Question: please do both parts correct . Intro A stock just paid an annual dividend of $2.2. The dividend is expected to grow by 7% per

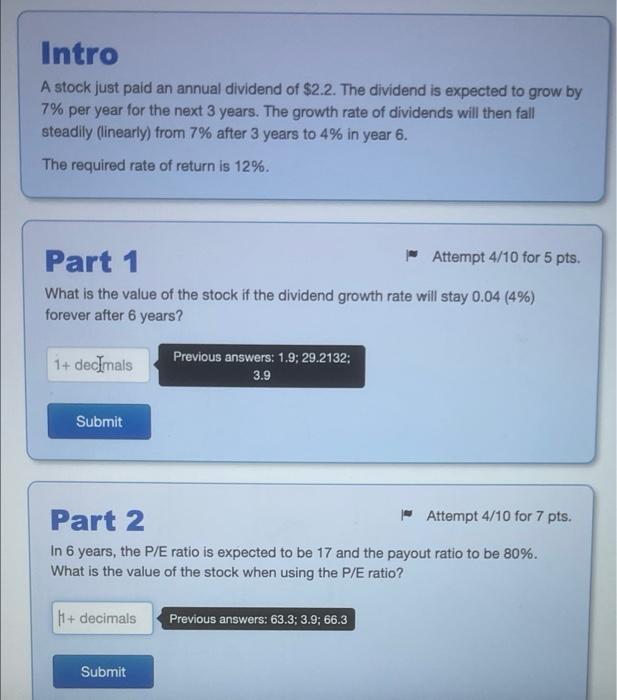

Intro A stock just paid an annual dividend of $2.2. The dividend is expected to grow by 7% per year for the next 3 years. The growth rate of dividends will then fall steadily (linearly) from 7% after 3 years to 4% in year 6. The required rate of return is 12%. Part 1 Attempt 4/10 for 5 pts. What is the value of the stock if the dividend growth rate will stay 0.04 (4%) forever after 6 years? 1+ decimals Previous answers: 1.9; 29.2132; 3.9 Submit Part 2 1 Attempt 4/10 for 7 pts. In 6 years, the P/E ratio is expected to be 17 and the payout ratio to be 80%. What is the value of the stock when using the P/E ratio? M + decimals Previous answers: 63.3; 3.9; 66.3 Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts