Question: please do all. thank you accounting into practice as you handle the accounting work of The Fashion Rack during the month of October 2007 INTRODUCTION

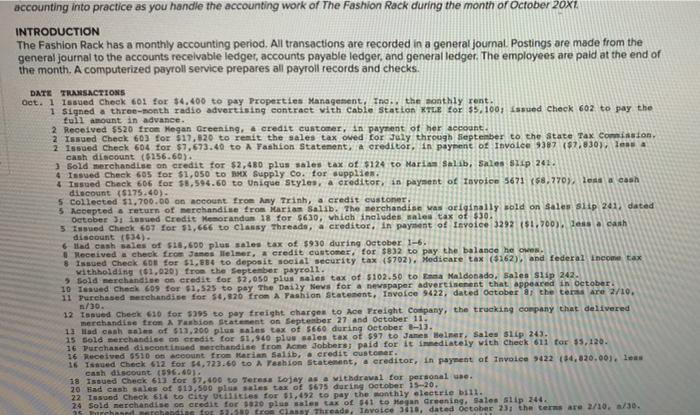

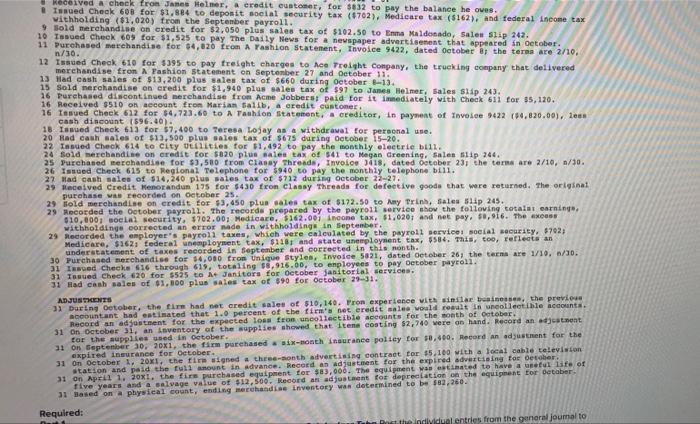

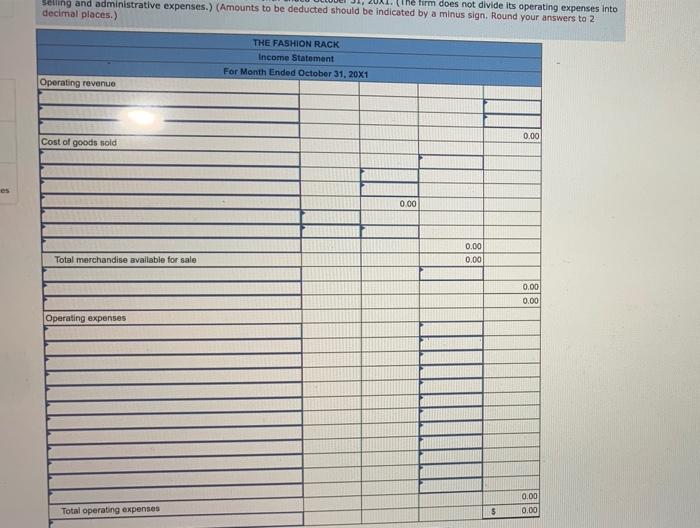

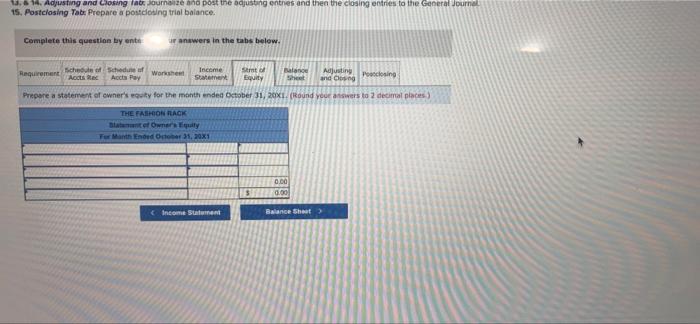

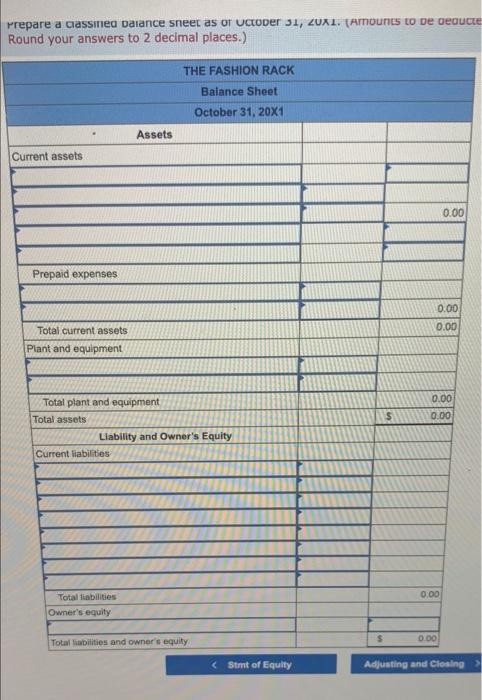

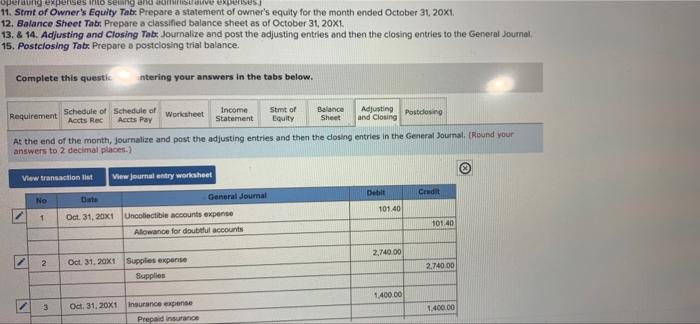

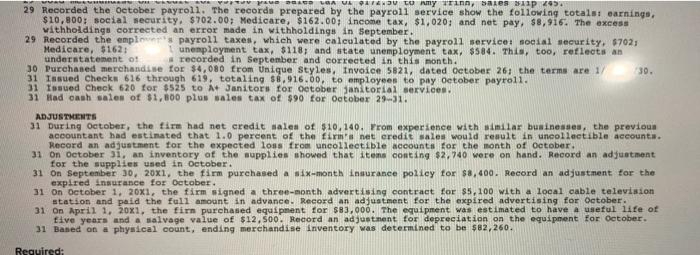

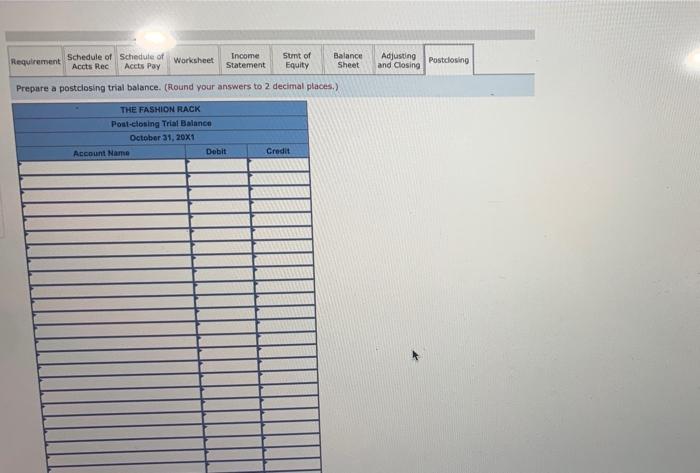

accounting into practice as you handle the accounting work of The Fashion Rack during the month of October 2007 INTRODUCTION The Fashion Rack has a monthly accounting period. All transactions are recorded in a general joumat Postings are made from the general journal to the accounts receivable ledger, accounts payable ledger, and general ledger. The employees are paid at the end of the month. A computerized payroll service prepares all payroll records and checks. DATE TRANSACTIONS Qet. 1 Issued Check 601 for $4,400 to pay Properties Management, Ina.. the monthly rent. 1 Signed a three-month radio advertising contract with Cable Station KTLE for $5.100; issued Check 602 to pay the tull amount in advance. 2 Received $520 from Megan Greening, credit customer, in payment of her account. 2 Issued Check 603 for $17.820 to remit the sales tax oved for July through September to the State Tax Commission 2 Issued Check 604 for $7,673.40 to A Fashion Statement, a creditor, in payment of Invoice 9387 ($2,830) Tess cash discount (6156.60). 1 Sold merchandise on credit for $2,400 plus sales tax of $124 to Maria Salib, sales op 24. 4 Issued Check 605 for $1,050 to BMX Supply Co. for supplies. 4 Issued Check 606 for $3,594.60 to Unique Styles, a creditor in payment of Tavoice 5671 (58,770, les a cash discount ($175.40). 5 Collected $1,700.00 on account from Any Trinh, a credit customer 5 Accepted a return of merchandise from Marian salib. The merchandise was originally sold on Sales Slip 241, dated October i swed Credit Memorandum 18 for $630, which includes sales tax of $30. 5 Issued Check 607 for $1,666 to Classy Threads, a creditor, in payment of Invoice 3292 ($1,700), less a cash discount (34). llad cash sales of $18.600 plus sales tax of $930 during October 1-6. Received check from James Helmer, a credit customer, for $832 to pay the balance he owes. 8 Issued Check 68 for $1,934 to deposit social security tax (5702). Medicare tax ($162), and federal income tax withholding 61,020) from the september payroll. Gold merchandise on credit for $2.050 plus sales tax of $102.50 to na Maldonado, Bales Slip 242. 