Question: PLEASE DO BOTH A AND B Five years ago you took out a 5/1 adjustable rate mortgage and the five-year fixed rate period has just

PLEASE DO BOTH A AND B

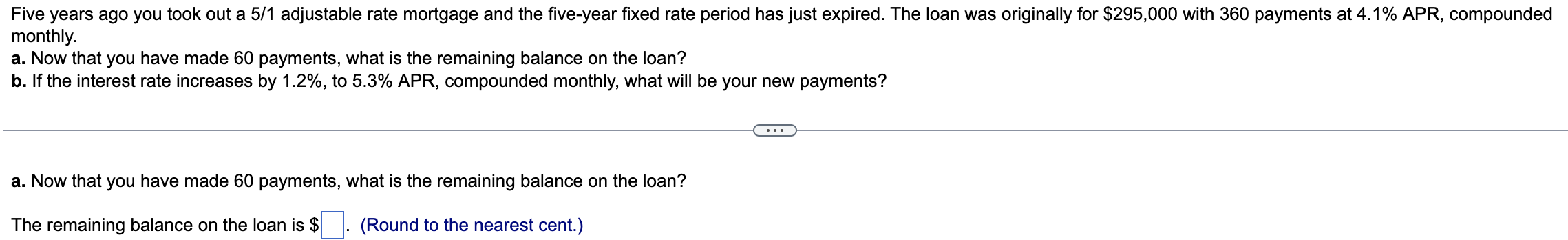

Five years ago you took out a 5/1 adjustable rate mortgage and the five-year fixed rate period has just expired. The loan was originally for $295,000 with 360 payments at 4.1% APR, compounded monthly. a. Now that you have made 60 payments, what is the remaining balance on the loan? b. If the interest rate increases by 1.2%, to 5.3% APR, compounded monthly, what will be your new payments? a. Now that you have made 60 payments, what is the remaining balance on the loan? The remaining balance on the loan is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts