Question: *** PLEASE DO ALL OR DO NOT RESPOND *** At the beginning of the month, you owned $5,000 of General Dynamics, $7,000 of Starbucks, and

*** PLEASE DO ALL OR DO NOT RESPOND ***

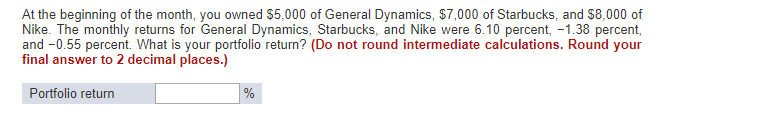

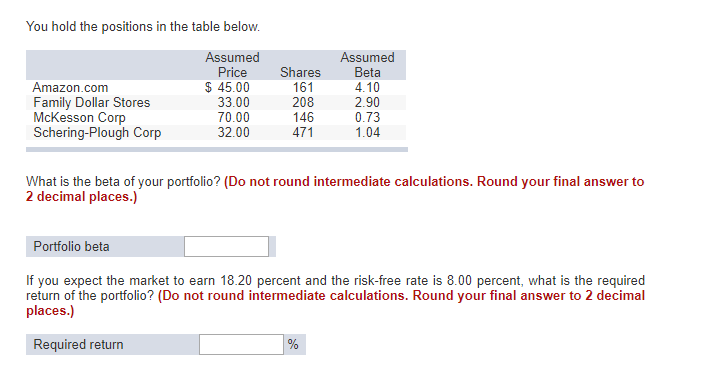

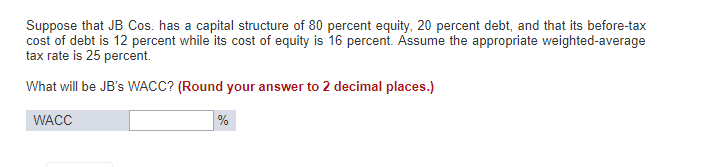

At the beginning of the month, you owned $5,000 of General Dynamics, $7,000 of Starbucks, and $8,000 of Nike. The monthly returns for General Dynamics, Starbucks, and Nike were 6.10 percent, -1.38 percent, and -0.55 percent. What is your portfolio return? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Portfolio return % You hold the positions in the table below. Assumed Amazon.com Family Dollar Stores McKesson Corp Schering-Plough Corp Assumed Price $ 45.00 33.00 70.00 32.00 Shares 161 208 146 471 4.10 2.90 0.73 1.04 What is the beta of your portfolio? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Portfolio beta If you expect the market to earn 18.20 percent and the risk-free rate is 8.00 percent, what is the required return of the portfolio? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Required return Suppose that JB Cos. has a capital structure of 80 percent equity, 20 percent debt, and that its before-tax cost of debt is 12 percent while its cost of equity is 16 percent. Assume the appropriate weighted average tax rate is 25 percent. What will be JB's WACC? (Round your answer to 2 decimal places.) WACC %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts