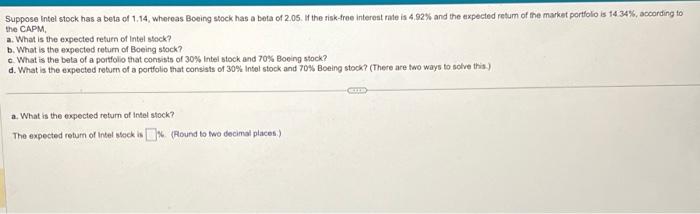

Question: please do all parts Suppose Intel stock has a beta of 1,14 , whereas Boeing stock has a beta of 2.05 . If the sisk-free

Suppose Intel stock has a beta of 1,14 , whereas Boeing stock has a beta of 2.05 . If the sisk-free intereat rate is 4.92% and the expected retum of the market portfolo is 14.34%, according to the CAPM, a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a porffolio that consists of 30% intel stock and 70% Boeing stock? d. What is the expected return of a portfolio that consists of 30% infol stock and 70% Boeing stock? (There are two ways to solve this.) a. What is the expected return of Intel stock? The expected retum of Intel slock is K. (Pound to two decimal places.) Suppose Intel stock has a beta of 1,14 , whereas Boeing stock has a beta of 2.05 . If the sisk-free intereat rate is 4.92% and the expected retum of the market portfolo is 14.34%, according to the CAPM, a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a porffolio that consists of 30% intel stock and 70% Boeing stock? d. What is the expected return of a portfolio that consists of 30% infol stock and 70% Boeing stock? (There are two ways to solve this.) a. What is the expected return of Intel stock? The expected retum of Intel slock is K. (Pound to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts