Question: please do calculation and explanation for above question. The latest financial statements for a public limited company are summarised below: Income statements for the years

please do calculation and explanation for above question.

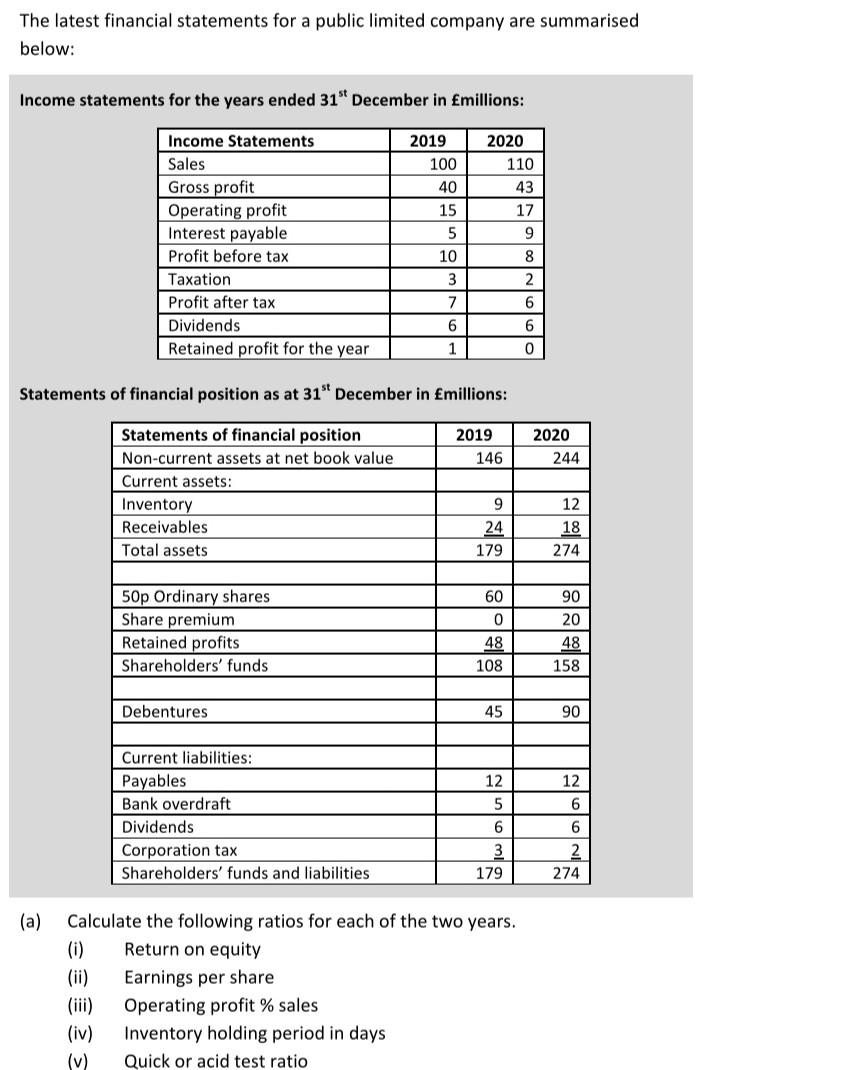

The latest financial statements for a public limited company are summarised below: Income statements for the years ended 31" December in millions: 2020 Income Statements Sales Gross profit Operating profit Interest payable Profit before tax Taxation Profit after tax Dividends Retained profit for the year 2019 100 40 15 5 10 110 43 17 9 8 2 3 7 6 6 6 1 0 Statements of financial position as at 31" December in millions: 2020 2019 146 244 Statements of financial position Non-current assets at net book value Current assets: Inventory Receivables Total assets 9 24 179 12 18 274 50p Ordinary shares Share premium Retained profits Shareholders' funds 60 0 48 108 90 20 48 158 Debentures 45 90 Current liabilities: Payables Bank overdraft Dividends Corporation tax Shareholders' funds and liabilities 12 5 6 3 179 12 6 6 2 274 (a) Calculate the following ratios for each of the two years. (i) Return on equity Earnings per share (iii) Operating profit % sales (iv) Inventory holding period in days (v) Quick or acid test ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts