Question: please do C-F e. What is the difference between an ordinary, of regular annuity and an anmuity due? What type of annuity is illustrated in

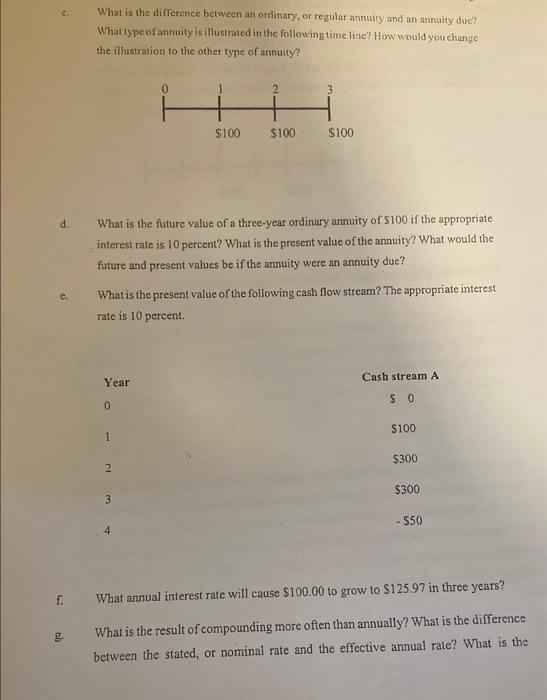

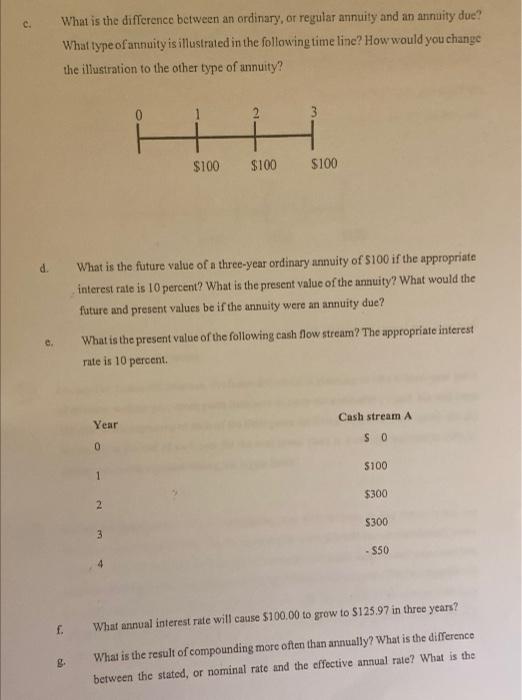

e. What is the difference between an ordinary, of regular annuity and an anmuity due? What type of annuity is illustrated in the following time line? How would you change the illustration to the other fyne of annuity? d. What is the future value of a three-year ordinary annuity of $100 if the appropriate interest rate is 10 percent? What is the present value of the annuity? What would the future and present values be if the annuity were an annuity due? e. What is the present value of the following cash flow stream? The appropriate interest rate is 10 percent. f. What annual interest rate will cause $100.00 to grow to $125.97 in three years? g. What is the result of compounding more often than annually? What is the difference between the stated, or nominal rate and the effective annual rate? What is the c. What is the difference between an ordinary, or regular annuity and an annuity duc? What type of annuity is illustrated in the following time line? How would you change the illustration to the other type of annuity? d. What is the future value of a three-year ordinary annuity of $100 if the appropriate interest rale is 10 percent? What is the present value of the anmuity? What would the future and present values be if the annuity were an annuity due? e. What is the present value of the following eash flow stream? The appropriate interest rate is 10 percent. f. What annual interest rate will cause $100.00 to grow to $125.97 in three years? g. What is the result of compounding more often than annually? What is the difference between the stated, or nominal rate and the effective annual rate? What is the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts