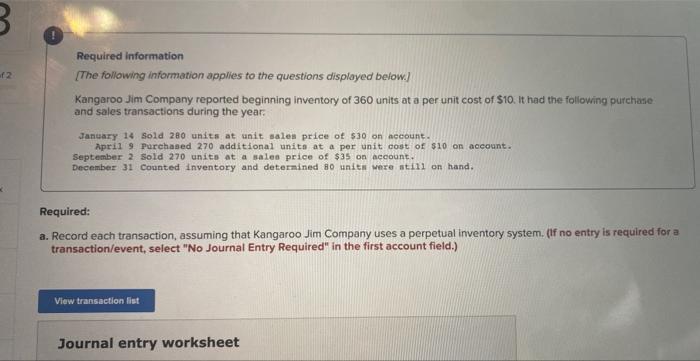

Question: please do asap thanks :) Required information [The following information applies to the questions displayed below] Kangaroo Jim Company reported beginning inventory of 360 units

![to the questions displayed below] Kangaroo Jim Company reported beginning inventory of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb9f55009c1_35666fb9f54973e4.jpg)

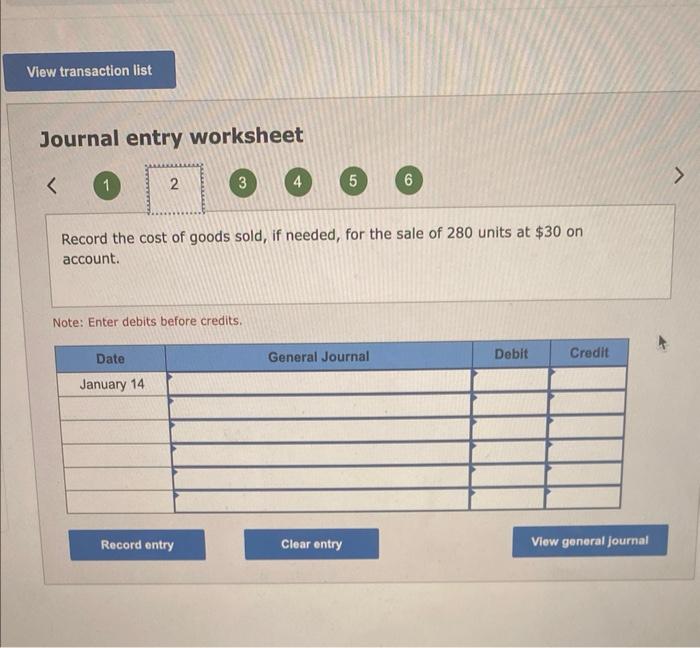

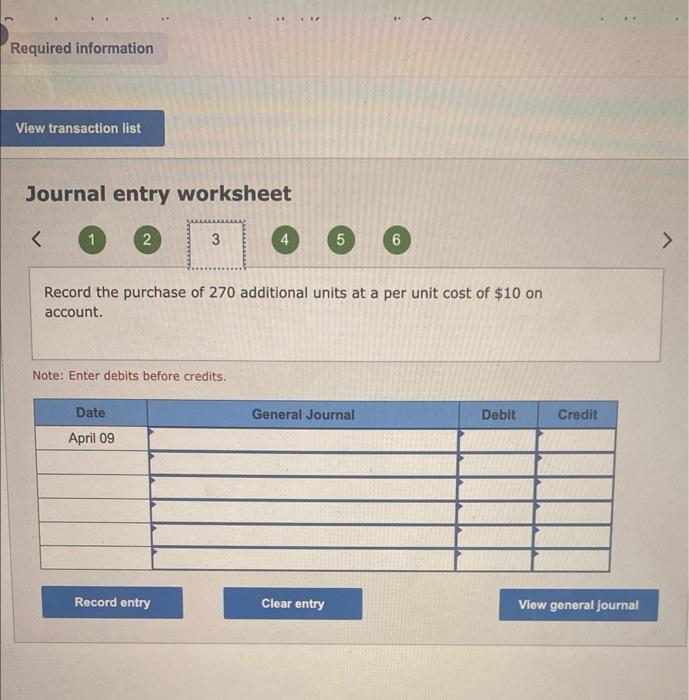

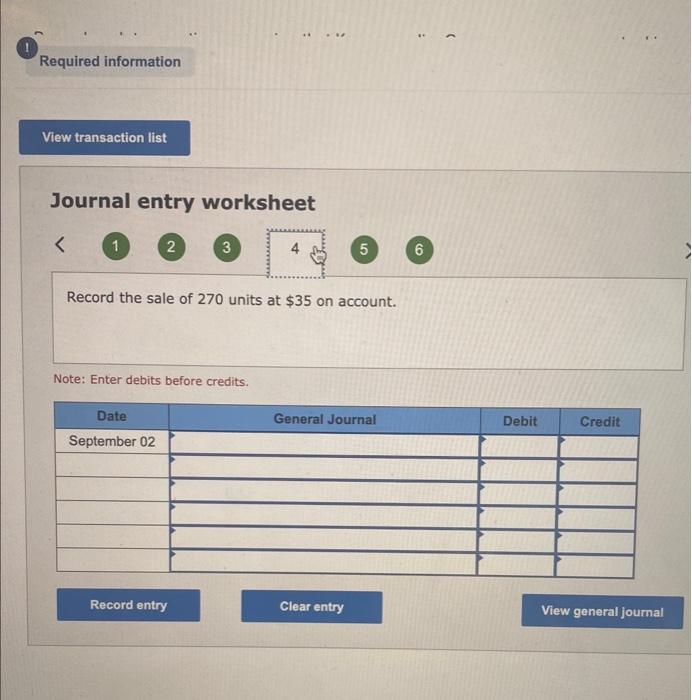

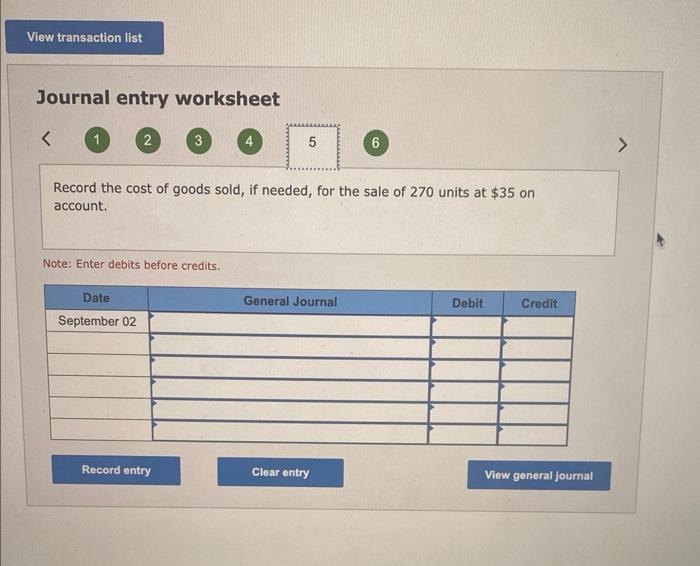

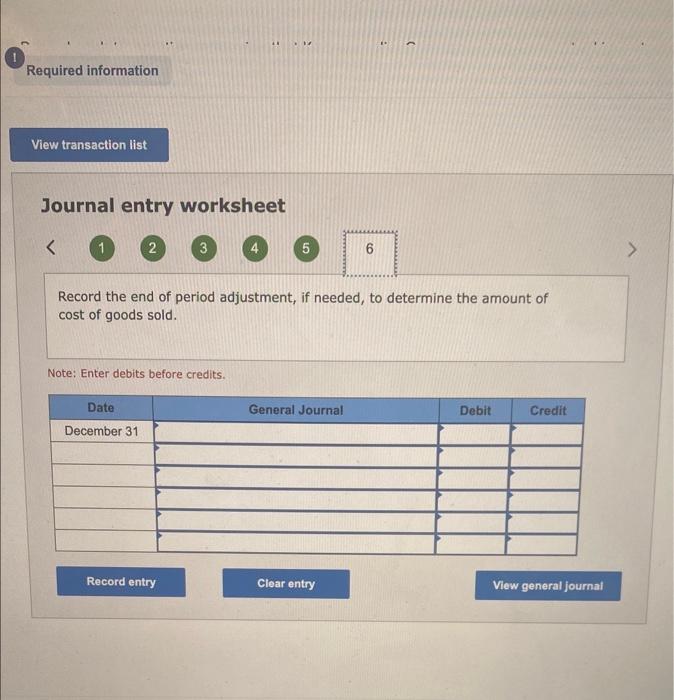

Required information [The following information applies to the questions displayed below] Kangaroo Jim Company reported beginning inventory of 360 units at a per unit cost of $10. It had the following purchase and sales transactions during the year: Janeary 14 sold 280 units at anit sales price of 530 on aecount. April 9. Purchased 270 additional unita at a per unit cost of $10 on aocount. September 2 Sold 270 units at a sales price of $35 on account. December 31 Counted inventory and determined 80 unitm were ntill on hand. Required: a. Record each transaction, assuming that Kangaroo Jim Company uses a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold, if needed, for the sale of 280 units at $30 on account. Note: Enter debits before credits. Journal entry worksheet Record the purchase of 270 additional units at a per unit cost of $10 on account. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the sale of 270 units at $35 on account. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold, if needed, for the sale of 270 units at $35 on account. Note: Enter debits before credits. Journal entry worksheet Record the end of period adjustment, if needed, to determine the amount of cost of goods sold. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts