Question: please do e 4-11 and 4-14 E4-10 Merchandise is sold on account to a customer for (b) amount debited to Accounts Receivable, (c) amount of

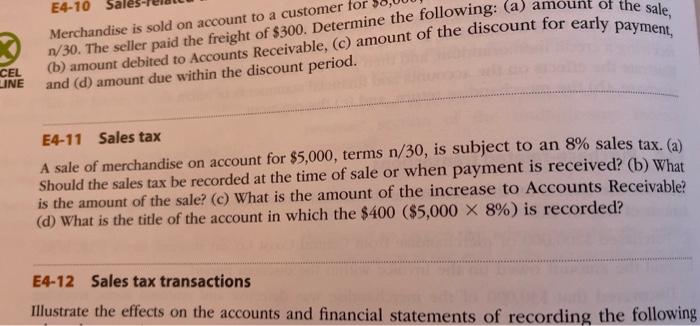

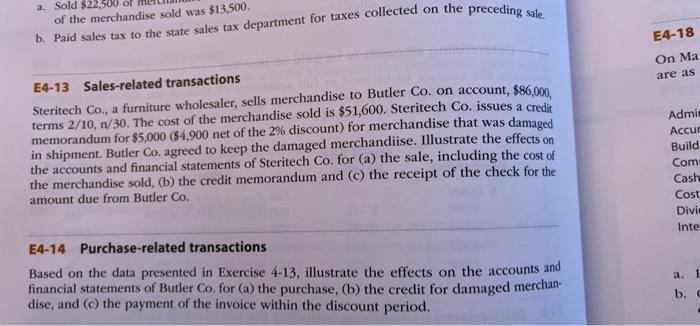

E4-10 Merchandise is sold on account to a customer for (b) amount debited to Accounts Receivable, (c) amount of the discount for early payment, n/30. The seller paid the freight of $300. Determine the following: (a) amount of the sale, and (d) amount due within the discount period. CEL LINE E4-11 Sales tax A sale of merchandise on account for $5,000, terms n/30, is subject to an 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount of the sale? (c) What is the amount of the increase to Accounts Receivable? (d) What is the title of the account in which the $400 ($5,000 X 8%) is recorded? E4-12 Sales tax transactions Illustrate the effects on the accounts and financial statements of recording the following a. Sold $22,500 of the merchandise sold was $13,500. b. Paid sales tax to the state sales tax department for taxes collected on the preceding sale. E4-18 On Ma are as E4-13 Sales-related transactions Steritech Co., a furniture wholesaler, sells merchandise to Butler Co. on account, $86,000, terms 2/10, 1/30. The cost of the merchandise sold is $51,600. Steritech Co. issues a credit memorandum for $5,000 ($4,900 net of the 2% discount) for merchandise that was damaged in shipment. Butler Co. agreed to keep the damaged merchandiise. Illustrate the effects on the accounts and financial statements of Steritech Co. for (a) the sale, including the cost of the merchandise sold, (b) the credit memorandum and (c) the receipt of the check for the amount due from Butler Co. Admit Accur Build Com Cash Cost Divie Inte a. 1 E4-14 Purchase-related transactions Based on the data presented in Exercise 4-13, illustrate the effects on the accounts and financial statements of Butler Co. for (a) the purchase, (b) the credit for damaged merchan- dise, and (c) the payment of the invoice within the discount period. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts