Question: please do ii). and do it with pen and paper (not with excel) 13.8 ram A company has to pay 2,000(10-t) at the end of

please do ii). and do it with pen and paper (not with excel)

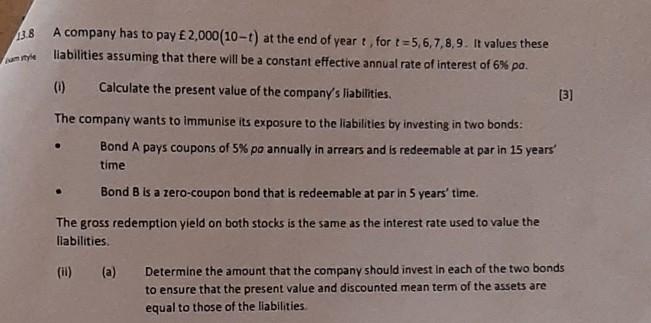

13.8 ram A company has to pay 2,000(10-t) at the end of yeart, fort=5,6,7,8,9. It values these liabilities assuming that there will be a constant effective annual rate of interest of 6% po. 0 Calculate the present value of the company's liabilities. [3] The company wants to immunise its exposure to the liabilities by investing in two bonds: Bond A pays coupons of 5% po annually in arrears and is redeemable at par in 15 years time Bond B is a zero-coupon bond that is redeemable at par in 5 years' time. . The gross redemption yield on both stocks is the same as the interest rate used to value the llabilities (10) (a) Determine the amount that the company should invest in each of the two bonds to ensure that the present value and discounted mean term of the assets are equal to those of the liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts