Question: please do equity method On January 1, 2013, Piper Company acquired an 80% interest in Sand Company for $2,302,200. At that time the commonstock and

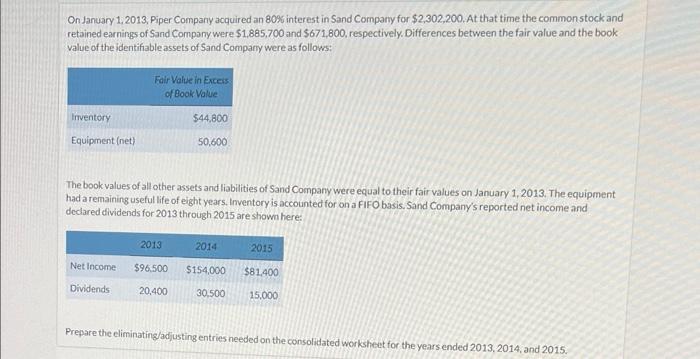

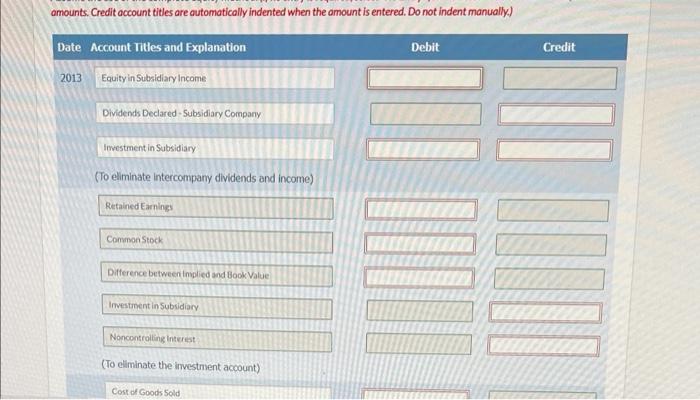

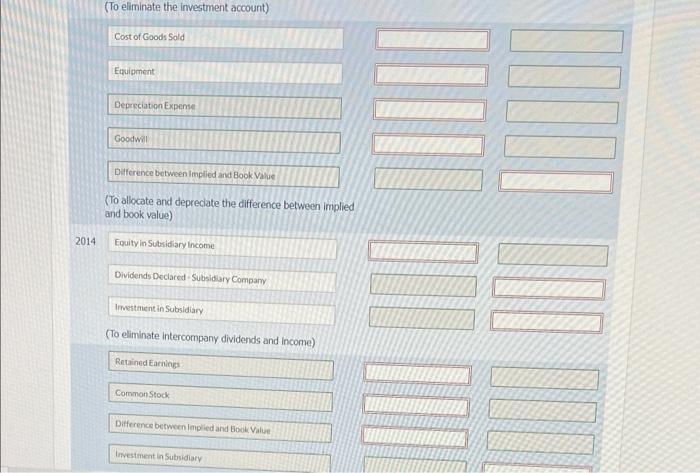

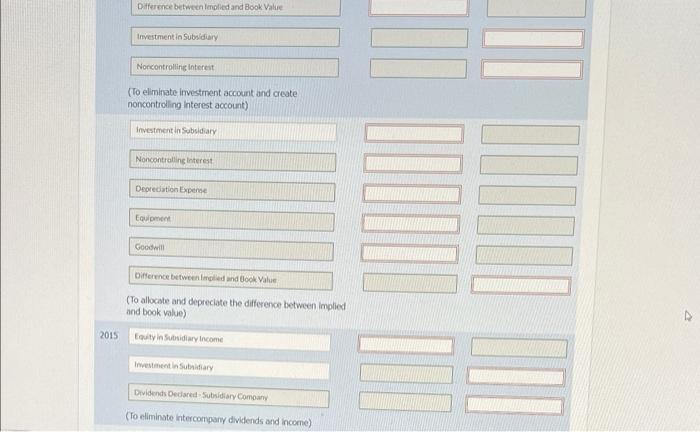

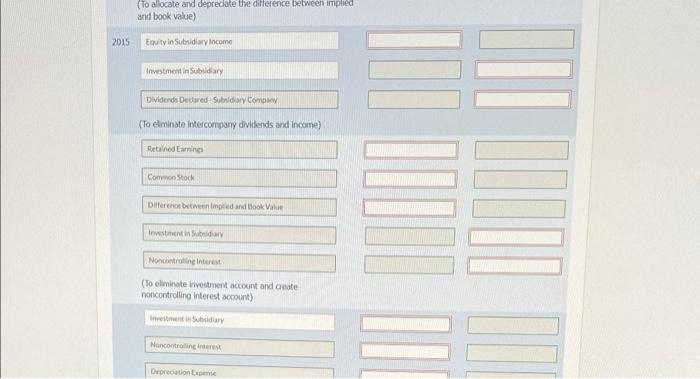

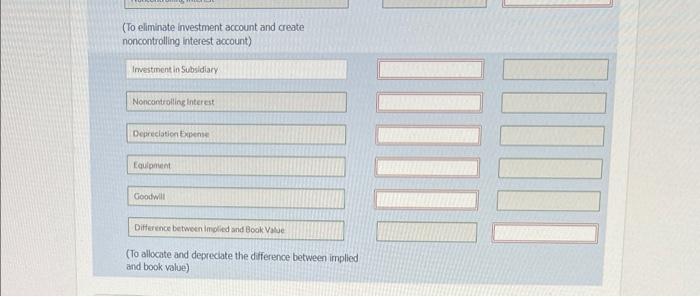

On January 1, 2013, Piper Company acquired an 80% interest in Sand Company for $2,302,200. At that time the commonstock and retained earnings of $ and Company were $1,885,700 and $671,800, respectively. Differences between the fair value and the book value of the identifiable assets of Sand Company were as follows: The book values of all other assets and liabilities of Sand Company were equal to their fair values on January 1, 2013. The equipment had a remaining useful life of eight years. Imventory is accounted for on a FIFO basis. Sand Company's reported net income and declared dividends for 2013 through 2015 are shown here: Prepare the eliminating/adjusting entries needed on the consolidated worksheut for the years ended 2013,2014, and 2015. amounts. Credit account titles are outomatically indented when the amount is entered. Do not indent manually.) (To eliminate the investment account) Cost of Goods Sold Equipment Depreciation Expense Goodwill Daference between Impliced and Book Value. (To allocate and depreclate the difference between implied and book value) 2014 Equity in Sutsidiary income Dividends Declared - Subsidary Compary Irvestment in Subsidiary (To eliminate intercompany dividends and incorne) Retained Earning Common Stock Difference befween implied and Book Value Investment in Subsidiary Diference betwern lenolied and Book Value Investment in Subsidiary Noncontrolling intereit (To elminate investment account and create noncontroling interest account) investment in Subsidiary Noncontralling interest Depreciation Experse Equipment Gocoswill Difference be tween lerpled and book Value: (To allocate and depreciate the difference between implied and book value) 2015 Equity insubvidiary income. investencenthsubiniary Dividends Dedarea - Subvidiary Comoany (To eliminate intercompany dividends and income) (to al ocate and depredate the difference between implied and book value) 2015 EQityin Subridiarylncome Investment in soblidary Dividendi Dectared Subvidary Conary (To eaminate intercompony dividends and income) Retalned Earning Commonstock Dilference bertween lingied and Book Valie Invotanent in Sibnidary Nonostroline interest (To elminote investmem account and ceate noncontrolling interest account) Wiretement in Subidiary Nancontroting inters: Deprecition tiperie (To eliminate investment account and create noncontrolling interest account) Irvestment in Subsidiary Noncontrolling interest Depreciation Bipense Equipment Goodwill Difference between inglied and Book Vase (To allocate and depreciate the difference between implied and book value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts