Question: please do fast The most likely outcomes for a particular project are estimated as follows: Unit price: Variable cost Fixed cost Expected sales $49 $24

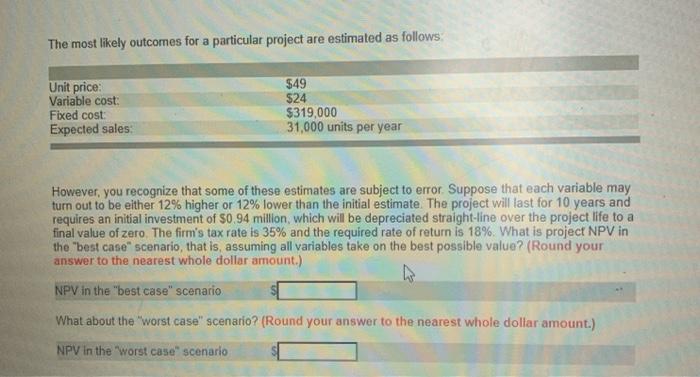

The most likely outcomes for a particular project are estimated as follows: Unit price: Variable cost Fixed cost Expected sales $49 $24 $319,000 31,000 units per year However, you recognize that some of these estimates are subject to error. Suppose that each variable may turn out to be either 12% higher or 12% lower than the initial estimate. The project will last for 10 years and requires an initial investment of $0.94 million, which will be depreciated straight-line over the project life to a final value of zero The firm's tax rate is 35% and the required rate of return is 18%. What is project NPV in the "best case scenario, that is, assuming all variables take on the best possible value? (Round your answer to the nearest whole dollar amount.) NPV in the "best case" scenario What about the worst case" scenario? (Round your answer to the nearest whole dollar amount.) NPV in the worst case scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts