Question: please do ammortization for 2019-2021 2. Acacia Communications develops, manufactures and sells high-speed coherent optical interconnect products that are designed to transform communications networks through

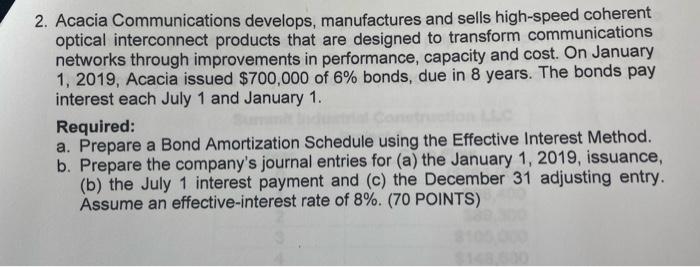

2. Acacia Communications develops, manufactures and sells high-speed coherent optical interconnect products that are designed to transform communications networks through improvements in performance, capacity and cost. On January 1, 2019, Acacia issued $700,000 of 6% bonds, due in 8 years. The bonds pay interest each July 1 and January 1. Required: a. Prepare a Bond Amortization Schedule using the Effective Interest Method. b. Prepare the company's journal entries for (a) the January 1, 2019, issuance, (b) the July 1 interest payment and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%. (70 POINTS) 2. Acacia Communications develops, manufactures and sells high-speed coherent optical interconnect products that are designed to transform communications networks through improvements in performance, capacity and cost. On January 1, 2019, Acacia issued $700,000 of 6% bonds, due in 8 years. The bonds pay interest each July 1 and January 1. Required: a. Prepare a Bond Amortization Schedule using the Effective Interest Method. b. Prepare the company's journal entries for (a) the January 1, 2019, issuance, (b) the July 1 interest payment and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%. (70 POINTS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts