Question: please do all the questions from 1 up to 4. [ASSIGNMENT 1 - 100 MARKS] QUESTION 1 25 MARKS Namib Processor Limited makes and sells

![1 - 100 MARKS] QUESTION 1 25 MARKS Namib Processor Limited makes](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea5e7eeaebe_64666ea5e7e5b43f.jpg)

please do all the questions from 1 up to 4.

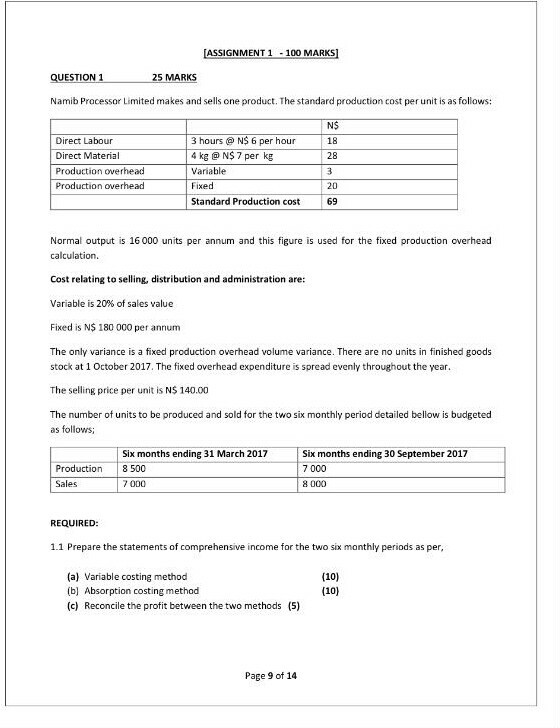

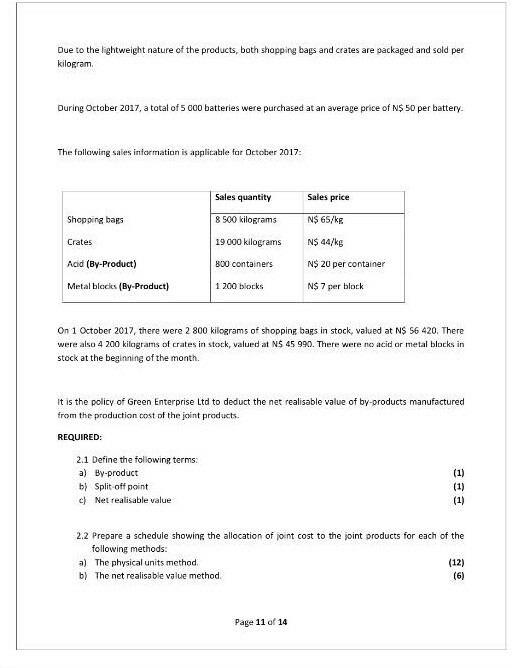

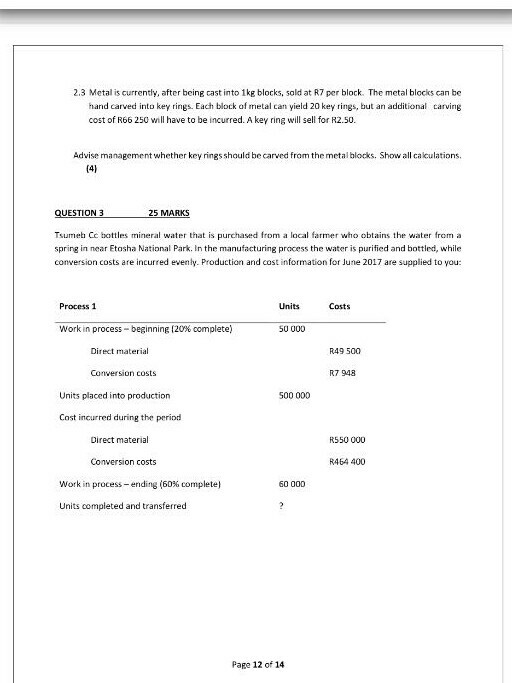

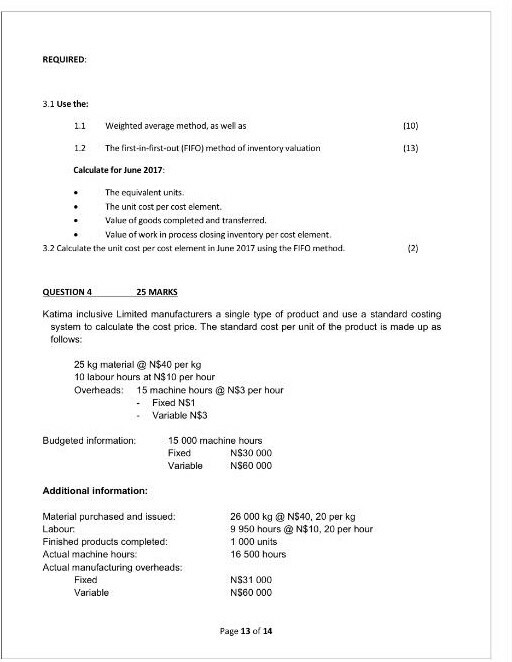

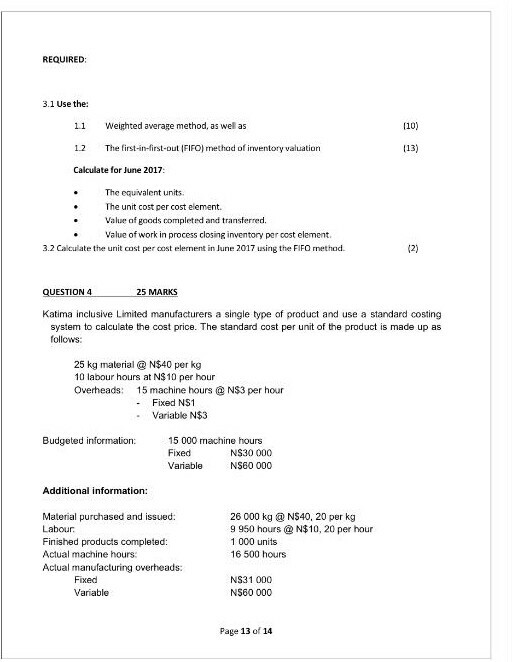

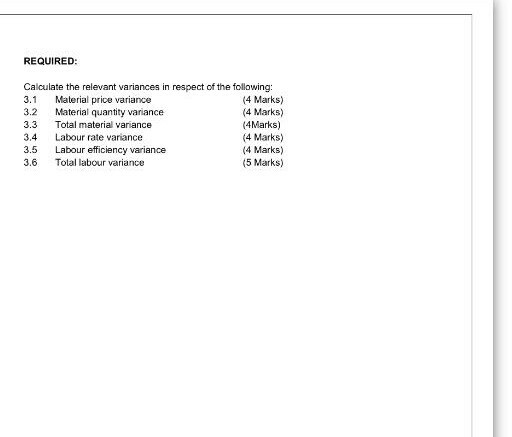

[ASSIGNMENT 1 - 100 MARKS] QUESTION 1 25 MARKS Namib Processor Limited makes and sells one product. The standard production cost per unit is as follows: Direct Labour Direct Material Production Overhead Production overhead 3 hours @ N$ 6 per hour 4 kg @ N$ 7 per kg Variable Fixed Standard Production cost NS 18 28 3 20 69 Normal output is 16 000 units per annum and this figure is used for the fixed production overhead calculation. Cost relating to selling distribution and administration are: Variable is 20% of sales value Fixed is N$ 180 000 per annum The only variance is a fixed production overhead volume variance. There are no units in finished goods stock at 1 October 2017. The fixed overhead expenditure is spread evenly throughout the year The selling price per unit is NS 140.00 The number of units to be produced and sold for the two six monthly period detailed bellow is budgeted as follows: Production Sales Six months ending 31 March 2017 8 500 7 000 Six months ending 30 September 2017 7 000 8 000 REQUIRED: 1.1 Prepare the statements of comprehensive income for the two six monthly periods as per, (a) Variable costing method (b) Absorption costing method (c) Reconcile the profit between the two methods (5) (10) (10) Page 9 of 14 QUESTION 2 25 MARKS Green Enterprise Ltd is in the business of recycling used automotive batteries and has seen a huge surge in business due to the recent focus on environmental awareness. Green Enterprise Ltd purchases used batteries from suppliers, which are then transported to their premises at the company's expense. The total transport costs for the month amounted to N$ 12 000. Green Enterprise Ltd mainly uses the plastic casings and covers of the batteries to manufacture plastic crates and shopping bags. A typical battery weighs six kilograms and consists of the following components: Plastic casings and covers 805 Battery acid 1596 Various small metal parts 5% Once at the processing plant, batteries are forwarded to the dismantling department. During this process, the batteries are separated into their different components by highly specialised employees. These employees are paid a wage of N$ 25 for every battery separated. The specialised equipment used in this process is leased from the United States at a cost of N$ 25 000 per month. The metal parts are castinto 1kg blocks at a cost of N$ 2.50 per block, and then sold to the dental industry for the manufacture of tooth fillings. The acid is bottled in Skg containers at a fixed monthly cost of N$ 6 750 and sold to schools for use in science experiments. The plastic casings and covers are forwarded to the furnace department for further processing. The battery acid and metal parts are regarded as by products in the process. Once in the furnace department, the plastic is heated at extreme temperatures until the mixture obtains a liquid consistency. The furnace consumes an average of N$ 20 000 worth of electricity per month. The mixture is then cleaned to remove any remaining impurities, before 70% of the mixture is used to manufacture crates and the remaining 30% of the mixture is used to manufacture shopping bags. It costs the company N$ 2 to clean a kilogram of the mixture. A hardening agent is added to the crate mixture before it is moulded. The hardening agent costs N$ 2.75 per kilogram plastic moulded. The moulding costs for the month for shopping bags and crates were NS 118 000 and N$ 243 000, respectively. Page 10 of 14 Due to the lightweight nature of the products, both shopping bags and crates are packaged and sold per kilogram During October 2017, a total of 5 000 batteries were purchased at an average price of N$ 50 per battery The following sales information is applicable for October 2017: Sales quantity Sales price Shopping bags 8 500 kilograms N$ 65/kg Crates 19 000 kilograms N$ 44/kg N$ 20 per container Acid (By-Product) 800 containers Metal blocks (By-Product) 1 200 blocks N$ 7 per block On 1 October 2017, there were 2 800 kilograms of shopping bags in stock, valued at N$ 56 420. There were also 4 200 kilograms of crates in stock, valued at N$ 45 990. There were no acid or metal blocks in stock at the beginning of the month. It is the policy of Green Enterprise Ltd to deduct the net realisable value of by-products manufactured from the production cost of the joint products. REQUIRED: 2.1 Define the following terms: a) By-product b) Split off point c) Net realisable value 2.2 Prepare a schedule showing the allocation of joint cost to the joint products for each of the following methods. a) The physical units method b) The net realisable value method. Page 11 of 14 2.3 Metal is currently, after being cast into 1kg blocks, sold at R7 per block. The metal blocks can be hand carved into key rings. Each block of metal can yield 20 key rings, but an additional carving cost of R66 250 will have to be incurred. A key ring will sell for R2.50. Advise management whether keyrings should be carved from the metal blocks. Show all calculations QUESTION 3 25 MARKS Tsumeb Cc bottles mineral water that is purchased from a local farmer who obtain the water from a spring in near Etosha National Park. In the manufacturing process the water is purified and bottled, while conversion costs are incurred evenly. Production and cost information for June 2017 are supplied to you: Process 1 Units Costs Work in process - beginning (20% complete) 50 000 Direct material R49 500 Conversion costs R7 948 Units placed into production 500 000 Cost incurred during the period Direct material R550 000 Conversion costs R464 400 Work in process - ending (60% complete) 60 000 Units completed and transferred Page 12 of 14 REQUIRED: 3.1 Use the: 11 Weighted average method, as well as 1.2 The first-in-first-out FIFO) method of inventory valuation Calculate for June 2017: The equivalent units. The unit cost per cost element. Value of goods completed and transferred. Value of work in process closing inventory per cost element 3.2 Calculate the unit cost per cost elernent in June 2017 using the FIFO method. QUESTION 4 25 MARKS Katima inclusive Limited manufacturers a single type of product and use a standard costing system to calculate the cost price. The standard cost per unit of the product is made up as follows: 25 kg material @ N$40 per kg 10 labour hours at N$10 per hour Overheads: 15 machine hours @ N$3 per hour - Fixed N$1 Variable N$3 Budgeted information: 15 000 machine hours Fixed NS30 000 Variable NS60 000 Additional information: Material purchased and issued: Labour Finished products completed: Actual machine hours Actual manufacturing overheads: Fixed Variable 26 000 kg @ N$40, 20 per kg 9950 hours @ N$10, 20 per hour 1 000 units 16 500 hours NS31 000 N560 000 Page 13 of 14 REQUIRED: Calculate the relevant variances in respect of the following: 3.1 Material price variance (4 Marks) 3.2 Material quantity variance (4 Marks) 3.3 Total material variance (4Marks) 3.4 Labour rate variance (4 Marks) 3.5 Labour efficiency variance (4 Marks) 3.6 Total labour variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts