Question: please do all parts 4) You are evaluating two bonds to purchase. Bond A is a corporate bond with a modified duration of 7 years

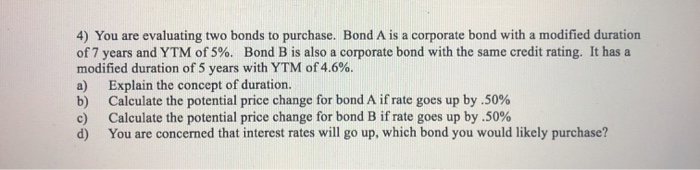

4) You are evaluating two bonds to purchase. Bond A is a corporate bond with a modified duration of 7 years and YTM of 5%. Bond B is also a corporate bond with the same credit rating. It has a modified duration of 5 years with YTM of 4.6%. a) Explain the concept of duration. b) Calculate the potential price change for bond A if rate goes up by 50% c) Calculate the potential price change for bond B if rate goes up by 50% d) You are concerned that interest rates will go up, which bond you would likely purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts