Question: Please do (b) with detailed steps For example, Kihis, month Knext month Real-time Futures Latest Quote Futures Last Cho Chg % Premium Vol Open Day

Please do (b) with detailed steps

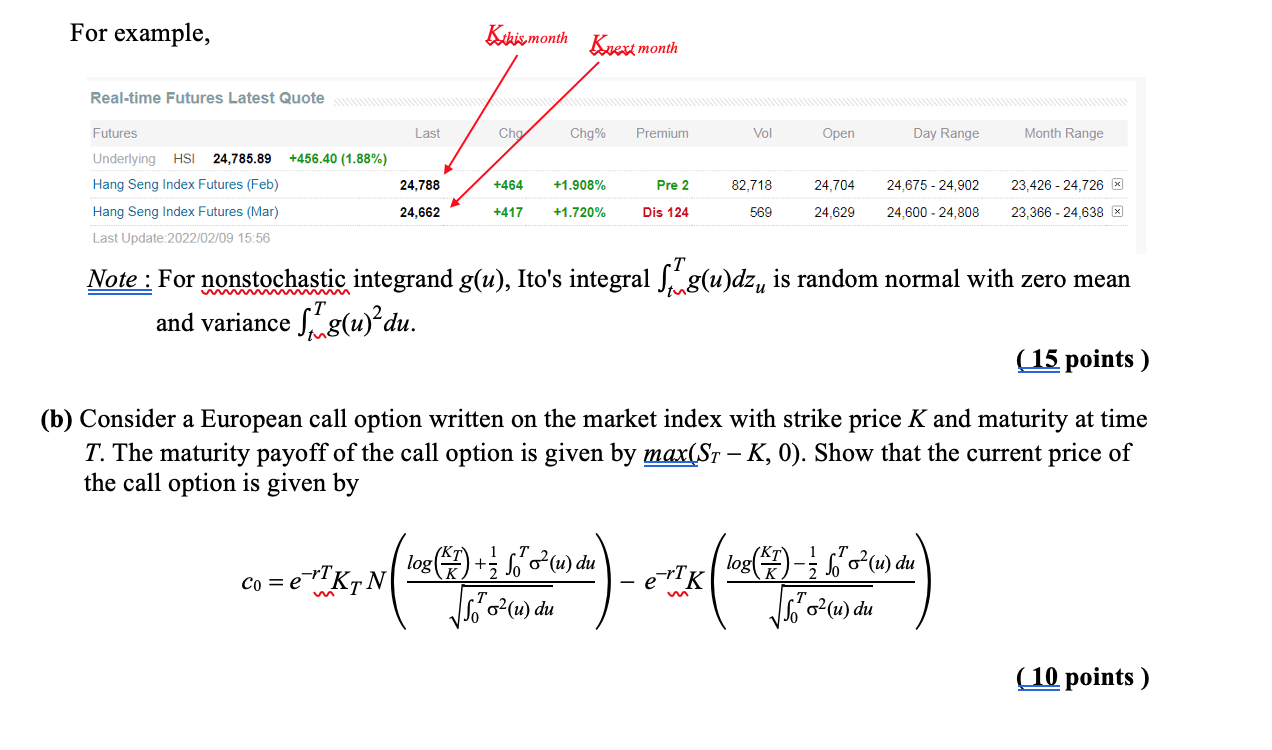

For example, Kihis, month Knext month Real-time Futures Latest Quote Futures Last Cho Chg % Premium Vol Open Day Range Month Range +456.40 (1.88%) 24.788 +464 +1.908% Pre 2 82,718 24,704 23,426 - 24,726 % Underlying HSI 24.785.89 Hang Seng Index Futures (Feb) Hang Seng Index Futures (Mar) Last Update: 2022/02/09 15:56 24,675 - 24,902 24.600 - 24,808 24.662 +417 +1.720% Dis 124 569 24,629 23,366 - 24,638 x T Note : For nonstochastic integrand g(u), Ito's integral Sims(u)dz, is random normal with zero mean and variance Sims(u)?du. (15 points ) (b) Consider a European call option written on the market index with strike price K and maturity at time T. The maturity payoff of the call option is given by max(St K, 0). Show that the current price of the call option is given by Co = e =e='TKIN ()--( ) log (*) + s62(u) du Jso*o?(u) du Selecom e log() - 5*O?(u) du Vlo^o2(u) du (10 points ) For example, Kihis, month Knext month Real-time Futures Latest Quote Futures Last Cho Chg % Premium Vol Open Day Range Month Range +456.40 (1.88%) 24.788 +464 +1.908% Pre 2 82,718 24,704 23,426 - 24,726 % Underlying HSI 24.785.89 Hang Seng Index Futures (Feb) Hang Seng Index Futures (Mar) Last Update: 2022/02/09 15:56 24,675 - 24,902 24.600 - 24,808 24.662 +417 +1.720% Dis 124 569 24,629 23,366 - 24,638 x T Note : For nonstochastic integrand g(u), Ito's integral Sims(u)dz, is random normal with zero mean and variance Sims(u)?du. (15 points ) (b) Consider a European call option written on the market index with strike price K and maturity at time T. The maturity payoff of the call option is given by max(St K, 0). Show that the current price of the call option is given by Co = e =e='TKIN ()--( ) log (*) + s62(u) du Jso*o?(u) du Selecom e log() - 5*O?(u) du Vlo^o2(u) du (10 points )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts