Question: please do ASAP For this assignment, you will create a balance sheet as of December 31, 2020 for Krolewski Legal Services a sole proprietorship, owned

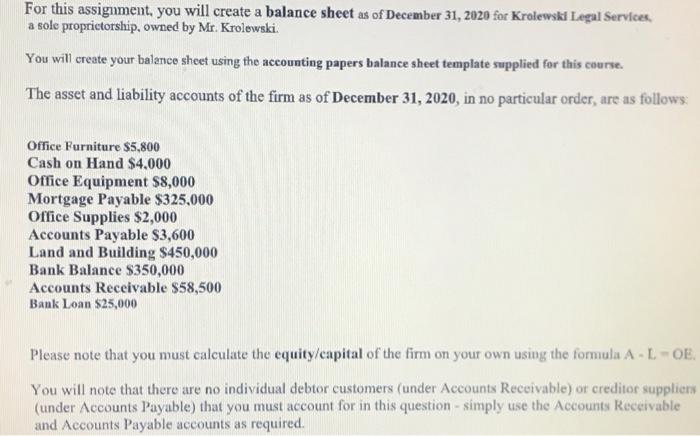

For this assignment, you will create a balance sheet as of December 31, 2020 for Krolewski Legal Services a sole proprietorship, owned by Mr. Krolewski. You will create your balance sheet using the accounting papers balance sheet template supplied for this course. The asset and liability accounts of the firm as of December 31, 2020, in no particular order, are as follows: Office Furniture $5,800 Cash on Hand $4.000 Office Equipment $8,000 Mortgage Payable $325,000 Office Supplies $2,000 Accounts Payable $3,600 Land and Building $450,000 Bank Balance $350,000 Accounts Receivable $58,500 Bank Loan $25,000 Please note that you must calculate the equity/capital of the firm on your own using the formula A.L-OE. You will note that there are no individual debtor customers (under Accounts Receivable) or creditor suppliers (under Accounts Payable) that you must account for in this question - simply use the Accounts Receivable and Accounts Payable accounts as required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts