Question: please do E9-13 a and b for each: FV-OCI and FV-NI E9.12 (LO 2) (Debt Investment Entries-Amortized Cost) On January 1, 2019, Hi and Lois

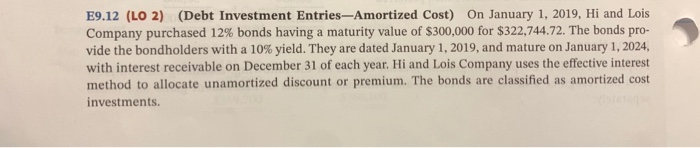

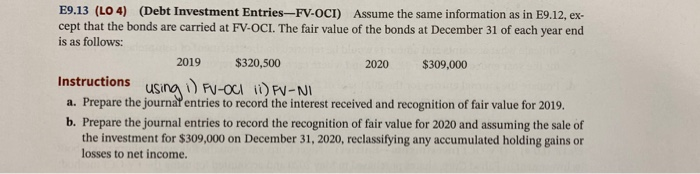

E9.12 (LO 2) (Debt Investment Entries-Amortized Cost) On January 1, 2019, Hi and Lois Company purchased 12% bonds having a maturity value of $300,000 for $322,744.72. The bonds pro- vide the bondholders with a 10% yield. They are dated January 1, 2019, and mature on January 1, 2024, with interest receivable on December 31 of each year. Hi and Lois Company uses the effective interest method to allocate unamortized discount or premium. The bonds are classified as amortized cost investments. E9.13 (LO4) (Debt Investment Entries-FV-OCI) Assume the same information as in E9.12, ex- cept that the bonds are carried at FV-OCI. The fair value of the bonds at December 31 of each year end is as follows: 2019 $320,500 2020 $309,000 Instructions using PU-OCI (0) PV-NI a. Prepare the journal entries to record the interest received and recognition of fair value for 2019. b. Prepare the journal entries to record the recognition of fair value for 2020 and assuming the sale of the investment for $309,000 on December 31, 2020, reclassifying any accumulate losses to net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts