Question: please do both :) Question 23 4 pts Firm X has a total market value of $9.5 million with debt of $2.5 million outstanding. The

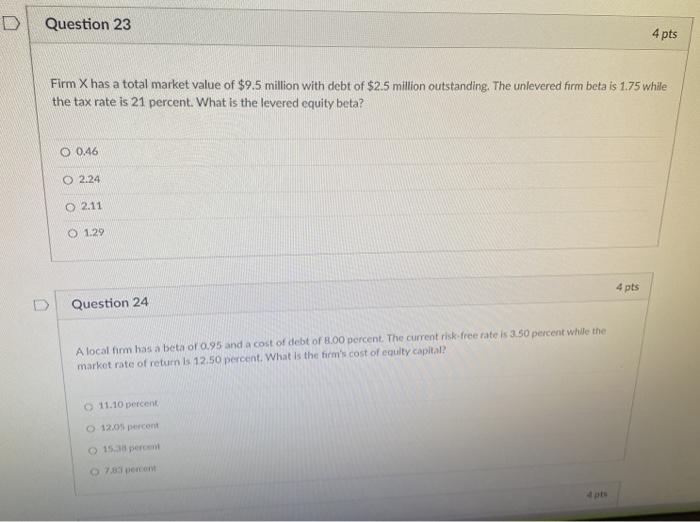

Question 23 4 pts Firm X has a total market value of $9.5 million with debt of $2.5 million outstanding. The unlevered firm beta is 1.75 while the tax rate is 21 percent. What is the levered equity beta? O 0.46 O 2.24 02.11 O 1.29 4 pts Question 24 A local firm has a beta or 0.95 and a cost of debt of 8.00 percent. The current risk free rate is 3.50 percent while the market rate of return is 12.50 percent. What is the firm's cost of equity capital? 11.10 percent 12/05 percent 15.3 percent 7.8 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts