Question: Please do all Question 2 (1 point) On January 1, 2020, Ocean Co. purchased equipment for $200,000. It is estimated that the equipment will have

Please do all

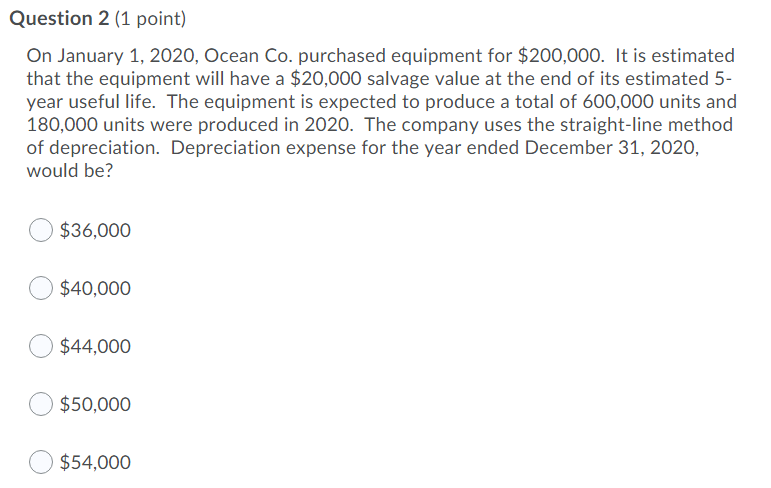

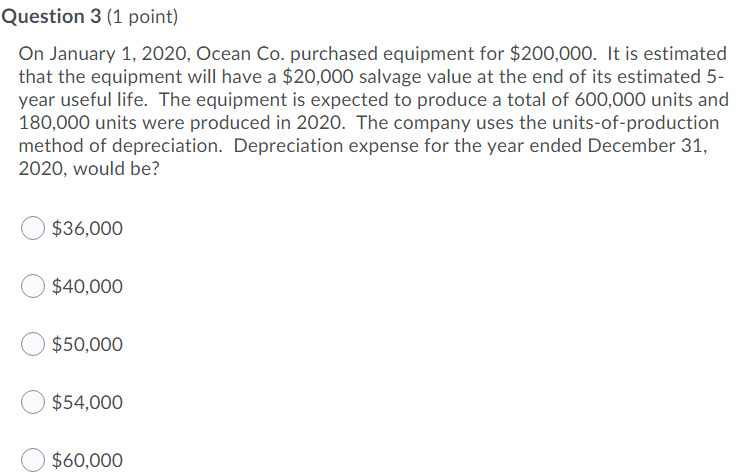

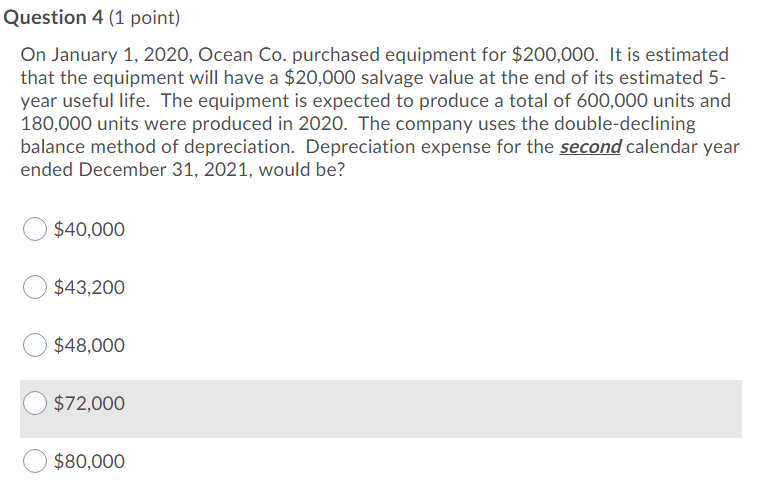

Question 2 (1 point) On January 1, 2020, Ocean Co. purchased equipment for $200,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its estimated 5- year useful life. The equipment is expected to produce a total of 600,000 units and 180,000 units were produced in 2020. The company uses the straight-line method of depreciation. Depreciation expense for the year ended December 31, 2020, would be? $36,000 $40,000 $44,000 $50,000 $54,000 Question 3 (1 point) On January 1, 2020, Ocean Co. purchased equipment for $200,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its estimated 5- year useful life. The equipment is expected to produce a total of 600,000 units and 180,000 units were produced in 2020. The company uses the units-of-production method of depreciation. Depreciation expense for the year ended December 31, 2020, would be? $36,000 $40,000 $50,000 $54,000 $60,000 Question 4 (1 point) On January 1, 2020, Ocean Co. purchased equipment for $200,000. It is estimated that the equipment will have a $20,000 salvage value at the end of its estimated 5- year useful life. The equipment is expected to produce a total of 600,000 units and 180,000 units were produced in 2020. The company uses the double-declining balance method of depreciation. Depreciation expense for the second calendar year ended December 31, 2021, would be? $40,000 $43,200 $48,000 $72,000 $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts