Question: Please do all parts step by step etat N (c) Assume that N= 10 years. d) What recommendation do you have for the firm 5

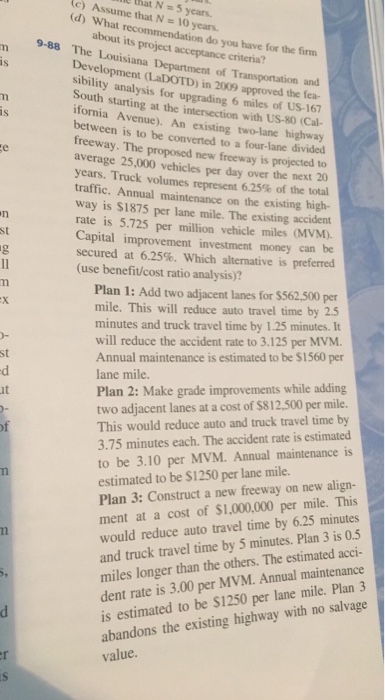

etat N (c) Assume that N= 10 years. d) What recommendation do you have for the firm 5 years. about its project acceptance criteria? 9-88 The Louisiana Department Development (LaDOTD) in 2009 sibility analysis for upgrading 6 miles of US-167 South starting at the intersection with US-80 (Cal- ifornia Avenue). An existing two-lane highway between is to be converted to a four-lane divided freeway. The proposed new freeway is projected to average 25,000 vehicles per day over the next 20 years. Truck volumes represent 6.25% of the total traffic. Annual maintenance on the existing high- way is $1875 per lane mile. The existing accident rate is 5.725 per million vehicle miles (MVM) Capital improvement investment money can be secured at 6.25%, which alternative is preferred (use benefitu/cost ratio analysis)? of Transportation and approved the fea- st Plan 1: Add two adjacent lanes for $562500 per mile. This will reduce auto travel time by 2.5 minutes and truck travel time by 1.25 minutes. It will reduce the accident rate to 3.125 per MVM Annual maintenance is estimated to be $1560 per lane mile. Plan 2: Make grade improvements while adding two adjacent lanes at a cost of $812,500 per mile. This would reduce auto and truck travel time by st it 3.75 minutes each. The accident rate is estimated to be 3.10 per MVM. Annual maintenance is estimated to be $1250 per lane mile. Plan 3: Construct a new freeway on new align- ment at a cost of $1,000,000 per mile. This would reduce auto travel time by 6.25 minutes and truck travel time by 5 minutes. Plan 3 is 0.5 miles longer than the others. The estimated acci- dent rate is 3.00 per MVM. Annual maintenance is estimated to be $1250 per lane mile. Plan 3 abandons the existing highway with no salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts