Question: PLEASE DO ALL REQUIREMENTS Please do all requirements ! Daniel and Sons' Law Offices opened on January 1 , Daniel's unadjusted trial balance at December

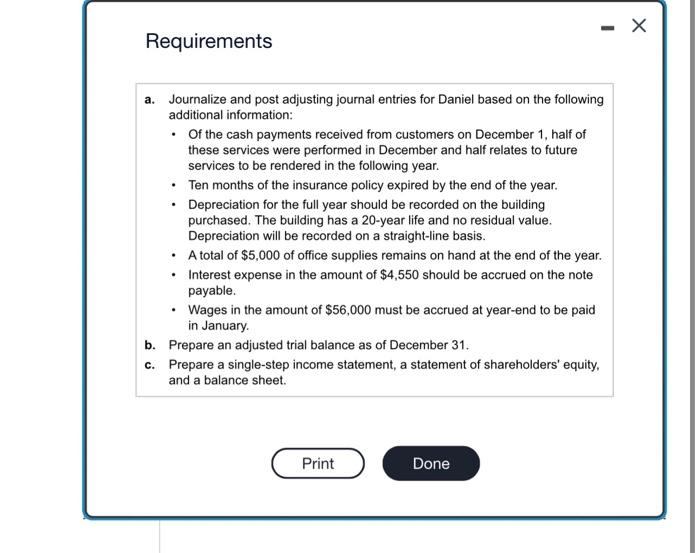

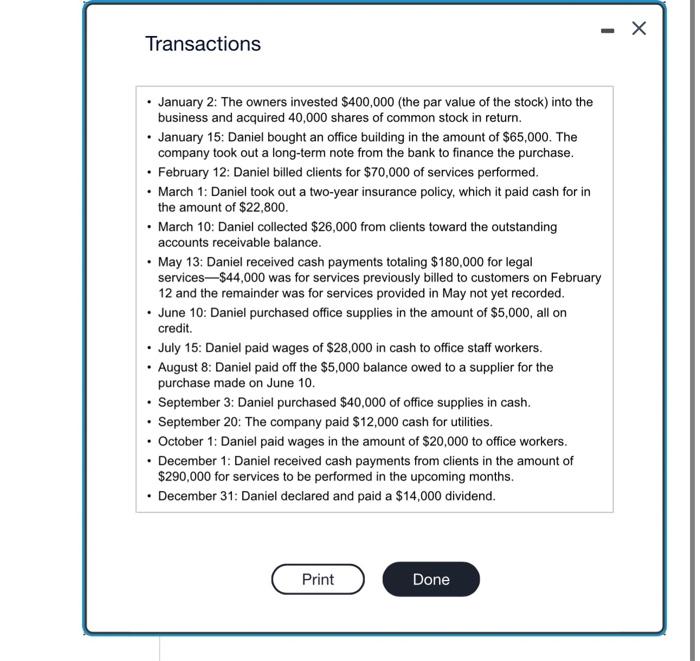

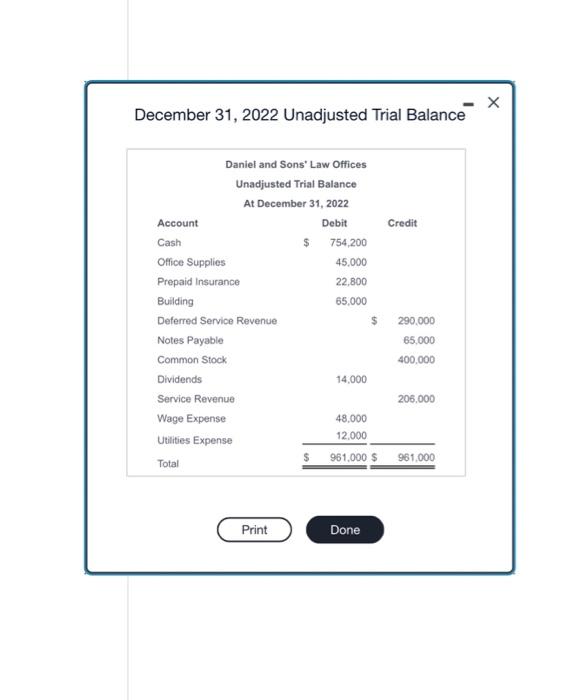

Daniel and Sons' Law Offices opened on January 1 , Daniel's unadjusted trial balance at December 31 , 2022. During the first year of business, the company had the following transactions: 2022 is as follows: (Click the icon to view the transactions.) (Click the icon to view the unadjusted trial balance.) Read the requirements, Requirement a. Journalize and post adjusting journal entries for Daniel. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by preparing the adjusting journal entries. Of the cash payments received from customers on December 1 , half of these services were performed in December and half relates to future services to be rendered in the following year. Requirements a. Journalize and post adjusting journal entries for Daniel based on the following additional information: - Of the cash payments received from customers on December 1 , half of these services were performed in December and half relates to future services to be rendered in the following year. - Ten months of the insurance policy expired by the end of the year. - Depreciation for the full year should be recorded on the building purchased. The building has a 20 -year life and no residual value. Depreciation will be recorded on a straight-line basis. - A total of $5,000 of office supplies remains on hand at the end of the year. - Interest expense in the amount of $4,550 should be accrued on the note payable. - Wages in the amount of $56,000 must be accrued at year-end to be paid in January. b. Prepare an adjusted trial balance as of December 31 . c. Prepare a single-step income statement, a statement of shareholders' equity, and a balance sheet. Transactions - January 2: The owners invested $400,000 (the par value of the stock) into the business and acquired 40,000 shares of common stock in return. - January 15: Daniel bought an office building in the amount of $65,000. The company took out a long-term note from the bank to finance the purchase. - February 12: Daniel billed clients for $70,000 of services performed. - March 1: Daniel took out a two-year insurance policy, which it paid cash for in the amount of $22,800. - March 10: Daniel collected $26,000 from clients toward the outstanding accounts receivable balance. - May 13: Daniel received cash payments totaling $180,000 for legal services- $44,000 was for services previously billed to customers on February 12 and the remainder was for services provided in May not yet recorded. - June 10: Daniel purchased office supplies in the amount of $5,000, all on credit. - July 15: Daniel paid wages of $28,000 in cash to office staff workers. - August 8: Daniel paid off the $5,000 balance owed to a supplier for the purchase made on June 10. - September 3: Daniel purchased $40,000 of office supplies in cash. - September 20: The company paid $12,000 cash for utilities. - October 1: Daniel paid wages in the amount of $20,000 to office workers. - December 1: Daniel received cash payments from clients in the amount of $290,000 for services to be performed in the upcoming months. - December 31: Daniel declared and paid a $14,000 dividend. December 31, 2022 Unadjusted Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts