Question: Please do both Question 5-TVM I (15 marks) Justin and Melanie have one child, Sara aged 8, and would like her to go to University

Please do both

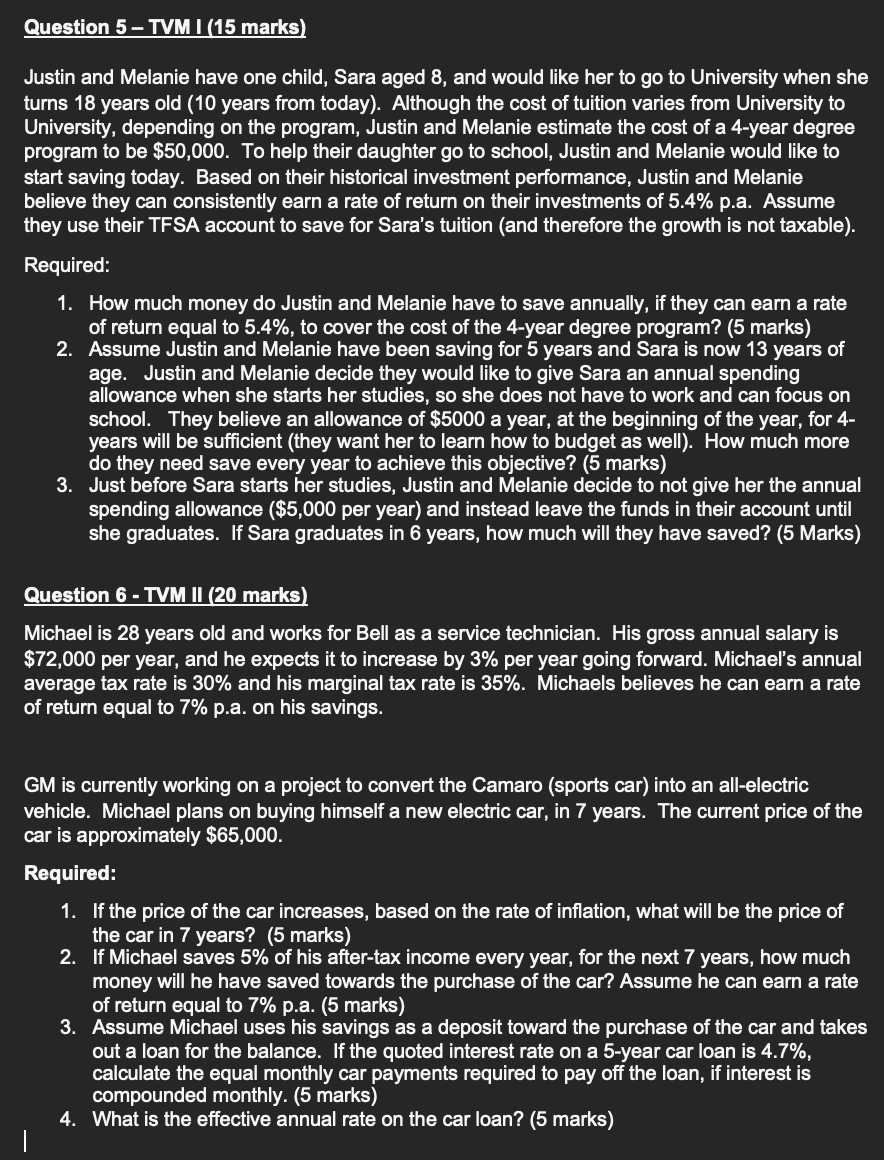

Question 5-TVM I (15 marks) Justin and Melanie have one child, Sara aged 8, and would like her to go to University when she turns 18 years old (10 years from today). Although the cost of tuition varies from University to University, depending on the program, Justin and Melanie estimate the cost of a 4-year degree program to be $50,000. To help their daughter go to school, Justin and Melanie would like to start saving today. Based on their historical investment performance, Justin and Melanie believe they can consistently earn a rate of return on their investments of 5.4% p.a. Assume they use their TFSA account to save for Sara's tuition (and therefore the growth is not taxable). Required: 1. How much money do Justin and Melanie have to save annually, if they can earn a rate of return equal to 5.4%, to cover the cost of the 4-year degree program? (5 marks) 2. Assume Justin and Melanie have been saving for 5 years and Sara is now 13 years of age. Justin and Melanie decide they would like to give Sara an annual spending allowance when she starts her studies, so she does not have to work and can focus on school. They believe an allowance of $5000 a year, at the beginning of the year, for 4years will be sufficient (they want her to learn how to budget as well). How much more do they need save every year to achieve this objective? (5 marks) 3. Just before Sara starts her studies, Justin and Melanie decide to not give her the annual spending allowance (\$5,000 per year) and instead leave the funds in their account until she graduates. If Sara graduates in 6 years, how much will they have saved? (5 Marks) Question 6 - TVM II (20 marks) Michael is 28 years old and works for Bell as a service technician. His gross annual salary is $72,000 per year, and he expects it to increase by 3% per year going forward. Michael's annual average tax rate is 30% and his marginal tax rate is 35%. Michaels believes he can earn a rate of return equal to 7% p.a. on his savings. GM is currently working on a project to convert the Camaro (sports car) into an all-electric vehicle. Michael plans on buying himself a new electric car, in 7 years. The current price of the car is approximately $65,000. Required: 1. If the price of the car increases, based on the rate of inflation, what will be the price of the car in 7 years? ( 5 marks) 2. If Michael saves 5% of his after-tax income every year, for the next 7 years, how much money will he have saved towards the purchase of the car? Assume he can earn a rate of return equal to 7% p.a. (5 marks) 3. Assume Michael uses his savings as a deposit toward the purchase of the car and takes out a loan for the balance. If the quoted interest rate on a 5 -year car loan is 4.7%, calculate the equal monthly car payments required to pay off the loan, if interest is compounded monthly. (5 marks) 4. What is the effective annual rate on the car loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts