Question: please do as fast as you can Required information A potential investment has a cost of $425,000 and a useful life of 5 years. Annual

please do as fast as you can

please do as fast as you can

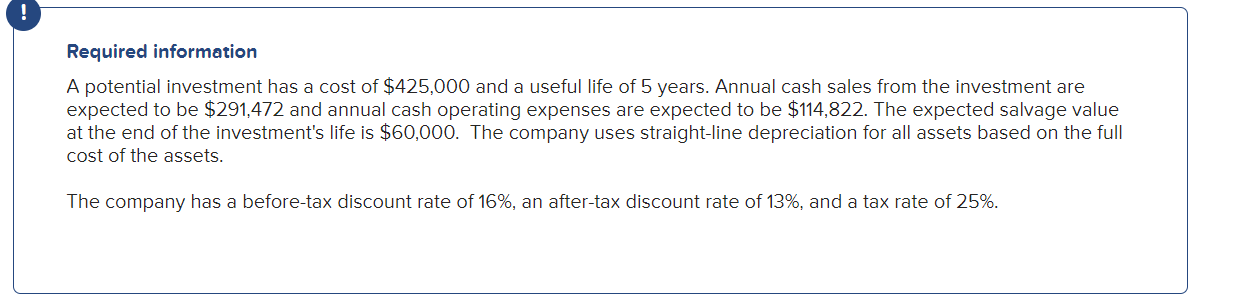

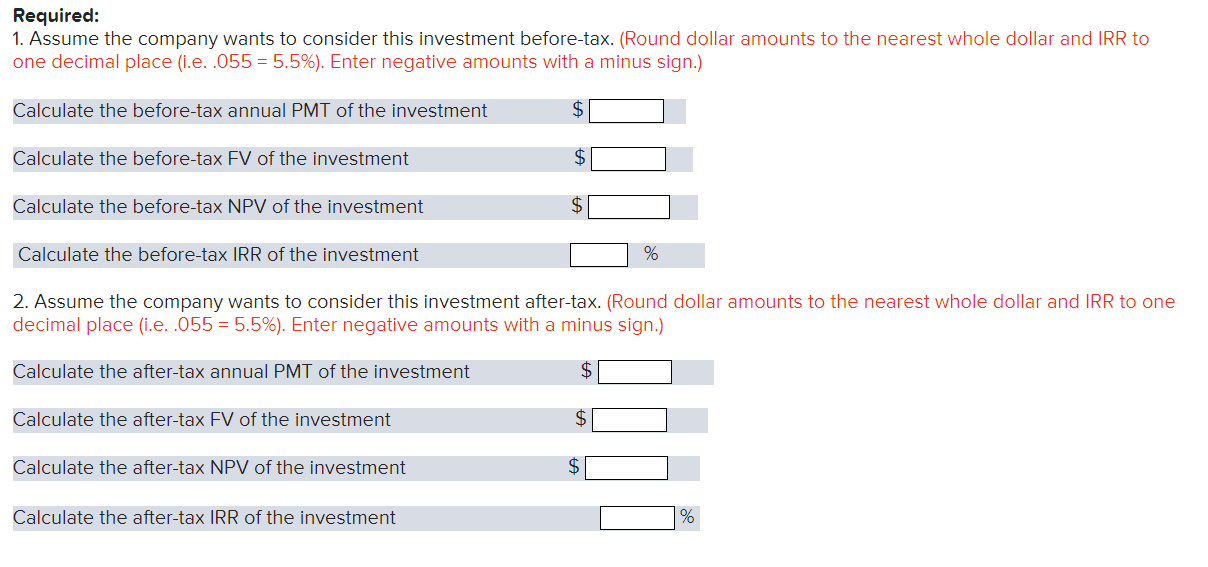

Required information A potential investment has a cost of $425,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $291,472 and annual cash operating expenses are expected to be $114,822. The expected salvage value at the end of the investment's life is $60,000. The company uses straight-line depreciation for all assets based on the full cost of the assets. The company has a before-tax discount rate of 16%, an after-tax discount rate of 13%, and a tax rate of 25%. Required: 1. Assume the company wants to consider this investment before-tax. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Calculate the before-tax annual PMT of the investment $ Calculate the before-tax FV of the investment $ Calculate the before-tax NPV of the investment $ Calculate the before-tax IRR of the investment % 2. Assume the company wants to consider this investment after-tax. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Calculate the after-tax annual PMT of the investment $ Calculate the after-tax FV of the investment Calculate the after-tax NPV of the investment Calculate the after-tax IRR of the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts