Question: Please do all the steps in excel Consider the following pro forma for the next 4 questions Potential Gross Income 100,000 sq. ft for the

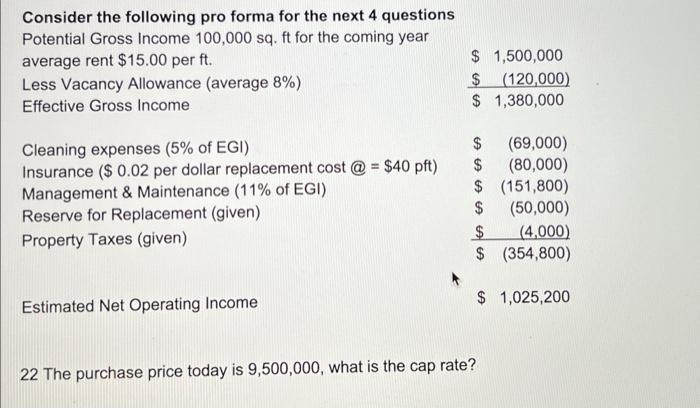

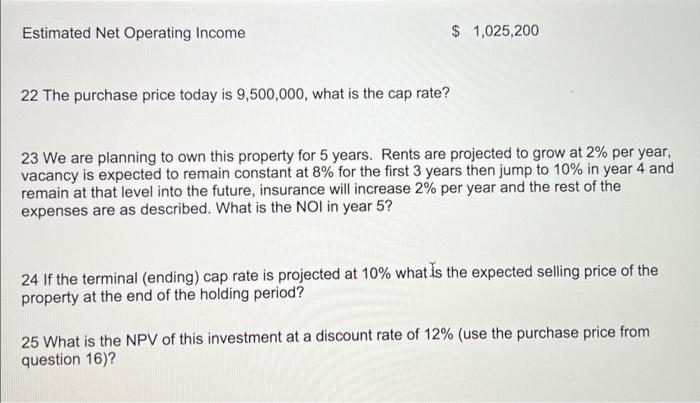

Consider the following pro forma for the next 4 questions Potential Gross Income 100,000 sq. ft for the coming year average rent $15.00 per ft. Less Vacancy Allowance (average 8% ) Effective Gross Income Estimated Net Operating Income \$ 1,025,200 22 The purchase price today is 9,500,000, what is the cap rate? Estimated Net Operating Income $1,025,200 22 The purchase price today is 9,500,000, what is the cap rate? 23 We are planning to own this property for 5 years. Rents are projected to grow at 2% per year, vacancy is expected to remain constant at 8% for the first 3 years then jump to 10% in year 4 and remain at that level into the future, insurance will increase 2% per year and the rest of the expenses are as described. What is the NOI in year 5 ? 24 If the terminal (ending) cap rate is projected at 10% what is the expected selling price of the property at the end of the holding period? 25 What is the NPV of this investment at a discount rate of 12% (use the purchase price from question 16)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts