Question: Please do all parts. Question 3 (Total: 12 points) You are given the following information about a risk free asset and the Mean Variance Efficient

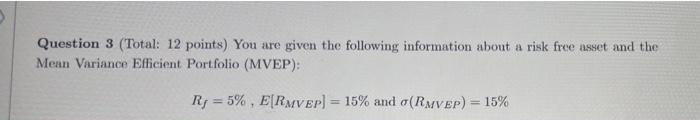

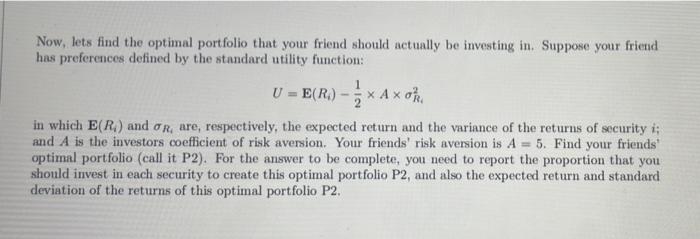

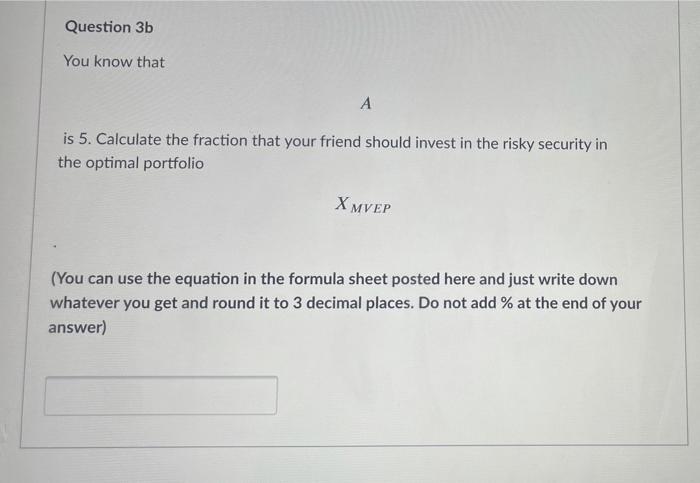

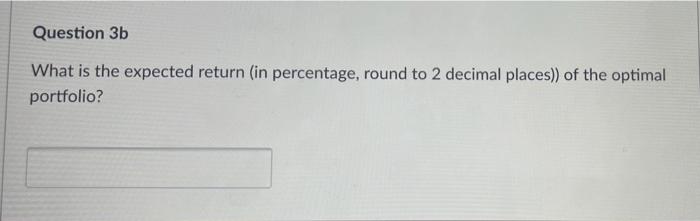

Question 3 (Total: 12 points) You are given the following information about a risk free asset and the Mean Variance Efficient Portfolio (MVEP): Rj = 5%, ERMVEP) = 15% and o(RMVEP) = 15% Now, lets find the optimal portfolio that your friend should actually be investing in. Suppose your friend has preferences defined by the standard utility function: U = E(R.) x A xoru in which E(R) and or, are, respectively, the expected return and the variance of the returns of security : and A is the investors coefficient of risk aversion. Your friends' risk aversion is A = 5. Find your friends optimal portfolio (call it P2). For the answer to be complete, you need to report the proportion that you should invest in each security to create this optimal portfolio P2, and also the expected return and standard deviation of the returns of this optimal portfolio P2. Question 3b You know that A is 5. Calculate the fraction that your friend should invest in the risky security in the optimal portfolio X MVEP (You can use the equation in the formula sheet posted here and just write down whatever you get and round it to 3 decimal places. Do not add % at the end of your answer) Question 3b What is the expected return (in percentage, round to 2 decimal places)) of the optimal portfolio? Question 3b What is the standard deviation (in percentage, round to 2 decimal places)) of the optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts