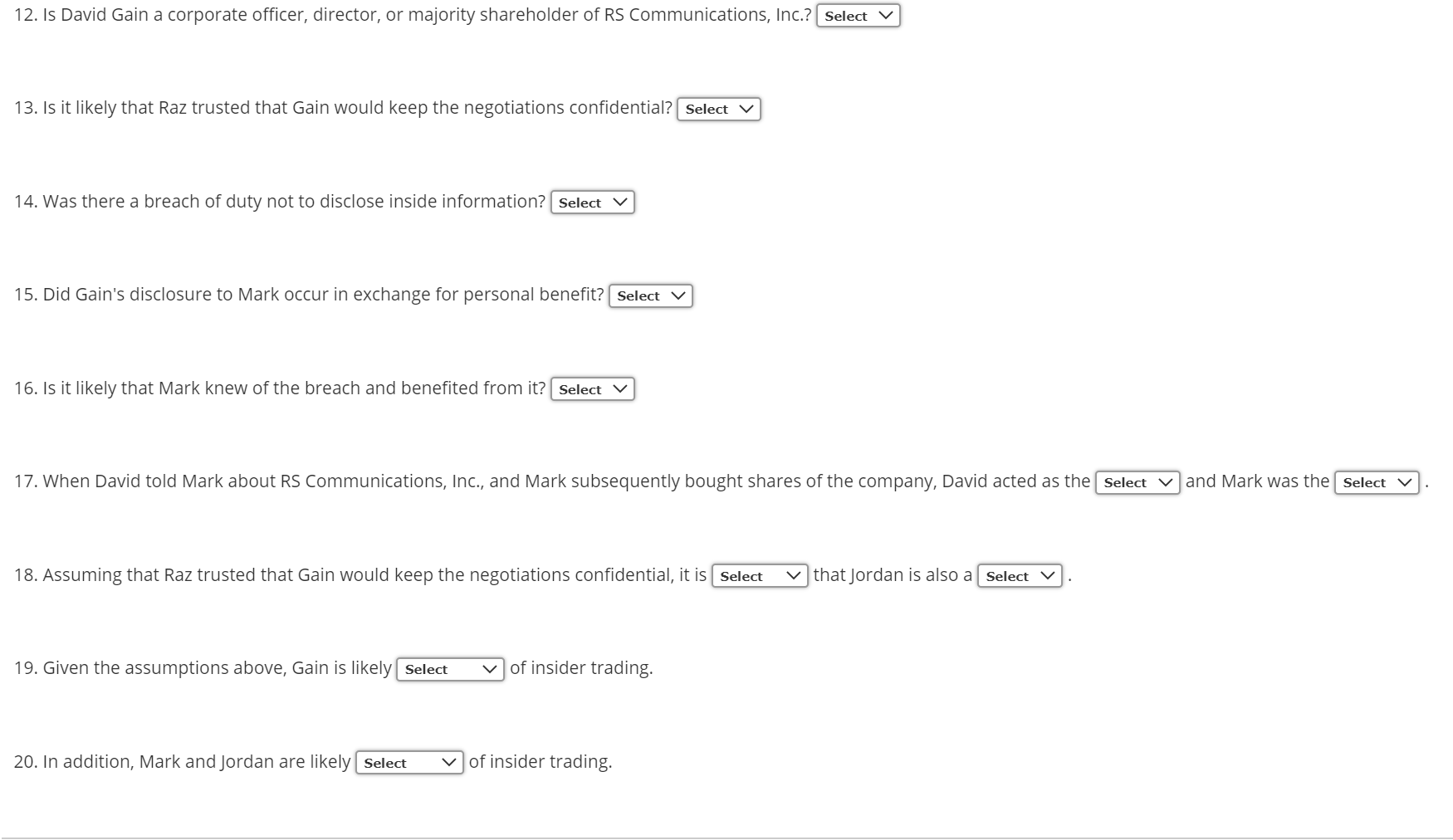

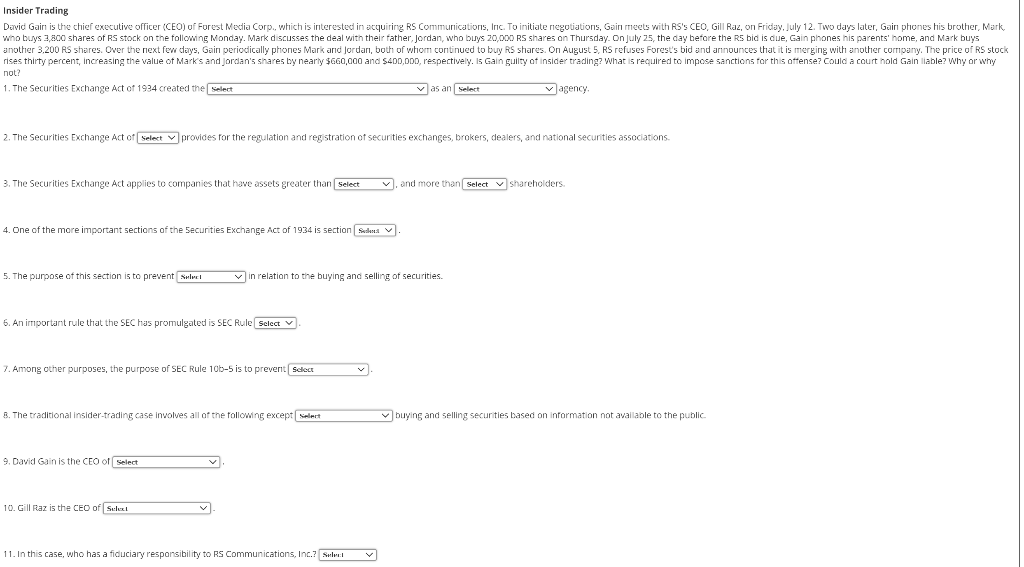

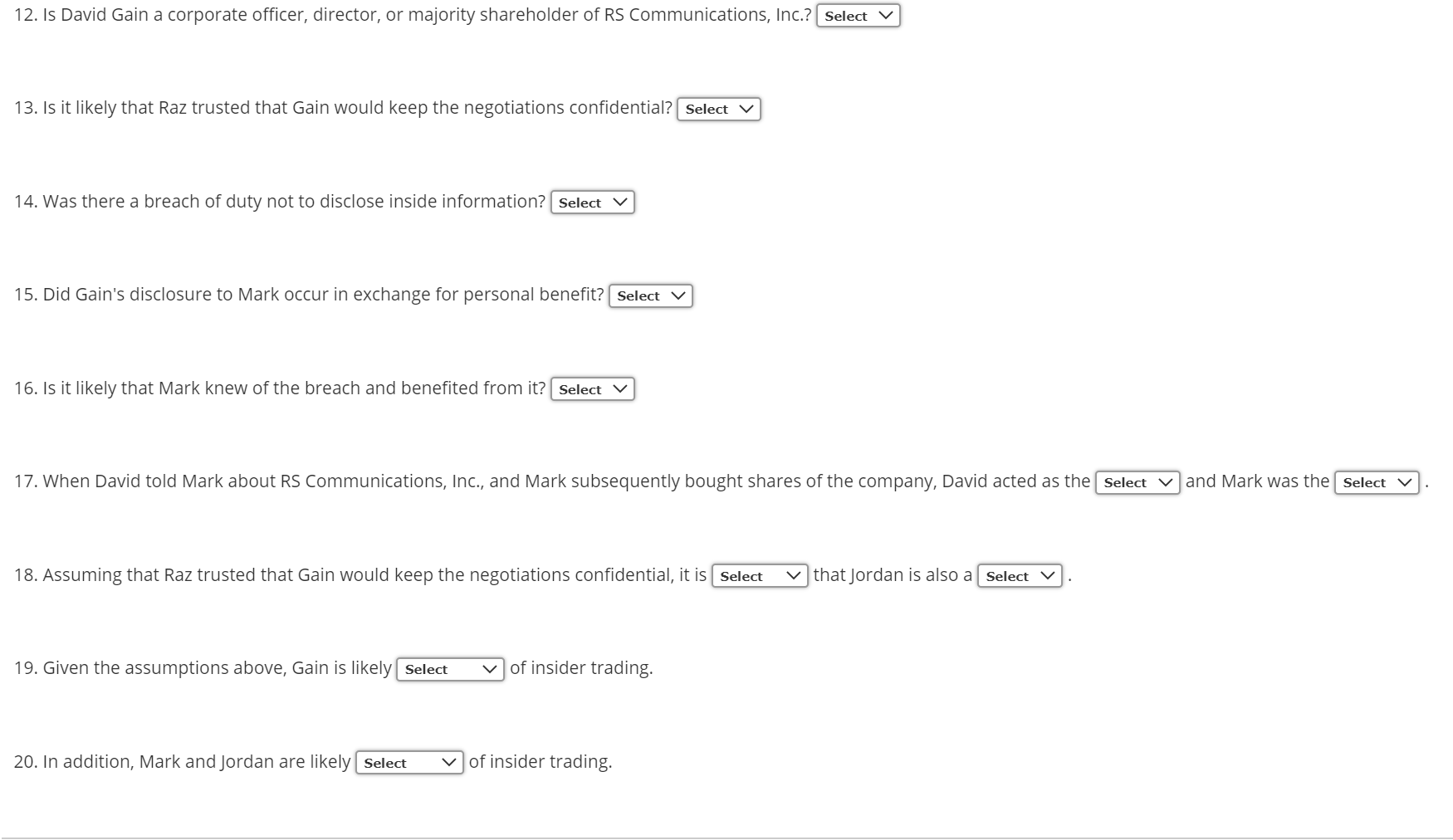

Insider Trading David Gain is the chief executive officer (CEO) of Forest Media Corp., which is interested in acquiring RS Communications, Inc. To initiate negotiations, Gain meets with RS'S CEO, Gill Raz, on Friday, July 12. Two days later, Gain phones his brother, Mark who buys 3,800 shares of RS stock on the following Monday. Mark discusses the deal with their father, Jordan, who buys 20,000 RS shares on Thursday. On July 25, the day before the Rs bid is due, Gain phones his parents' home, and Mark buys another 3.200 RS shares. Over the next few days, Gain periodically phones Mark and Jordani, both of whom continued to buy RS shares. On August 5, RS refuses Forest's bid and announces that it is merging with another company. The price of RS stock rises thirty percent, increasing the value of Marks and Jordan's shares by nearly $660,000 and $400,000, respectively. Is Gain guilty of insider trading? What is required to impose sanctions for this offense? Could a court hold Gain liable? Why or why not? 1. The Securities Exchange Act of 1934 created the select as an Select agency 2. The Securities Exchange Act of Select provides for the regulation and registration of securities exchanges, brokers, dealers, and national securities associations 3. The Securities Exchange Act applies to companies that have assets greater than Select and more than Select vshareholders 4. One of the more important sections of the Securities Exchange Act of 1934 is section Selv 5. The purpose of this section is to prevent Sulpet in relation to the buying and selling of securities. 6. An important rule that the SEC has promulgated is SEC Rule Select 7. Among other purposes, the purpose of SEC Rule 10b-5 is to preventSchect 8. The traditional insider-trading case involves all of the following except Select buying and selling securities based on information not available to the public 9. David Gain is the CEO of Select 10. Gill Raz is the CEO of Sulut 11. In this case, who has a fiduciary responsibility to RS Communications, Inc.? Select 12. Is David Gain a corporate officer, director, or majority shareholder of RS Communications, Inc.? Select V 13. Is it likely that Raz trusted that Gain would keep the negotiations confidential? Select V 14. Was there a breach of duty not to disclose inside information? Select V 15. Did Gain's disclosure to Mark occur in exchange for personal benefit? Select v 16. Is it likely that Mark knew of the breach and benefited from it? Select V 17. When David told Mark about RS Communications, Inc., and Mark subsequently bought shares of the company, David acted as the Select V and Mark was the Select v 18. Assuming that Raz trusted that Gain would keep the negotiations confidential, it is Select that Jordan is also a Select V 19. Given the assumptions above, Gain is likely Select of insider trading. 20. In addition, Mark and Jordan are likely Select of insider trading. Insider Trading David Gain is the chief executive officer (CEO) of Forest Media Corp., which is interested in acquiring RS Communications, Inc. To initiate negotiations, Gain meets with RS'S CEO, Gill Raz, on Friday, July 12. Two days later, Gain phones his brother, Mark who buys 3,800 shares of RS stock on the following Monday. Mark discusses the deal with their father, Jordan, who buys 20,000 RS shares on Thursday. On July 25, the day before the Rs bid is due, Gain phones his parents' home, and Mark buys another 3.200 RS shares. Over the next few days, Gain periodically phones Mark and Jordani, both of whom continued to buy RS shares. On August 5, RS refuses Forest's bid and announces that it is merging with another company. The price of RS stock rises thirty percent, increasing the value of Marks and Jordan's shares by nearly $660,000 and $400,000, respectively. Is Gain guilty of insider trading? What is required to impose sanctions for this offense? Could a court hold Gain liable? Why or why not? 1. The Securities Exchange Act of 1934 created the select as an Select agency 2. The Securities Exchange Act of Select provides for the regulation and registration of securities exchanges, brokers, dealers, and national securities associations 3. The Securities Exchange Act applies to companies that have assets greater than Select and more than Select vshareholders 4. One of the more important sections of the Securities Exchange Act of 1934 is section Selv 5. The purpose of this section is to prevent Sulpet in relation to the buying and selling of securities. 6. An important rule that the SEC has promulgated is SEC Rule Select 7. Among other purposes, the purpose of SEC Rule 10b-5 is to preventSchect 8. The traditional insider-trading case involves all of the following except Select buying and selling securities based on information not available to the public 9. David Gain is the CEO of Select 10. Gill Raz is the CEO of Sulut 11. In this case, who has a fiduciary responsibility to RS Communications, Inc.? Select 12. Is David Gain a corporate officer, director, or majority shareholder of RS Communications, Inc.? Select V 13. Is it likely that Raz trusted that Gain would keep the negotiations confidential? Select V 14. Was there a breach of duty not to disclose inside information? Select V 15. Did Gain's disclosure to Mark occur in exchange for personal benefit? Select v 16. Is it likely that Mark knew of the breach and benefited from it? Select V 17. When David told Mark about RS Communications, Inc., and Mark subsequently bought shares of the company, David acted as the Select V and Mark was the Select v 18. Assuming that Raz trusted that Gain would keep the negotiations confidential, it is Select that Jordan is also a Select V 19. Given the assumptions above, Gain is likely Select of insider trading. 20. In addition, Mark and Jordan are likely Select of insider trading