10 Tenued Check 609 for $1.525 to pay The Daily News for a newspaper advertisement that appeared in October 11 Purchased merchandise for $4,520 from A Fashion Statement, Invoice 9422, dated October 8, the tem are 2/10 /30 12 tonued Check 610 for $795 to pay freight charges to Ace Treight Company, the trucking company that delivered merchandise trom A Taxsion statement on September 27 and October 11. 13 led cash sales of $13,200 plus sales tax of 5660 during October 8-13 15 told merchandise on credit for $1,940 plus sales tax ot $97 to James Helmer, Sales slip 24). 16 Purchased discontinued merchandise from home Jobbers paid for it immediately with Check 611 for $5,120. 16 Received $510 on account from Marin Salib, a credit customer. 16 Issued Check 12 for 54.723.60 to A Teshion Statement, creditor, in payment of Invoice 5422 (14,020.00). less cash discount (596.401. 18 Issued Check 613 for $2.400 to Teresa Lojay as withdrawal for personal use. 20 Had cash sales of $13.500 plus sales tax ot 5675 during October 15-20. 22 Issued Check 616 to city Utilities for $1,492 to pay the monthly electrie bill. 24 Sold merchandise on credit for 1920 plus sales tax of 141 to Megan creening, sales slip 244. 75 turchantshandlas 9E 119 from CLASSY Threade, TAVOL 3010, dated October 23; the terms are 2/10./30. Received a check from James Helmer. Acredit customer, for $832 to pay the balance he oves. # Issued Check 608 for $1,884 to deposit social security tax (702), Medicare tax (5162), and federal income tax withholding ($1,020) from the September payroll. 9 Sold merchandise on credit for $2,050 plus sales tax of $102.50 to Enma Maldonado, Sales Slip 242. 10 Issued Cheek 609 for $1.525 to pay The Daily News for a newspaper advertisement that appeared in Otober. 11 Purchased merchandise for $4,020 from A Fashion Statement, Tavoice 9422, dated October B the terms are 2/10, n/30. 12 Issued Check 610 for $395 to pay freight charges to Ace Treight Company, the trucking company that delivered merchandise from a Fashion Statement on September 27 and October 11. 13 Had cash sales of $13,200 plus sales tax of $660 during October 8-13. 15 Sold merchandise on credit for $1,940 plus sales tax of 597 to James Helmer, Sales Slip 24). 16 Purchased discontinued merchandise from Acme Jobberst paid for it immediately with Check 611 for $5,120. 16 Received $510 on account from Marian salib. credit customer 16 Tosued Check 612 for $4,723.60 to A Fashion Statement, creditor, in payment of Invoice 0422 (4.820.00), les cash discount (596.40) 18 Issued Check 613 for $3,400 to Teresa Lojay as a withdrawal for personal use. 20 Kad cash sales of $12.500 plus sales tax of $675 during October 15-20 22 Lased check 614 to city unities for $1.492 to pay the monthly electrie bill. 24 Sold merebandise on credit for 5820 plus sales tax of 541 to Megan Creening, sales slip 244. 25 2 Purebabes chardosef 22.500 from ChanayThreads, Involo Dle, dated October 23, the terms are 2/10, 1/30. to Regional Telephone for $40 to pay the monthly telephone bili. 27 Had cash sales of $14,240 plus pales tax of $212 during October 23-27. 29 Received Credit Menor andun 125 for 5430 from Classy Threads for defective goods that were returned. The original purchase was recorded on October 25 29 told merchandise on credit for $3,450 plus sales tax of $172.50 to Amy Trinh, sales slip 245. 29 Recorded the Otober payroll The recorde prepared by the payroll service how the following total earnings $10,0001 social security $702.001 Medicare. $162.001 Ancone tax, $1,0201 and not pay, 58,916. The ecos withholding corrected an error made in withholding in September 29 Recorded the employer'. payroll taxes, which were calculated by the payroll service social security $702, Medicare. $162 federal unemployment tax. $2101 and state unenploynent tax, 6584. Tals, too, reflects an 30 Purchased merchandise for $4,000 from unique styles. Invoice 5021, dated October 26; the terms are 1/10, 1/30. understatement of taxes recorded in September and corrected in his month 31 Inwood Check 616 through 619, totaling $6.916.00, to employees to pay October payroll 31 Tonued Check 620 for $525 to Janitors for October janitorial services. 31 Had cash sales of $1,100 plus sales tax of 690 for October 29-31. ADJUSTMENTS 31 During Detoher, the time had not credit sales of $10,140. Fron experience with inte bains, the previous Aountant had estimated that 1.6 percent of the firm's net eredet sales would conneollectible account Record an adjustment for the expected loss to collectible accounts for the sonth of October 31 On October 3i, an Inventory of the supplies showed that Itene costing 52,740 were on hand. Record an adjustment for the supplies used in october. 31 On September 30, 20x1, the firm purchased a six-month Insurance policy for $0,40. Record an adjustment for the expired Insurance for October 31 On October 1, 20x1, the fire signed a three-sonth advertising contract for 5,100 with a local cable television station and paid the full amount in advance. Record an adjustment for the expired advertising for Betober 31 on April 1, 20x1. the fire purchased equipment for $83,000. The equipment was estimated to have a refuse of five years and a selvage value of $12,500. Record an adjustment for depreciation on the equipment for Detaber 31 Based on a physical count, ending merchandise Inventory was determined to be $82,260. Required: vidual entries from the general joumalto The firm does not divide its operating expenses into Selling and administrative expenses.) (Amounts to be deducted should be indicated by a minus sign. Round your answers to 2 decimal places.) THE FASHION RACK Income Statement For Month Ended October 31, 20X1 Operating revenue 0.00 Cost of goods sold 0.00 0.00 0.00 Total merchandise available for sale 0.00 0.00 Operating expenses 0.00 $ 0.00 Total operating expenses W... Adjusting and closing course and post the adjusting enthes and then the closing entries to the General Journal 15. Postclosing Tabs: Prepare a postdoing trial balance. Complete this question by ente answers in the tabs below. Requirement Sichts scheduse Acts Red Accs Pay Worksheet Income Statement Strator Equity an Wheet Adjusting Powder and long Prepare a statement of owner's guity for the month endea October 31, 20X1. Round your answers to 2 decimal places THE FASHION BLACK Blanet Ownergy For anth End Otor 1, 20X1 0.00 $ 0.00 Income Samen Balance Sheet) Prepare a classinea Dalance sheet as or uctober 31, 20X1. (Amounts to be deducte Round your answers to 2 decimal places.) THE FASHION RACK Balance Sheet October 31, 20X1 Assets Current assets 0.00 Prepaid expenses 0.00 0.00 Total current assets Plant and equipment 0.00 0.00 Total plant and equipment Total assets Liability and Owner's Equity Current liabilities 0.00 Total liabilities Owner's equity $ 0.00 Total liabilities and owner's equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts